Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

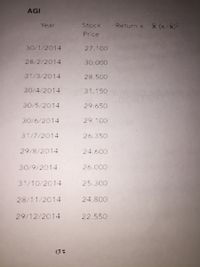

Compute for the returns, average of returns and Standard Deviation:

Transcribed Image Text:AGI

Year

Stock

Return x X (x -X)

Price

30/1/2014

27.100

28/2/2014

30.000

31/3/2014

28.500

30/4/2014

31.150

30/5/2014

29.650

30/6/2014

29.100

31/7/2014

26.350

29/8/2014

24.600

30/9/2014

26.000

31/10/2014

25.300

28/11/2014

24.800

29/12/2014

22.550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What are the characteristics of Probability Proportionate to Size (PPS) sampling?arrow_forwardUsing the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. Year Returns X Y 1 9% 23% 2 27 44 3 16 -6 4 -17 -20 5 18 52 Calculate the arithmetic average return for X. Calculate the arithmetic average return for Y.arrow_forwardSuppose you're given a data set that classifies each sample unit into one of four categories: A, B, C, the data as A = 1, B=2, C = 3, and D=4. Are the data consisting of the classifications A, B, C, and D or quantitative? Are the data consisting of the classifications A, B, C, and D qualitiative or quantitative? OA. Qualitative, because they are measured on a naturally occuring numerical scale. B. Quantitative, because they are measured on a naturally occuring numerical scale. C. Quantitative, because they can only be classified into categories. D. Qualitative, because they can only be classified into categories. *** After the data are input as 1, 2, 3, or 4, are they qualitative or quantitative? OA. Qualitative, because they cannot be meaningfully added, subtracted, multiplied, or divided. B. Qualitative, because they are measured on a naturally occurring numerical scale. OC. Quantitative, because they are measured on a naturally occurring numerical scale. OD. Quantitative, because…arrow_forward

- How can we determine the mean and variance of the NPW on the basis of the three NPW estimates?arrow_forwardDescribe the two basic differences between the weighted average and the FIFO method.arrow_forwardWhich measure of central tendency is best used for categorical data? a) Mean b) Median c) Mode d) Standard Deviationarrow_forward

- Which of the following statistical techniques are used to test controls? Mean-per-unit sampling. Attribute sampling. Difference estimation. Ratio estimation.arrow_forwardUsing the current rate method, COGS is translated using a combination of historical and average rates. ATrue BFalsearrow_forwardb. Convert the Data available into a Table and choose a Design of your choice.c. Obtain the Mean, Median, Standard Deviation, Variance, Quartiles (Q1, Q2, Q3, Q4), IQRfor the entire data (1895-1998), using ONLY Excel Functions (not using the Analysis ToolPak Add-In)d. Use the Statistical measurements generated from the Analysis Toolpak (Add-In) andcompare the values obtained in (c). Comment on your findings.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education