Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

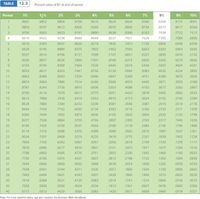

Complete the following using

| On PV Table 12.3 | |||||||

|

Amount desired at end of period |

Length of time |

Rate | Compounded |

Period used |

Rate used | PV factor used |

PV of amount desired at end of period |

| $18,100 | 5 years | 24% | Quarterly | % |

Transcribed Image Text:TABLE 12.3

Present value of $1 at end of period

Perlod

1%

14%

2%

3%

4%

5%

6%

7%

8%

9%

10%

1

9901

9852

9804

9709

9615

.9524

9434

9346

9259

.9174

9091

9803

.9707

.9612

9426

.9246

9070

8900

.8734

.8573

.8417

8264

9706

9563

9423

.9151

8890

.8638

8396

8163

7938

7722

7513

4

.9610

9422

.9238

.8885

8548

.8227

7921

7629

7350

7084

.6830

.9515

9283

.9057

8626

8219

.7835

7473

7130

.6806

.6499

.6209

.9420

9145

.8880

8375

7903

7462

7050

.6663

.6302

5963

.5645

7

.9327

.9010

8706

.8131

7599

7107

.6651

.6227

5835

.5470

5132

8.

.9235

8877

.8535

.7894

7307

.6768

.6274

5820

5403

.5019

4665

9.

.9143

8746

.8368

7664

7026

.6446

.5919

5439

5002

.4604

4241

10

.9053

.8617

.8203

7441

.6756

.6139

.5584

5083

4632

.4224

.3855

11

.8963

8489

.8043

7224

.6496

.5847

5268

4751

4289

.3875

3505

12

.8874

8364

.7885

7014

.6246

5568

4970

4440

3971

3555

3186

13

.8787

8240

.7730

.6810

.6006

.5303

4688

4150

3677

.3262

2897

14

.8700

.8119

7579

.6611

5775

.5051

.4423

.3878

.3405

2992

2633

15

.8613

7999

.7430

.6419

.5553

4810

4173

3624

.3152

2745

2394

16

.8528

.7880

7284

.6232

5339

4581

3936

3387

2919

2519

2176

17

.8444

.7764

7142

.6050

5134

4363

3714

.3166

2703

2311

.1978

18

.8360

.7649

.7002

.5874

.4936

.4155

3503

2959

2502

2120

.1799

19

.8277

.7536

.6864

.5703

4746

3957

3305

2765

2317

.1945

.1635

20

.8195

.7425

.6730

5537

.4564

3769

3118

2584

2145

.1784

.1486

21

.8114

.7315

.6598

.5375

4388

.3589

2942

2415

.1987

.1637

.1351

22

.8034

.7207

.6468

.5219

.4220

.3418

2775

2257

1839

.1502

.1228

23

.7954

.7100

.6342

5067

4057

3256

2618

2109

.1703

.1378

.1117

24

.7876

.6995

.6217

4919

3901

3101

2470

.1971

.1577

.1264

.1015

25

.7798

.6892

.6095

.4776

.3751

2953

2330

.1842

.1460

.1160

.0923

26

.7720

.6790

5976

4637

.3607

2812

2198

.1722

.1352

.1064

.0839

27

.7644

.6690

.5859

4502

3468

2678

2074

.1609

.1252

.0976

.0763

28

.7568

.6591

.5744

.4371

.3335

2551

.1956

.1504

.1159

.0895

.0693

29

.7493

.6494

5631

.4243

3207

2429

.1846

.1406

.1073

.0822

.0630

30

7419

6398

.5521

4120

3083

2314

.1741

.1314

0994

.0754

.0573

35

.7059

5939

5000

3554

2534

.1813

.1301

.0937

.0676

.0490

.0356

40

.6717

5513

4529

.3066

2083

.1420

.0972

.0668

0460

.0318

.0221

Note: For more detalled tables, see your booklet, the Business Math Handbook.

N 3

LO

CO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Complete the following using present value. (Use the Table 12.3.) Note: Do not round intermediate calculations. Round the "PV factor" to 4 decimal places and final answer to the nearest cent. Amount desired at end of period $ 18,500 Length of time 5 years Rate Compounded 8 % Quarterly On PV Table 12.3 Period used Rate used % PV factor used PV of amount desired at end of periodarrow_forwardFind the APR, or stated rate, in each of the following cases. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year. Stated Rate (APR) Number of Times Compounded % Semiannually % Monthly % Weekly % Daily Effective Rate (EAR) 12.50 % 8.50 % 12.50 % 10.50 %arrow_forwardFind the APR, or stated rate, in each of the following cases. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year. Number of Times Compounded Semiannually Stated Rate (APR) % % Monthly % Weekly % Daily Effective Rate (EAR) 13.75 % 9.75 % 11.25 % 9.25 %arrow_forward

- Complete the following using present value. (Use the Table 12.3.) Note: Do not round intermediate calculations. Round the "PV factor" to 4 decimal places and final answer to the nearest cent. Amount desired at end of period $ 19,200 Length of time 4 years Rate Compounded 12% Quarterly On PV Table 12.3 Period used Rate used % PV factor used PV of amount desired at end of periodarrow_forwardUse the present value table to complete: Note: Round the "PV factor" answer to 4 decimal places. Future Amount Length of Time Desired $ 12,000 12 years Rate Compounded 12% semiannually Table Periods A Rate Used P.V. P.V. Factor Amount C Darrow_forwardNonearrow_forward

- Please calculate the rate used, present value factor used, present value of amount desired at end of period with the present value interest factor chart. Thank you! $6,000 3% 8years compounded semiannually 16 periodsarrow_forwardFind the APR, or stated rate, in each of the following cases. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year. Number of Times Compounded Semiannually Stated Rate (APR) % % Monthly % Weekly % Daily Effective Rate (EAR) 14.75 % 10.75 % 10.25 % 8.25 %arrow_forwardT2.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education