FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

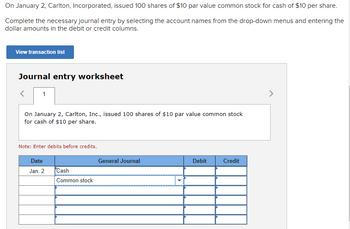

Transcribed Image Text:On January 2, Carlton, Incorporated, issued 100 shares of $10 par value common stock for cash of $10 per share.

Complete the necessary journal entry by selecting the account names from the drop-down menus and entering the

dollar amounts in the debit or credit columns.

View transaction list

Journal entry worksheet

1

On January 2, Carlton, Inc., issued 100 shares of $10 par value common stock

for cash of $10 per share.

Note: Enter debits before credits.

Date

Jan. 2

Cash

Common stock

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following comments each relate to the recording of journal entries. Which statement is true? Question 1 Select one: a. Journalization is the process of converting transactions and events into debit/credit format. b. For any given journal entry, debits must exceed credits c. The chart of accounts reveals the amount to debit and credit to the affected accounts d. It is customary to record credits on the left and debits on the rightarrow_forwardGary Moss, owner of Moss Interiors, is negotiating for the purchase of Cullumber Galleries. The balance sheet of Cullumber is given in an abbreviated form below. Cullumber Gallaries Balance Sheet As of December 31, 2020 Assets Liabilities and Stockholders' Equity Cash $124,000 Accounts payable $50,900 Land 71,900 Notes payable (long-term) 301,900 Buildings (net) 201,900 Total liabilities 352,800 Equipment (net) 176,900 Common stock Copyrights (net) 31,900 Retained earnings 253,800 Total assets $606,600 Total liabilities and stockholders' equity $606,600 Moss and Cullumber agree that: 1. Land is undervalued by $30,000. 2. Equipment is overvalued by $5,000. Cullumber agrees to sell the gallery to Moss for $350,000. $232,900 20,900arrow_forwardBefore processing a batch of invoices, the accounts payable clerk sums the quantities billed. The sum obtained is best described as a(n): A. financial total B. grand total C. record count D. hash total E. cross-footing totalarrow_forward

- Instructions The following equity investment transactions were completed by Romero Company during a recent year. Apr. July Sept. 10 Purchased 4,700 shares of Dixon Company for a price of $49 per share plus a brokerage commission of $120. 8 Received a quarterly dividend of $0.70 per share on the Dixon Company investment. 10 Sold 1,900 shares for a price of $41 per share less a brokerage commission of $75. Journalize the entries for these transactions. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers the nearest dollar.arrow_forwardWhy are transactions recorded in the journal? Group of answer choices To ensure that total debit equal total credits To help prepare the financial statements To ensure that all transactions are posted to the ledger To have a chronological record of all transactionsarrow_forwardThe General Ledger How does posting journal entries work in a computerized accounting system? What does it mean when posting is done automatically? Explain.arrow_forward

- 46) The journal entry behind the screen that QuickBooks creates when a bill is recorded using the Enter Bills window includes: A) Debit Accounts Payable, Credit Checking accountB) Debit Checking account, Credit Accounts PayableC) Debit Expense account, Credit Accounts PayableD) Debit Accounts Payable, Credit Expense account Group of answer choices A B C Darrow_forwardBriefly explain the difference between a sales receipt and an invoice in QuickBooksarrow_forwardInstructions Adele Corp., a wholesaler of music equipment, issued $31,400,000 of 20-year, 5% callable bonds on March 1, 20Y1, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions Refer to the Chart of Accounts for exact wording of account fifles 20Y1 Mar. Sept. 20Y5 Sept. Chart of Accounts Journal 1 Issued the bonds for cash at their face amount. Paid the interest on the bonds 1 1 Called the bond issue at 103, the rate provided in the bond indenture. (Omit entry for payment of interest.) Xarrow_forward

- Blossom Company purchases various types of beach toys for sale to consumers. Listed below are the transactions for the month of June. Blossom uses a perpetual inventory system. June 1 Purchased 25 water tubes for $260 each terms n/30 FOB destination. 8 Returned 4 tubes purchased on June 1 due to defects. Received a full refund for the defective tubes. 10 Freight charges of $100 for the June 1 transaction are paid by the responsible party. 11 Made a complaint about competitive pricing. Received a $400 credit for the water tubes purchased on June 1. 15 Purchased 110 water tubes for $235 each on account, terms 2/10 n/30. 18 Made payment for the amount owing for the June 1 transaction. 20 Made payment for the amount owing for the June 15 transaction.arrow_forwardWildhorse Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2025. Wildhorse had the following transactions related to notes payable Sept. 1 Sept. 30 Oct. 1 Oct. 31 Nov. 1 Nov. 30 Dec. 1 Dec. 31 Issued a $13,200 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Wildhorse uses a perpetual inventory system) Recorded accrued interest for the Pippen note. Issued a $22,800, 9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Recorded accrued interest for the Pippen note and the Prime Bank note. Issued a $24,000 note and paid $7,600 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Recorded accrued interest for the Pippen note, the Prime Bank note, and…arrow_forwardPost the unadjusted balances and adjusting entries into the appropriate t-accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education