Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

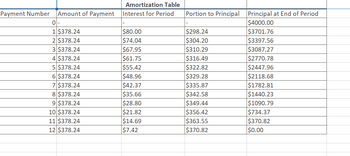

Use the amortization table to determine how much of the 10th payment is interest. The interest amount of the 10th payment is $ enter your response here

Transcribed Image Text:Payment Number

Amount of Payment

0-

1 $378.24

2 $378.24

3 $378.24

4 $378.24

5 $378.24

6 $378.24

7 $378.24

8 $378.24

9 $378.24

10 $378.24

11 $378.24

12 $378.24

Amortization Table

Interest for Period

$80.00

$74.04

$67.95

$61.75

$55.42

$48.96

$42.37

$35.66

$28.80

$21.82

$14.69

$7.42

Portion to Principal

-

$298.24

$304.20

$310.29

$316.49

$322.82

$329.28

$335.87

$342.58

$349.44

$356.42

$363.55

$370.82

Principal at End of Period

$4000.00

$3701.76

$3397.56

$3087.27

$2770.78

$2447.96

$2118.68

$1782.81

$1440.23

$1090.79

$734.37

$370.82

$0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An annuity due is an annuity for which: Question 10 options: A) the payments are made to repay a loan B) the payments are made at the beginning of each payment period C) the payments continue forever D) the payments are made at the end of each payment period E) the payment period is not the same as the conversion periodarrow_forwardUse the table below to answer the following questions: Present Value of 1 Factor Present Value of an Annuity of 1 Factor Period 1/2 Yr Full-Yr 1/2 Yr Full-Yr 1 0.9578 0.9174 0.9578 0.9174 2 0.9174 0.8417 1.8753 1.7591 3 0.8787 0.7722 2.7540 2.5313 4 0.8417 0.7084 3.5957 3.2397 5 0.8062 0.6499 4.4019 3.8897 6 0.7722 0.5963 5.1740 4.4859 Assumption: Required annual effective rate (EPR) of return is 9%. If an investment pays you $108,000 at the end of each year for 3 years, what is its present value? Group of answer choices $291,703 $273,380 $279,396 $250,193arrow_forwardUse the table below to answer the following questions: Present Value of an Annuity of 1 Future Value of an Annuity of 1 Period 4% 5% 8% 10% 4% 5% 8% 10% 4 3.6299 3.5460 3.3121 3.1699 4.2465 4.3101 4.5061 4.6410 5 4.4518 4.3295 3.9927 3.7908 5.4163 5.5256 5.8666 6.1051 6 5.2421 5.0757 4.6229 4.3553 6.6330 6.8019 7.3359 7.7156 7 6.0021 5.7864 5.2064 4.8684 7.8983 8.1420 8.9228 9.4872 8 6.7327 6.4632 5.7466 5.3349 9.2142 9.5491 10.6366 11.4359 9 7.4353 7.1078 6.2469 5.7590 10.5828 11.0266 12.4876 13.5795 10 8.1109 7.7217 6.7101 6.1446 12.0061 12.5779 14.4866 15.9374 11 8.7605 8.3064 7.1390 6.4951 13.4864 14.2068 16.6455 18.5312 Bobby gets a yearly alimony payment from his ex-wife and wants to saves enough to put a 15% down payment on a home in 4 years. Median…arrow_forward

- Following is a table for the present value of $1 at compound interest: Year 1 2 3 4 0.893 0.797 0.712 0.636 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 5 1 2 3 6% 4 0.943 0.890 0.840 0.792 0.747 6% 0.943 1.833 2.673 10% 3.465 4.212 0.909 0.826 0.751 0.683 0.621 10% 0.909 1.736 12% 2.487 3.170 3.791 12% 0.893 1.690 2.402 3.037 3.605 5 Using the tables provided, the internal rate of return of an investment of $227,460 that would generate an annual cash inflow of $60,000 for the next 5 years a. cannot be determined from the data given b. is 12% O c. is 6% O d. is 10%arrow_forwardSolve for the FVA or PVA value of the following annuity DUEs; Solve for… Payment amt #Pmts/year years Annual rate Answer; Future Value $ 12,000.00 1 20 8.00% Present Value $ 60,000.00 1 20 8.00% Future Value $ 1,000.00 12 20 12.00% Present Value $ 10,000.00 12 20 12.00%arrow_forward9. Examine the time line for Now the annuity shown. 250 (1.015) 250 (1.015) 250 (1.015) E 250 (1.015)23 250 (1.015) a) What is the duration of this annuity? How can you tell? b) Determine the annual rate of interest and the number of compounding periods per year. c) Determine the present value of this annuity. d) Determine the total interest earned. ANSWER 9. a) 6 years b) 6%; 4 compounding periods per year c) $5007.60 d) $992.40 Time (3-month periods) 1 2 250 250 250 250 250 3 23 24 H-Harrow_forward

- 2: Future value of an ordinary annuity:arrow_forwardPlease answer fast I will rate for you sure....arrow_forwardUse the table below to answer the following questions: Present Value of an Annuity of 1 Future Value of an Annuity of 1 Period 4% 5% 8% 10% 4% 5% 8% 10% 4 3.6299 3.5460 3.3121 3.1699 4.2465 4.3101 4.5061 4.6410 5 4.4518 4.3295 3.9927 3.7908 5.4163 5.5256 5.8666 6.1051 6 5.2421 5.0757 4.6229 4.3553 6.6330 6.8019 7.3359 7.7156 7 6.0021 5.7864 5.2064 4.8684 7.8983 8.1420 8.9228 9.4872 8 6.7327 6.4632 5.7466 5.3349 9.2142 9.5491 10.6366 11.4359 9 7.4353 7.1078 6.2469 5.7590 10.5828 11.0266 12.4876 13.5795 10 8.1109 7.7217 6.7101 6.1446 12.0061 12.5779 14.4866 15.9374 11 8.7605 8.3064 7.1390 6.4951 13.4864 14.2068 16.6455 18.5312 Bobby receives alimony payments every 6 months and the next payment is tomorrow. Median homes go for $950,000 and he wants to save $190,000 in 4 years. How much money should Bobby put away into an investment each time he receives alimony payments if he can get a 8% return a year? Group of answer choices…arrow_forward

- The following table is for the present value of $1 at compound interest. Year 1 2 3 4 5 6% Year 1 2 3 4 5 0.943 0.890 0.840 0.792 0.747 The following table is for the present value of an annuity of $1 at compound interest. 6% 0.943 1.833 2.673 10% 0.909 0.826 0.751 0.683 0.621 3.465 4.212 12% 0.893 0.797 0.712 0.636 0.567 10% 0.909 1.736 2.487 3.170 3.791 12% 0.893 1.690 2.402 3.037 3.605 Using these tables, what would be the present value of $15,000 (rounded to the nearest dollar) to be received 3 years from today, assuming an earnings rate of 6%?arrow_forwardComplete the ordinary annuity. (Please use the following provided Table.) Note: Do not round intermediate calculations. Amount of payment Payment payable Years Interest rate Value of annuity $ 5,000 Annually 11 4 %arrow_forwardThe deferral period lasts from the original deposit date (lump sum) up until the start of the term for the annuity. True 6. Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education