1) Assume that no changes are made to the selling price or costs, calculate the amount of units that Thermo Blast must sell: a. To breakeven b. To attain the estimated net profit ( 2) Determine the alternative that Thermo Blast should select to achieve its Net profit goal.

1) Assume that no changes are made to the selling price or costs, calculate the amount of units that Thermo Blast must sell: a. To breakeven b. To attain the estimated net profit ( 2) Determine the alternative that Thermo Blast should select to achieve its Net profit goal.

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Please answer part A thanks

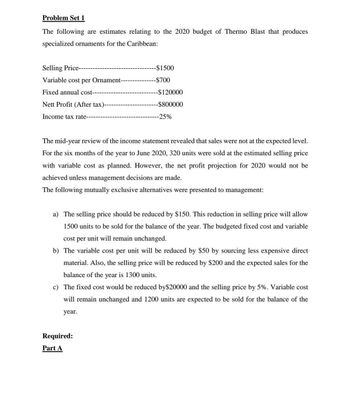

Transcribed Image Text:Problem Set 1

The following are estimates relating to the 2020 budget of Thermo Blast that produces

specialized ornaments for the Caribbean:

Selling Price---

Variable cost per Ornament-

Fixed annual cost---

Nett Profit (After tax)-

Income tax rate-----

-$1500

-$700

-$120000

-$800000

-25%

The mid-year review of the income statement revealed that sales were not at the expected level.

For the six months of the year to June 2020, 320 units were sold at the estimated selling price

with variable cost as planned. However, the net profit projection for 2020 would not be

achieved unless management decisions are made.

The following mutually exclusive alternatives were presented to management:

Required:

Part A

a) The selling price should be reduced by $150. This reduction in selling price will allow

1500 units to be sold for the balance of the year. The budgeted fixed cost and variable

cost per unit will remain unchanged.

b) The variable cost per unit will be reduced by $50 by sourcing less expensive direct

material. Also, the selling price will be reduced by $200 and the expected sales for the

balance of the year is 1300 units.

c) The fixed cost would be reduced by$20000 and the selling price by 5%. Variable cost

will remain unchanged and 1200 units are expected to be sold for the balance of the

year.

Transcribed Image Text:1) Assume that no changes are made to the selling price or costs, calculate the amount of units

that Thermo Blast must sell:

a. To breakeven

b. To attain the estimated net profit

2) Determine the alternative that Thermo Blast should select to achieve its Net profit goal.

Part B

3) By reference to the above data, explain:

a. Variable costs in the context of cost-volume-profit (CPV) analysis?

b. Fixed costs in the context of CPV analysis?

c. Contribution margin in the context of CPV analysis?

Problem Set 2

Carrie's Limited has two departments, the assembly department and the testing department in

its brake-pad manufacturing plant, where each brake-pad is conveyed through each

department.

Carrie's process-costing system consist of two cost categories: Single direct cost (direct

materials) and a single indirect-cost category (conversion costs).

Direct materials are added at the beginning of the process. Conversion costs are added evenly

during the process. When the assembly department finishes work on each brake-pad, it is

immediately transferred to testing. Carrie's uses the weighted-average method of process

costing.

Data for the assembly department for October 2019 are as follows:

Work in process, October 1*

Started during October 2019

Physical Units

(Brake Pads)

6,000

21,000

Completed during October 2019 23,500

Direct Materials

$1,200,000

Conversion Costs

$ 400,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please answer part B thanks

Transcribed Image Text:Problem Set 1

The following are estimates relating to the 2020 budget of Thermo Blast that produces

specialized ornaments for the Caribbean:

Selling Price---

Variable cost per Ornament-

Fixed annual cost---

Nett Profit (After tax)-

Income tax rate-----

-$1500

-$700

-$120000

-$800000

-25%

The mid-year review of the income statement revealed that sales were not at the expected level.

For the six months of the year to June 2020, 320 units were sold at the estimated selling price

with variable cost as planned. However, the net profit projection for 2020 would not be

achieved unless management decisions are made.

The following mutually exclusive alternatives were presented to management:

Required:

Part A

a) The selling price should be reduced by $150. This reduction in selling price will allow

1500 units to be sold for the balance of the year. The budgeted fixed cost and variable

cost per unit will remain unchanged.

b) The variable cost per unit will be reduced by $50 by sourcing less expensive direct

material. Also, the selling price will be reduced by $200 and the expected sales for the

balance of the year is 1300 units.

c) The fixed cost would be reduced by$20000 and the selling price by 5%. Variable cost

will remain unchanged and 1200 units are expected to be sold for the balance of the

year.

Transcribed Image Text:1) Assume that no changes are made to the selling price or costs, calculate the amount of units

that Thermo Blast must sell:

a. To breakeven

b. To attain the estimated net profit

2) Determine the alternative that Thermo Blast should select to achieve its Net profit goal.

Part B

3) By reference to the above data, explain:

a. Variable costs in the context of cost-volume-profit (CPV) analysis?

b. Fixed costs in the context of CPV analysis?

c. Contribution margin in the context of CPV analysis?

Problem Set 2

Carrie's Limited has two departments, the assembly department and the testing department in

its brake-pad manufacturing plant, where each brake-pad is conveyed through each

department.

Carrie's process-costing system consist of two cost categories: Single direct cost (direct

materials) and a single indirect-cost category (conversion costs).

Direct materials are added at the beginning of the process. Conversion costs are added evenly

during the process. When the assembly department finishes work on each brake-pad, it is

immediately transferred to testing. Carrie's uses the weighted-average method of process

costing.

Data for the assembly department for October 2019 are as follows:

Work in process, October 1*

Started during October 2019

Physical Units

(Brake Pads)

6,000

21,000

Completed during October 2019 23,500

Direct Materials

$1,200,000

Conversion Costs

$ 400,750

Solution

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education