Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

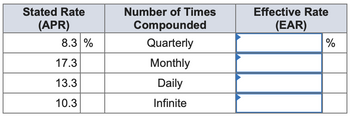

| Find the EAR in each of the following cases: (Use 365 days a year. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) |

Transcribed Image Text:Stated Rate

(APR)

8.3 %

17.3

13.3

10.3

Number of Times

Compounded

Quarterly

Monthly

Daily

Infinite

Effective Rate

(EAR)

%

Expert Solution

arrow_forward

Step 1

EAR is the annual equivalent rate for a given interest rate after taking into consideration the effects and impacts of compounding.

EAR is the actual interest rate that one end up earning on an investment (or ends up paying on a loan) when the impact of compounding is considered over a given time period. So when you invest in something and it pays 5% with monthly compounding then in that case EAR will not be 5% but a different number.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Solve for x in the equation 5.9x−14=12.Round your final answer to eight decimal places. arrow_forwardPlease do not give solution in image format thankuarrow_forwardConsider the problem below... Find the accumulated balance after 3 years when $6500 is deposited into an account that compounds monthly with an APR of 4% compounding monthly. Match the values given in the problem with the correct notation. Question 2 options: 1234 0.04 1234 3 1234 12 1234 6500 1. P 2. APR 3. n 4. Yarrow_forward

- Find the APR, or stated rate, in each of the following cases. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year. Number of Times Compounded Semiannually Stated Rate (APR) % % Monthly % Weekly % Daily Effective Rate (EAR) 13.75 % 9.75 % 11.25 % 9.25 %arrow_forwardCalculate the arithmetic average of the following retums. Year Retum 1 0.27 2 0.21 30.02 4 0.09 5 0.18 Enter the answer with 4 decimals, eg. 0.1234..arrow_forwardIf you could earn 10 percent annually, compute the present value of each alternative: (Do not round intermediate calculations. Round your final answers to 2 decimal places.)arrow_forward

- Using exact time, the due date of a loan that is made on February 10 of a leap year and is due in 60 days is on Blank 1. Blank 1 Add your answerarrow_forwardUnit Information with BWIP, FIFO Method Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: Production: Units in process, July 1, 60% complete* Units completed and transferred out Units in process, July 31, 80% complete* * With respect to conversion costs. 11,000 88,000 15,100arrow_forwardFind the APR, or stated rate, in each of the following cases. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Use 365 days in a year. Number of Times Compounded Semiannually Stated Rate (APR) % % Monthly % Weekly % Daily Effective Rate (EAR) 14.75 % 10.75 % 10.25 % 8.25 %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education