Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

infoPractice Pack

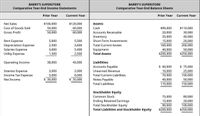

Compute the following ratio analysis:

Gross Profit Margin

Write your interpretation after the computation.

Transcribed Image Text:BARRY'S SUPERSTORE

BARRY'S SUPERSTORE

Comparative Year-End Income Statements

Comparative Year-End Balance Sheets

Prior Year

Current Year

Prior Year

Current Year

Net Sales

$100,000

$120,000

Assets:

Cost of Goods Sold

50,000

60,000

Cash

$90,000

$110,000

Gross Profit

50,000

60,000

Accounts Receivable

20,000

30,000

Inventory

35,000

40,000

Rent Expense

5,000

5,500

Short-Term Investments

15,000

20,000

Total Current Asstes

200,000

Depreciation Expense

Salaries Expense

2,500

3,600

160,000

3,000

5,400

Equipment

40,000

50,000

Utility Expense

1,500

2,500

Total Assets

$200,000

$250,000

Operating Income

38,000

43,000

Liabilities:

Accounts Payable

$ 60,000

$ 75,000

Interest Expense

3,000

2,000

Unearned Revenue

10,000

25,000

Income Tax Expense

5,000

6,000

Total Current Liabilities

70,000

100,000

Net Income

$ 30,000

$ 35,000

Notes Payable

40,000

50,000

Total Liabilities

110,000

150,000

Stockholder Equity

Common Stock

75,000

80,000

Ending Retained Earnings

Total Stockholder Equity

15,000

20,000

90,000

100,000

Total Liabilities and Stockholder Equity

$200,000

$250,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your wayIncludes step-by-step video

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- The accounts receivable turnover and inventory turnover are used to analyze long-term solvency. profitability. liquidity. O leverage.arrow_forwardFinancial ratios Draw the balance sheet and the income statement. Compare them with the items and figures on the statementarrow_forwardWhen should an average amount be used for the numerator or denominator? When the denominator is a balance sheet item or items. When a ratio consists of an income statement item and a balance sheet item. When the numerator is a balance sheet item or items. When the numerator is an income statement item or items.arrow_forward

- Describe the multi-step income statement.arrow_forwardThe income statement line gross profit will appear on which income statement format? Select one: a. Receipt and payment account b. Multiple step income statement c. Single step income statement d. Income and expenditure accountarrow_forwardwhich of the following comes first in the income statement O a. finance cost O b. gross profit O C. C. cost of sales O d. distribution costarrow_forward

- A. Which of the following is most closely associated with the cost of using assets? a. Asset utilization b. Sales revenue c. Proportion of debt and equity d. Average price B. Which of the following is most closely associated with the return on management’s use of assets? a. Cost of capital b. Mix of equity types c. Prime lending rate d. # of products soldarrow_forwardList the components of a statement of comprehensive income statement.arrow_forwardBest choicearrow_forward

- How to find Total Debt to Total Assets ration using an income statement, balance sheet or cash flow.arrow_forwardwhen putting together an income statement do the revenues and expenses have to put in order from highter amount to lowest?arrow_forwardDescribe the relationship between profit and turnover, revenue and sales, turn over and income and income and revenuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education