FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

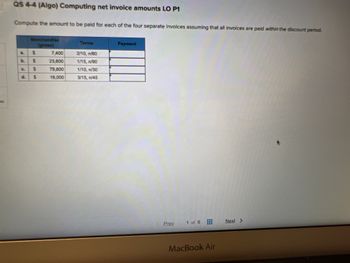

Transcribed Image Text:QS 4-4 (Algo) Computing net invoice amounts LO P1

Compute the amount to be paid for each of the four separate invoices assuming that all invoices are paid within the discount period.

b.

C.

હો

Merchandise

(gross)

$

$

$

$

7,400

23,600

79,800

16,000

Terms

2/10, n/60

1/15, n/90

1/10, n/30

3/15, n/45

Payment

Prey

1 of 8

MacBook Air

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the amount to be paid for each of the four separate invoices assuming that all invoices are paid within the discount period. Merchandise Payment (gross) Terms 2/10, n/60 a. b. 1/15, EOM C. 1/10, n/30 d. 3/15, n/45 $ 6,800 22,700 78,600 14,500arrow_forwardThe amount of discount to be recorded if the invoice is paid within the discount period on a purchase of goods having a list price of $1,600, subject to a trade discount of 25 percent with terms 2/10, n/30, is a.$24. b.$30. c.$29.40. d.$21. e.$450.arrow_forwardAn invoice received included the following information: merchandise price, $3,200; terms 1/10, n/eom; FOB shipping point with prepaid freight of $598. Assuming that a credit for merchandise returned of $600 is granted prior to payment and that the invoice is paid within the discount period, what amount of cash should be paid by the buyer? a. $600 b. $3,760 c. $3,200 d. $3,172arrow_forward

- Determining amounts to be paid on invoices Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period: ό ό ύ τ ο a. b. d. e. a. S b. S 00000 C. $ d. $ Merchandise e. S Invoice Amount $17,400 11,500 7,600 3,700 2,400 Freight Paid by Seller $500 100 FOB destination, n/30 FOB shipping point, 2/10, n/30 FOB shipping point, 2/10, n/30 FOB shipping point, 2/10, n/30 FOB destination, 2/10, n/30 Customer Returns and Allowances $900 1,400 700 500arrow_forward23. Sampson Co. sold merchandise to Batson Co. on account, $46,000, terms 2/15, net 45. The cost of the merchandise sold is $38,500. The Batson Co. paid the invoice within the discount period. Prepare the entries that both Sampson and Batson Companies would record for the above.arrow_forwardSh39arrow_forward

- Determine the amount to be paid by the buyer for full settlement of each invoice, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Merchandise Transportation Paid by Seller Transportation Terms Returns and Allowances (a) $7,100 $348 FOB Shipping Point, 1/10, net 30 $700 (b) $3,800 $124 FOB Destination, 2/10, net 45 $800 a. $ b. $arrow_forward21-The buyer received an invoice from the seller for merchandise with list price of RO 7500 and credit terms of 2/10 and n/30. The number 10 in the credit term is: a. Percentage of Cash Discount b. Credit period c. Discount period d. Trade discountarrow_forwardComplete the following by calculating the cash discount and net amount paid: (If more than one discount, assume date of last discount.) Date of Gross amount of invoice (freight charge already included) Freight charge Terms of invoice Date of payment invoice None 8/14 4/10, 3/15, n/30 8/26 700 Cash discount Net amount paidarrow_forward

- c. On 9/12 Year 7 $2,000 of ACCOUNTS PAYABLE is paid after the discount period. Phrase 1st: 2nd: Phrase 1st: Account 2nd: Accounts Account Category AL SER E contra AL SER E contra + Accounts Debit Affect d. On 9/28 Year 7 INVENTORY originally purchased for $4,000 on 9/1 Year 7 and was paid for on 9/10 Year 7 is returned by the purchaser and a debit memorandum (a debit to A/P) is received from the seller. [Hint: the amount of cash involved in this transaction must take the 2% discount into account.] Debit + Category AL SE RE contra AL SE RE contra + - + Affect Dr. or Cr. Dr Cr Dr Cr Credit Dr. or Cr. Credit Dr Cr Dr Crarrow_forward5. Sales on account, with 2/10, n/30 cash discount terms. (a) Merchandise is sold on account for $450. (b) The balance is paid within the discount period. (c) Merchandise is sold on account for $280. (d) The balance is paid after the discount period. Cash Accounts Receivable Sales Sales Discountsarrow_forwardCompute the amount to be paid for each of the four separate invoices assuming that all invoices are paid within the discount period. Merchandise Terms Payment (gross) a. $ 8,800 2/10, n/60 b. $ 25,700 1/15, n/90 C. $ 82,600 1/10, n/30 d. $ 19,500 3/15, n/45arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education