FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Calculate the ratios of Coles group of Australia for the year 2019:

Ratios to calculate:

Profitability (ROSF, ROCE, Gross margin, Operating profit margin,

Efficiency (Inventory turnover period, Average settlement period, Sales revenue to capital employed)

Stability/Capital Structure (Gearing ratio, Interest cover ratio, Debt coverage ratio*)

Investment/Market Performance (Earnings per share, Price earnings ratio, Operating cash flow per share*)

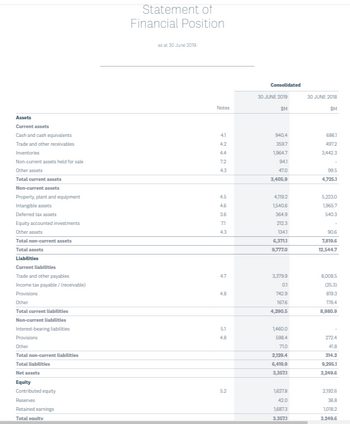

Transcribed Image Text:Assets

Current assets

Cash and cash equivalents

Trade and other receivables

Inventories

Non-current assets held for sale

Other assets

Total current assets

Non-current assets

Property, plant and equipment

Intangible assets

Deferred tax assets

Equity accounted investments

Other assets

Total non-current assets

Total assets

Liabilities

Current liabilities

Trade and other payables

Income tax payable/ (receivable)

Provisions

Other

Total current liabilities

Non-current liabilities

Interest-bearing liabilities

Provisions

Other

Total non-current liabilities

Total liabilities

Net assets

Equity

Contributed equity

Reserves

Retained earnings

Total equitv

Statement of

Financial Position

as at 30 June 2019.

Notes

41

4.2

72

4.3

45

46

3.6

71

4.3

47

4.8

5.1

4.8

5.2

Consolidated

30 JUNE 2019

SM

940.4

359.7

1,964.7

94.1

47.0

3,405.9

4,119.2

1,540.6

364.9

212.3

134.1

6,371.1

9,777.0

3,379.9

0.1

742.9

167.6

4,290.5

1,460.0

598.4

710

2,129.4

6,419.9

3,357.1

1,627.8

42.0

1,687.3

3.357.1

30 JUNE 2018

SM

686.1

497.2

3,442.3

99.5

4,725.1

5,223.0

1,965.7

540.3

90.6

7,819.6

12,544.7

8,008.5

(25.3)

819.3

178.4

8,980.9

272.4

41.8

314.2

9,295.1

3,249.6

2,192.6

38.8

1,018.2

3.249.6

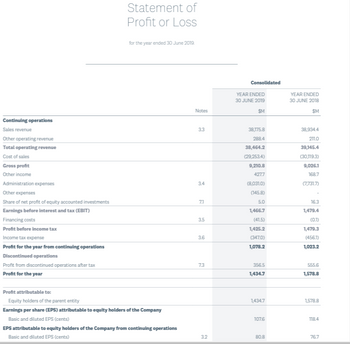

Transcribed Image Text:Continuing operations

Sales revenue

Other operating revenue

Total operating revenue

Cost of sales

Gross profit

Other income

Administration expenses

Other expenses

Share of net profit of equity accounted investments

Earnings before interest and tax (EBIT)

Financing costs

Profit before income tax

Income tax expense

Profit for the year from continuing operations

Discontinued operations

Profit from discontinued operations after tax

Profit for the year

Statement of

Profit or LosS

for the year ended 30 June 2019.

Profit attributable to:

Equity holders of the parent entity

Earnings per share (EPS) attributable to equity holders of the Company

Basic and diluted EPS (cents)

EPS attributable to equity holders of the Company from continuing operations

Basic and diluted EPS (cents)

Notes

3.3

3.4

7.1

3.5

3.6

7.3

3.2

Consolidated

YEAR ENDED

30 JUNE 2019

SM

38,175.8

288.4

38,464.2

(29,253.4)

9,210.8

427.7

(8,0310)

(145.8)

5.0

1,466.7

(41.5)

1,425.2

(347.0)

1,078.2

356.5

1,434.7

1,434.7

107.6

80.8

YEAR ENDED

30 JUNE 2018

SM

38,934.4

211.0

39,145.4

(30,119.3)

9,026.1

168.7

(7,731.7)

16.3

1,479.4

(0.1)

1,479.3

(456.1)

1,023.2

555.6

1,578.8

1,578.8

118.4

76.7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected financial data for Bahama Bay and Caribbean Key are as follows:Required:1. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. Which company has the higher ratio?2. Calculate the return on assets for Bahama Bay and Caribbean Key. Which company appears more profitable?3. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key. Which company is better able to meet interest payments as they become due?arrow_forward1. Provide a Liquidity Ratio Analysis based on the current Ratio. 2. Provide a Profitability ratio Analysis based on the following: - ROA - ROE - Overseas Sales Ratio - Cost of Sales to Net Assets - Gross Profit to Net salesarrow_forwardDuPont system of analysis Use the following financial information for AT&T and Verizon to conduct a DuPont system of analysis for each company. Sales Earnings available for common stockholders Total assets Stockholders' equity a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE? c. Which company has the higher financial leverage multiplier? a. Net profit margin (Round to three decimal places.) AT&T Net profit margin AT&T $164,000 13,333 403,921 201,934 Verizon Verizon $126,280 13,608 244,280 24,232arrow_forward

