FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

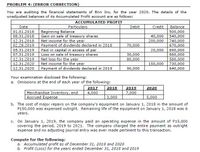

Transcribed Image Text:PROBLEM 4: (ERROR CORRECTION)

You are auditing the financial statements of Brin Inc. for the year 2020. The details of the

unadjusted balances of its Accumulated Profit account are as follows:

ACCUMULATED PROFIT

Date

Particulars

Debit

Credit

Balance

Beginning Balance

Gain on sale of treasury shares

Net income for the year

Payment of dividends declared in 2018

Paid in capital in excess of par

Loss on sale of treasury shares

Net loss for the year

Net income for the year

Payment of dividends declared in 2019

01.01.2018

500,000

540,000

740,000

670,000

690,000

660,000

580,000

730,000

640,000

08.31.2018

40,000

200,000

12.31.2018

02.28.2019

70,000

05.31.2019

20,000

07.31.2019

30,000

80,000

12.31.2019

12.31.2020

150,000

12.31.2020

90,000

Your examination disclosed the following:

a. Omissions at the end of each year of the following:

2017

2018

2019

2020

Merchandise Inventory, end

| Accrued Expense

4,000

7,000

3,000

5,000

b. The cost of major repairs on the company's equipment on January 1, 2018 in the amount of

P150,000 was expensed outright. Remaining life of the equipment on January 1, 2018 was 6

years.

c. On January 1, 2019, the company paid an operating expense in the amount of P15,000

covering the period, 2019 to 2021. The company charged the entire payment as outright

expense and no adjusting journal entry was ever made pertinent to this transaction.

Compute for the following:

a. Accumulated profit as of December 31, 2018 and 2020

b. Profit (Loss) for the years ended December 31, 2018 and 2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Indicate the effect of the transactions listed in the following table on total current assets, current ration, and net income. Use (+) to indicate an increase, (-) to indicate a decrease, and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any necessary assumptions and assume an initial current ratio of more than 1.0. Federal income tax due for the previous year is paid.arrow_forwardState the effect the following situation would have on the amount of annual net income reported for 2019. No adjustment was made for the revenue earned previously recorded as unearned revenue for USD 6,000 as of 2019 December 31. Group of answer choices Net income is overstated, liabilities are understated Net income is understated, assets are overstated Net income is overstated, assets are overstated Net income is understated, liabilities are overstatedarrow_forwardCommon size analysis of the balance sheet expresses each item as a percentage of the _____________. Total Asset Revenue Base year figure Current assetarrow_forward

- Net Sales COGS Depreciation EBIT Interest Taxable Income Taxes Net Income 2019 Income Statement Dividends Additions to Retained Earnings 147 647.74 3,456 1,895 235 1,326 320 1,006 211.26 794.74arrow_forwardPlease help mearrow_forwardCompute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018; confirm that RNOA= NOPM x NOAT.arrow_forward

- HIC GROUP OF Companies COMPARATIVE INCOME STATEMENT For years ended 3rd December 2019 2020 Revenue and gains Sales revenue 495,500 496,738.75 Interest revenue 278,500 279,196.25 Investment Income 71,700 71,879.25 Other revenue 101,500 101,753.75 Total revenue and gains 947,200 949,968 Expenses and losses Cost of good sold 450,000 447,750 Selling&administrative 185,000 184,075 Computer (operating) 42,500 42,288…arrow_forwardUse Table 1 and the following information on Company X to perform a pro-forma financial modeling using a percentage sales method, and answers the next questions. Note: When applying the percentage sales method, you should assume that the 2024 percentage values with respect to sales of the (i) costs except depreciation, (ii) depreciation, (iii) cash and equivalents, (iv) accounts receivable, (v) inventories, (vi) property, plant and equipment, and (vi) accounts payable will remain equal to those percentages of 2023. Sales in 2024 are expected to grow at a rate of 20%, with respect to the values of 2023. Assume also that the total values in 2024 of interest expense and debt will not change from its 2023 values; income tax will remain at 30% of the Pretax Income; and that Company X initially plans to payout 35% of its net income to its shareholders. 1. What is the forecasted value of sales for 2024? 2. What is the forecasted value of EBITDA for 2024? 3. What is the forecasted value of…arrow_forwardAt September 30, 2022, the end of the first year of operations at Lukancic Incorporated, the firm's accountant neglected to accrue payroll taxes of $2, 189 that were applicable to payrolls for the year then ended. Exercise 7 - 9 (Algo) Part c c. Assume that when the payroll taxes were paid in October 2022, the payroll tax expense account was charged. Assume that at September 30, 2023, the accountant again neglected to accrue the payroll tax liability, which was $2,660 at that date. Determine the income statement and balance sheet effects of not accruing payroll taxes at September 30 2023arrow_forward

- The trial balance of Kroeger Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Gain on sale of investments Gain on debt securities Loss on projected benefit obligation Cost of goods sold Selling expense Goodwill impairment loss Interest expense General and administrative expense Debits $ 160,000 6,100,000 600,000 500,000 30,000 500,000 Credits $ 8,200,000 60,000 120,000 140,000 The gain on debt securities represents the increase in the fair value of debt securities and is classified a component of other comprehensive income. Kroeger had 300,000 shares of stock outstanding throughout the year. Income tax expense has not yet been recorded. The effective tax rate is 25%. Required: Prepare a 2024 single, continuous statement of comprehensive income for Kroeger Incorporated. Use a multiple-step income statement format. Note: Round earnings per share answer to 3 decimal places.arrow_forwardThe comparative balance sheet of Best Buy for January 31, 2020 and 2019, is shown as follows (values are in millions): Best Buy Comparative Balance Sheet For January 31, 2020 and 2019 $In militans Jan 31, 2020 Jan 31, 2019 Assets Cash Accounts recelvable Inventory Investments Land Equlpment Accumulated depreciation - Equipment Total assets 2,229 S 1,980 1,149 5,174 $ 1,015 5,409 500 650 S 637 9,228 S (6,900) S 9,200 (6,690) 11,530 S 12,051 Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable (operating expenses) Dividends payable Common stock 5,288 906 S 5,257 982 564 564 26 27 Pald in capital: Excess of Issue price over par - common stock Retalned earnings Total liabilities and stockholders' equlty 4,745 S 11,530 $ 5,221 12,051 Additional data obtained from an examination of the accounts in the ledger for 2020 are as follows: a. The investments were sold for $875 million cash. b. Equipment and land were acquired for cash. c. There were no disposals of…arrow_forwardReturn on total assets ratio: net income/ average total assets 21,331/(321,195+225,248)/2= 0.07807= 7.8% (2020 year) 11588/(162,648+225,248)/2= 0.059= 6.0% (2019 year) Write financial analysis report.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education