FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

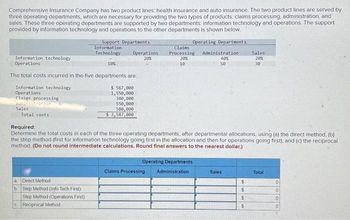

Transcribed Image Text:Comprehensive Insurance Company has two product lines, health insurance and auto insurance. The two product lines are served by

three operating departments, which are necessary for providing the two types of products: claims processing, administration, and

sales. These three operating departments are supported by two departments: Information technology and operations. The support

provided by information technology and operations to the other departments is shown below.

Operating Departments

Information technology.

Operations

Information technology

Operations

Claims processing

Sales

The total costs incurred in the five departments are:

Total costs

Support Departments

a

Direct Method

b. Step Method (Info Tech First)

Step Method (Operations First)

Information

Technology

10%

c Reciprocal Method

Operations

20%

$ 567,000

1,550,000

340,000

550,000

580,000

$3,587,000

Required:

Determine the total costs in each of the three operating departments, after departmental allocations, using (a) the direct method, (b)

the step method (first for information technology going first in the allocation and then for operations going first), and (c) the reciprocal

method. (Do not round intermediate calculations. Round final answers to the nearest dollar.)

Claims

Processing Administration

20%

40%

10

50

Operating Departments

Administration

Claims Processing

Sales

$

$

S

Sales

20%

30

$

Total

OOOO

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduction of Overhead

VIEW Step 2: Calculation of Total cost as per Direct method

VIEW Step 3: Calculation of Total cost as per Step method

VIEW Step 4: Working note of cost allocation as per reciprocal method

VIEW Step 5: Calculation of Total cost as per Reciprocal method

VIEW Solution

VIEW Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardThe Long Term Care Plus Company has two service departments — actuarial and premium rating, and two operations departments — marketing and sales. The distribution of each service department's efforts to the other departments is shown below: FROM TO Actuarial Rating Marketing Sales Actuarial 0 % 10 % 20 % 70 % Rating 20 % 0 % 40.0 % 40.0 % The direct operating costs of the departments (including both variable and fixed costs) were as follows: Actuarial $ 70,000 Premium Rating $ 130,000 Marketing $ 56,000 Sales $ 65,000 The total cost accumulated in the marketing department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar): Multiple Choice $131,510. $151,690. $130,714. $171,759. $179,338.arrow_forwardBetter Health Company has two service departments — actuarial and premium rating, and two operations departments — marketing and sales. The distribution of each service department's efforts to the other departments is shown below: FROM TO Actuarial Rating Marketing Sales Actuarial 0% 40% 20% 40% Rating 25% 0% 37.5% 37.5% The direct operating costs of the departments (including both variable and fixed costs) were as follows: Actuarial $ 75,000 Premium Rating $ 50,000 Marketing $ 75,000 Sales $ 85,000 The total cost accumulated in the marketing department using the step method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar; assume the actuarial department goes first): Multiple Choice a)$155,000. b)$130,000. c)$159,000. d)$164,000. e)$126,000.arrow_forward

- Gadubhaiarrow_forwardThe Long Term Care Plus Company has two service departments — actuarial and premium rating, and two operations departments — marketing and sales. The distribution of each service department's efforts to the other departments is shown below: FROM TO Actuarial Rating Marketing Sales Actuarial 0 % 10 % 20 % 70 % Rating 10 % 0 % 40.0 % 50.0 % The direct operating costs of the departments (including both variable and fixed costs) were as follows: Actuarial $ 80,000 Premium Rating $ 70,000 Marketing $ 40,000 Sales $ 86,000 The total cost accumulated in the sales department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar): Multiple Choice $89,091 $109,271. $186,909. $129,340. $136,919.arrow_forwardSolomon Information Services, Incorporated, has two service departments: human resources and billing. Solomon's operating departments, organized according to the special Industry each department serves, are health care, retall, and legal services. The billing department supports only the three operating departments, but the human resources department supports all operating departments and the billing department. Other relevant information follows. Number of employees Annual cost Annual revenue Req A1 Human Resources Department Reg A2 Billing Health Care Retail Legal Services Total *This is the operating cost before allocating service department costs. Allocation Rate 20 Req B1 $ 900,000 Complete this question by entering your answers in the tabs below. x X Billing Required a. Allocate service department costs to operating departments, assuming that Solomon adopts the step method. The company uses the number of employees as the base for allocating human resources department costs and…arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Jasmine Company manufactures both pesticide and liquid fertilizer, with each product manufactured in separate departments. Three support departments support the production departments: Power, General Factory, and Purchasing. Budgeted data on the five departments are as follows: Support Departments Producing Departments Power GeneralFactory Purchasing Pesticide LiquidFertilizer Overhead $90,000 $314,000 $167,000 $78,900 $107,800 Square feet 1,500 — 1,500 4,200 4,800 Machine hours — 1,403 1,345 24,000 8,000 Purchase orders 20 40 7 120 60 The bases for allocation are power—machine hours; general factory—square feet; and purchasing—purchase…arrow_forwardCar City is divided into three divisions: new car sales (NCS), used car sales (UCS), and parts and service (PAS). Each division is supervised by a division manager. The three division managers report to the general manager. Each division is subdivided into different departments managed by a department manager. For example, the PAS division has a parts department manager and a service department manager and NCS has a department manager for auto sales and a department manager for truck sales. The following items were contained in the company's most recent responsibility report: a Allocated utility cost for NCS division b Cost to rent vacant lot for storage of new vehicles c Parts revenue for the PAS division d Parts shipping/delivery costs e Salary of the gerneral manager f Salary of the Parts department manager g Salary of the PAS division manager h Salary of the UCS division manger I Sales commisions of UCS sales personnel J Service revenue for the PAS…arrow_forwardPlease provide answer in text (Without image)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education