- With a given information below: (A) Prepare Income Statement and Balance Sheet in the Year 2020. (B) Analyze Income Statement and Balance Sheet in the Year 2020 Vertically. (C) Compute Financial Ratios: (1) ROE, (2) ROA, (3) Average Collection Period, (4) Debt to Asset, (5) Debt to Equity, (6) Time Interest Earned, (7) Total Assets Turnover, (8) Operating Profit Margin, (9) Return On Common Equity (ROCE), (10) Net Working Capital Ratio, (11) Quick Ratio, (12) Current Ratio. Cash $6,000 Sales $100,000 Utility Expense $8,000 Buildings $65,000 Common Stock $45,000 Accounts Payable $12,000 Supplies $4,000 Cost of Goods Sold $58,000 Interest Expense $5,000 Additional Paid in Capital $20,000 Bonds Payable $40,000 Supplies Expense $3,000 Salaries Expense $16,000 Accounts Receivable $10,000 Inventories $45,000 Retained Earnings $5,000 (beg. bal.) Income Tax Rate 20%arrow_forwardCostco Financial Analysis. Perform the following ratio analysis for 2021, 2022, and 2023 for Costco using the attached financial statements. a. Profitability ratios b. Liquidity ratios c. Leverage ratios d. Activity ratios e. Price to earnings ratioarrow_forwardDiscuss on Credit Risk of Nordstrom Time-series analysis Analyze credit risk in the past and current years (You may obtain information about firms’ credit ratings from financial articles as well); trend analysis Cross-sectional analysis - How do you think about current and future firm value? Discuss on Profitability: - Time-series analysis Analyze profitability in the past and current years; Can you find patterns or trends over the three years? Cross-sectional analysisarrow_forward

- Calculate the ratios of Woolworths Group (Australian retail company) for the year 2021: Ratios to calculate: Profitability (ROSF, ROCE, Gross margin, Operating profit margin, Cash flow to Sales*) Efficiency (Inventory turnover period, Average settlement period, Sales revenue to capital employed) Liquidity (Current ratio, Acid test (quick) ratio, Cash flow ratio*). Stability/Capital Structure (Gearing ratio, Interest cover ratio, Debt coverage ratio*) Investment/Market Performance (Earnings per share, Price earnings ratio, Operating cash flow per share*)arrow_forwardThe image uploaded is the calculation of Access Bank's Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardIf given the opportunity, in which of the firms would you invest based on the result of your analysis of both companies and the comparison with the industry? If you would not invest, explain your reasons according to the results obtained. Company Name: Year 2018 Chemicals and Allied Products Industry Ratios ………….. Solvency or Debt Ratios Merck J&J 2018 Debt ratio 0.67 0.61 0.47 Debt-to-equity ratio 0.93 0.51 0.38 Interest coverage ratio 12.27 18.91 -9.43 Liquidity Ratios Current ratio 1.17 1.47 3.47 Quick ratio 0.92 1.16 2.12 Cash ratio 0.40 0.63 2.24 Profitability Ratios Profit margin 14.64% 18.75% -93.4% ROE (Return on equity), after tax 23.03% 25.60% -248.5 ROA (Return on assets) 7.49% 10.00% -146.5 Gross margin 68.06% 66.79% 55.3% Operating margin (Return on sales) 19.62% 24.27%…arrow_forward

- provide reasons for the attached calculated ratios using GSK 2023 annual report and provide non-financail performance analysis examples for GSK 2023.arrow_forwardFor Financial year 2021: Current ratio = Current assets / Current liabilities = 43.133 / 29.613 = 1.46 (2.d.p) Debt-to-equity = Total liabilities / Total equity = (29.613 + 25.382) / 47.069 = 1.17 (2.d.p) Return on total assets = Net profit / Average total assets = (-11.195) / 101.964 = -0.11 (2.d.p) Profit margin ratio = Net profit / Net sales = (-11.195) / 81.79 = -0.14 (2.d.p) Debt-to-asset = Total liabilities / Total assets = (29.613 + 25.382) / 101.964 = 0.54 (2.d.p) Cash flow on total assets = Net cash flow from operating activities / Average total assets = 4.717 / 101.964 = 0.05 (2.d.p) For Financial year 2022: Current ratio = Current assets / Current liabilities = 49.476 / 32.754 = 1.51 (2.d.p) Debt-to-equity = Total liabilities / Total equity = (32.754 + 27.625) / 46.732 = 1.29 (2.d.p) Return on total assets = Net profit / Average total assets = (-0.336) / 107.111 = -0.003 (3.d.p) Profit margin ratio = Net profit / Net sales = (-0.336) / 115.56 = -0.003 (3.d.p) Debt-to-asset…arrow_forwardUsing the financial statements in the image, calculate the following ratios for both the FY 2017 and FY 2018: Current Ratio Quick Ratio Total Asset Turnover Average Collection Total Debt to Total Assets Times Interest Earned Net Profit Margin Return on Assets Return on Equity Modified Du Point Equation for FY 2018 PE Ratio Market to Book Ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education