Rooney Company sells lamps and other lighting fixtures. The purchasing department manager prepared the following inventory purchases budget. Rooney’s policy is to maintain an ending inventory balance equal to 15 percent of the following month’s cost of goods sold. April’s budgeted cost of goods sold is $82,000.

Required

-

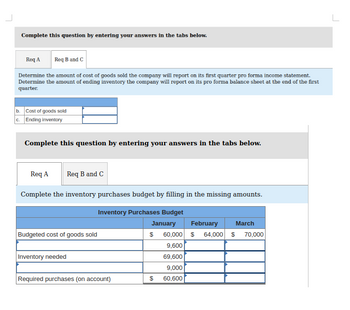

Complete the inventory purchases budget by filling in the missing amounts.

-

Determine the amount of cost of goods sold the company will report on its first quarter pro forma income statement.

-

Determine the amount of ending inventory the company will report on its pro forma

balance sheet at the end of the first quarter.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

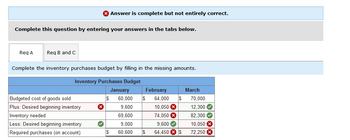

Rooney Company sells lamps and other lighting fixtures. The purchasing department manager prepared the following inventory purchases budget. Rooney’s policy is to maintain an ending inventory balance equal to 15 percent of the following month’s cost of goods sold. April’s budgeted cost of goods sold is $82,000.

Required

-

Complete the inventory purchases budget by filling in the missing amounts.

-

Determine the amount of cost of goods sold the company will report on its first quarter pro forma income statement.

-

Determine the amount of ending inventory the company will report on its pro forma

balance sheet at the end of the first quarter.

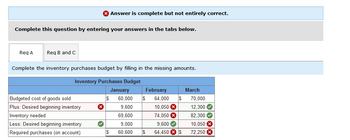

Rooney Company sells lamps and other lighting fixtures. The purchasing department manager prepared the following inventory purchases budget. Rooney’s policy is to maintain an ending inventory balance equal to 15 percent of the following month’s cost of goods sold. April’s budgeted cost of goods sold is $82,000.

Required

-

Complete the inventory purchases budget by filling in the missing amounts.

-

Determine the amount of cost of goods sold the company will report on its first quarter pro forma income statement.

-

Determine the amount of ending inventory the company will report on its pro forma

balance sheet at the end of the first quarter.

- 8arrow_forwardCarmen Company sells jar candles. The sales forecast (units) for the coming months is: April 210 May 140 June 150 July 200 August 160 Each candle costs $ 10. The ending inventory policy is 40% of next month's sales needs. April 1 inventory will be as expected under the policy. Carmen pays for purchases 30% in the month of purchase and 70% the following month. Accounts payable on April 1 is $2,460. Required: a. Prepare a purchases budget for the quarter ending June 30. Note: Deductible values must be indicated with a minus sign.a. Prepare a purchases budget for the quarter ending June 30. Note: Deductible values must be indicated with a minus sign. b. Prepare a cash payments budget for the quarter ending June 30.arrow_forwardSummit Company has budgeted purchases of merchandise inventory of $457,500 in January and $533,750 in February. Assume Summit pays for inventory purchases 40% in the month of the purchase and 60% in the month after purchase. The Accounts Payable balance on December 31 is $97,350. Prepare a schedule of cash payments for purchases for January and February. Cash Payments January February Total merchandise inventory purchases Cash Payments Merchandise Inventory: Dec.—Dec. 31 Accounts Payable, paid in Jan. Jan.—Jan. merchandise inventory purchases paid in Jan. Jan.—Jan. merchandise inventory purchases paid in Feb. Feb.—Feb. merchandise inventory purchases paid in Feb. Total payments for merchandise inventoryarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward(The following information applies to the questions displayed below.] Shadee Corporation expects to sell 600 sun shades in May and 800 in June. Each shade sells for $180. Shadee's beginning and ending finished goods inventories for May are 75 and 50 shades, respectively. Ending finished goods inventory for June will be 60 shades. Required: 1. Determine Shadee's budgeted total sales for May and June, 2. Determine Shadee's budgeted production in units for May and June. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine Shadee's budgeted total sales for May and June Budgeted Total Sales May Junaarrow_forwardMetro, Incorporated sells backpacks. The Company's accountant is preparing the purchases budget for the first quarter operations. Metro maintains ending inventory at 15% of the following month's expected cost of goods sold. Expected cost of goods sold for April is $78,000. All purchases are made on account with 30% of accounts paid in the month of purchase and the remaining 70% paid in the month following the month of purchase. Sales January $ 44,000 February $ 58,000 Budgeted cost of goods sold Plus: Desired ending inventory Inventory needed Less: Beginning inventory March $ 64,000 8,700 52,700 (6,600) Required purchases $ 43,900 Based on this information the amount of accounts payable appearing on the March 31 pro forma balance sheet is Multiple Choice $19,830. $46,270. $66,100. None of the answers is correct.arrow_forward

- 5 please follow instructions and show workarrow_forwardRooney Company sells lamps and other lighting fixtures. The purchasing department manager prepared the following inventory purchases budget. Rooney’s policy is to maintain an ending inventory balance equal to 15 percent of the following month’s cost of goods sold. April’s budgeted cost of goods sold is $82,000. Required Complete the inventory purchases budget by filling in the missing amounts. Determine the amount of cost of goods sold the company will report on its first quarter pro forma income statement. Determine the amount of ending inventory the company will report on its pro forma balance sheet at the end of the first quarter.arrow_forwardOld Antique Store prepared the following budget information for the month of May: Sales are budgeted at $303,000. All sales are on account and a provision for bad debts is made for each month at three percent of sales for the month. Inventory was $91,000 on April 30; an inventory increase of $17,000 is planned for May 31. All inventory is marked to sell at cost plus 50 percent. Estimated cash disbursements for selling and administrative expenses for the month are $55,000. Depreciation for May is projected at $6,700. Old Antique's budgeted cost of inventory purchases for May is:Multiple Choice $101,000. $151,500. $203,200. $219,000. $202,000.arrow_forward

- 3arrow_forwardA merchandiser, provides the following information for its December budgeting process: November 30 inventory 1,620 units Budgeted sales for December 4,050 units Desired December 31 inventory 2,835 units Budgeted purchases in December are:arrow_forwardPlease help me with show all calculation thankuarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education