FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

1. Compute the minimum transfer price that Green Yard should be required to accept.

2. Compute the increase (decrease) in total contribution margin for Lawn Supplies, Inc. for this transfer.

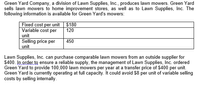

Transcribed Image Text:Green Yard Company, a division of Lawn Supplies, Inc., produces lawn mowers. Green Yard

sells lawn mowers to home improvement stores, as well as to Lawn Supplies, Inc. The

following information is available for Green Yard's mowers:

Fixed cost per unit $180

Variable cost per

unit

Selling price per

unit

120

450

Lawn Supplies, Inc. can purchase comparable lawn mowers from an outside supplier for

$400. In order to ensure a reliable supply, the management of Lawn Supplies, Inc. ordered

Green Yard to provide 100,000 lawn mowers per year at a transfer price of $400 per unit.

Green Yard is currently operating at full capacity. It could avoid $8 per unit of variable selling

costs by selling internally.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When evaluating if a company should accept a new contract to produce more product it should: Evaluate all possible fixed cost of accepting the contract. Evaluate the propose contract using a contribution margin approach. Accept the new contract if the sales price for the product is equal to or higher than the current sale price. Accept the new contract if fixed costs will remain the same.arrow_forwardWhich analysis involves a comparison of the cost of operating additional robotic tailors with additional revenues generated by increased product sales?arrow_forward1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: a. What is the total contribution margin? b. What is the total variable expense? c. How many units were sold? d. What is the per-unit variable expense? e. What is the per-unit contribution margin? 2. Answer the following questions about breakeven analysis: a. What is the breakeven point in units? b. What is the breakeven point in sales dollars? 3. Answer the following questions about target profit analysis and safety margin: a. How many units must the company sell in order to earn a profit of $48,000? b. What is the current margin of safety in units? c. What is the margin of safety in sales dollars? d. What is the margin of safety in percentage?arrow_forward

- Your answer is incorrect. Divide the estimated average annual income by the average investment. Investment cost plus residual value, divided by two, equals average investment. Can you please redo it? Thanksarrow_forwardPlease answer part A thanksarrow_forwardPlease explain this statement thoroughly. "To estimate what the profit will be at various levels of activity, multiply the number of units to be sold above or below the break-even point by the unit contribution margin."arrow_forward

- Need help solving this, please.arrow_forwardWithin a relevant range, fixed costs per unit: Group of answer choices Decrease as the level of activity decreases. Decrease as the level of activity increases. Increase as the level of activity increases. Remain the same as the level of activity increases.arrow_forward1. Using the high-low method of cost estimation, estimate the behavior of the maintenance costs incurred by Nation’s Capital Fitness, Incorporated. Express the cost behavior pattern in equation form. Note: Round coefficient of X to 2 decimal places and other answer to the nearest whole dollar amount. 2. 2. Using your answer to requirement 1, what is the variable component of the maintenance cost? Note: Round your answer to 2 decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education