FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

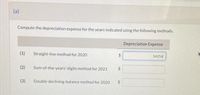

Transcribed Image Text:(a)

Compute the depreciation expense for the years indicated using the following methods.

Depreciation Expense

(1)

Straight-line method for 2020

14254

(2)

Sum-of-the-years'-digits method for 2021

(3)

Double-declining-balance method for 2020

%24

%24

Transcribed Image Text:Current Attempt in Progress

Tamarisk Company purchased Machine #201 on May 1, 2020. The following information relating to Machine #201 was gathered at

the end of May.

Price

$112,200

Credit terms

2/10, n/30

Freight-in

$1,056

Preparation and installation costs

$5,016

Labor costs during regular production operations

$13,860

It is expected that the machine could be used for 10 years, after which the salvage value would be zero. Tamarisk intends to use the

machine for only 8 years, however, after which it expects to be able to sell it for $1,980. The invoice for Machine #201 was paid May 5,

2020. Tamarisk uses the calendar year as the basis for the preparation of financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Determine the annual depreciation expense for each of the estimated 5 years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by (a) the straight-line method and (b) the double-declining-balance method. a. Straight-line method Additional Instruction Accumulated Depreciation, Year Depreciation Expense End of Year Book Value, End of Year 1 2 3 4 5 b. Double-declining-balance method Accumulated Depreciation, Year Depreciation Expense End of Year Book Value, End of Year 1 2 3 4 5 New lithographic equipment, acquired at a cost of $859,200 on March 1 at the beginning of a fiscal year, has an estimated useful life of 5 years and an estimated residual value of $96,660. The manager requested…arrow_forwardCalculate depreciation and fill out the form 4562 for 2022 year based on the following information: Depreciable assets: Recovery Prior Description Placed in Service Cost Method Convention Period Depreciation $32,963 MACRS/ 01/01/2020 $85,000 HY 7 200DB 01/15/2021 $13,930 HY 7 $1,991 04/15/20XX $1,900 7 Tools Equipment Sprayer MACRS/ 200DB MACRS/ 200DB HY Prior AMT Depreciation $32,963 $1,492 The S corporation has elected not to take the Section 179 deduction for the full amount of the cost of the sprayer or bonus depreciation.arrow_forwardFor each of the following depreciable assets, determine the missing amount. Abbreviations for depreciation methods are SL for straight-line and DDB for double-declining-balance. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Asset A B C D E Cost 68,000 93,000 258,000 214,000 Residual Value $ 34,000 13,000 24,000 34,000 Service Life Depreciation (Years) Method 5 8 10 8 DDB SL SL DDB Depreciation (Year 2) $ 39,000 5,900 10,000 23,400arrow_forward

- For each of the following depreciable assets, determine the missing amount. Abbreviations for depreciation methods are SL fa straight-line and DDB for double-declining-balance. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Asset A B C D MO E Cost Residual Value $ 31,000 62,000 87,000 252,000 211,000 6,000 21,000 31,000 Service Life (Years) 5 8 10 8 Depreciation Method DDB SL SL DDB Depreciation (Year 2) $ 30,000 5,600 9,000 23,100arrow_forwardPharoah Company purchases equipment on January 1, Year 1, at a cost of $267,000. The asset is expected to have a service life of 5 years and a salvage value of $20,000.arrow_forwardjaydeeparrow_forward

- Asset C3PO has a depreciable base of $17.60 million and a service life of 10 years. What would the accumulated depreciation be at the end of year five under the sum-of-the-years'-digits method? (Do not round intermediate calculations.)arrow_forward(c) Compute the amount of depreciation for each of Years 1 through 3 using the depreciation rate to 2 decimal places, e.g. 15.84% and final answers to 0 decimal places, e.g. 45,892.) Depreciation for Year 1 Depreciation for Year 2 Depreciation for Year 3 eTextbook and Media LA $ $ LA double-declining-balance method. (Round $ Assistance Usarrow_forwardSullivan Ranch Corporation has purchased a new tractor. The following information is given: $150,000 $10,000 Cost: Estimated Residual: Estimated Life in years: Estimated Life in hours: Actual Hours: Year 1 Year 2 Year 3 Year 4 4 1200 Required: 1. Prepare the following Straight-Line depreciation schedule by using the Excel SLN function to calculate Depreciation Expense and entering formulas for the remaining cells. Use absolute cell references when appropriate. (Use cells A4 to B12 from the given information to complete this question.) Year 1 2 360 270 350 220 3 4 Total Depreciation Schedule-Straight-Line Method End of year amounts Depreciatio Depreciatio n Expense n SULLIVAN RANCH CORPORATION Book Valuearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education