FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

If you don't mind using the second image to format the problem on the first that would be awesome thank you

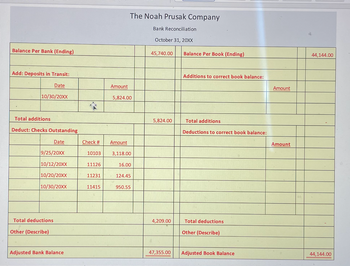

Transcribed Image Text:Balance Per Bank (Ending)

Add: Deposits in Transit:

Date

10/30/20XX

Total additions

Deduct: Checks Outstanding

Total deductions

Other (Describe)

Date

9/25/20XX

10/12/20XX

10/20/20XX

10/30/20XX

Adjusted Bank Balance

Check #

10103

11126

11231

11415

Amount

The Noah Prusak Company

Bank Reconciliation

October 31, 20XX

5,824.00

Amount

3,118.00

16.00

124.45

950.55

45,740.00

5,824.00

4,209.00

47,355.00

Balance Per Book (Ending)

Additions to correct book balance:

Total additions

Deductions to correct book balance:

Total deductions

Other (Describe)

Adjusted Book Balance

Amount

Amount

44,144.00

44,144.00

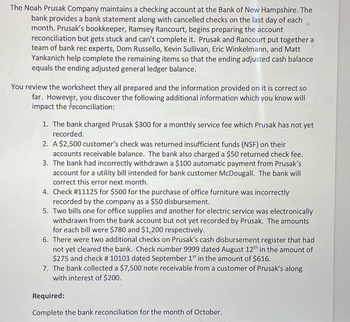

Transcribed Image Text:The Noah Prusak Company maintains a checking account at the Bank of New Hampshire. The

bank provides a bank statement along with cancelled checks on the last day of each

month. Prusak's bookkeeper, Ramsey Rancourt, begins preparing the account

reconciliation but gets stuck and can't complete it. Prusak and Rancourt put together a

team of bank rec experts, Dom Russello, Kevin Sullivan, Eric Winkelmann, and Matt

Yankanich help complete the remaining items so that the ending adjusted cash balance

equals the ending adjusted general ledger balance.

You review the worksheet they all prepared and the information provided on it is correct so

far. However, you discover the following additional information which you know will

impact the reconciliation:

1. The bank charged Prusak $300 for a monthly service fee which Prusak has not yet

recorded.

2. A $2,500 customer's check was returned insufficient funds (NSF) on their

accounts receivable balance. The bank also charged a $50 returned check fee.

3. The bank had incorrectly withdrawn a $100 automatic payment from Prusak's

account for a utility bill intended for bank customer McDougall. The bank will

correct this error next month.

4. Check #11125 for $500 for the purchase of office furniture was incorrectly

recorded by the company as a $50 disbursement.

5. Two bills one for office supplies and another for electric service was electronically

withdrawn from the bank account but not yet recorded by Prusak. The amounts

for each bill were $780 and $1,200 respectively.

6. There were two additional checks on Prusak's cash disbursement register that had

not yet cleared the bank. Check number 9999 dated August 12th in the amount of

$275 and check # 10103 dated September 1st in the amount of $616.

7. The bank collected a $7,500 note receivable from a customer of Prusak's along

with interest of $200.

Required:

Complete the bank reconciliation for the month of October.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!!arrow_forwardGive me right solution urgent pleasearrow_forwardExplain the Golsen Rule and, in your own words, provide an example of the application of the Golsen Rule. 4 MacBook Air Foarrow_forward

- Hi can you show how to input in excel using the PV formula thank you so mucharrow_forwardis there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forwardWhat is lossy compression? a MP3 is compressed music. b Reduce the size of files by taking out less important information. It drops nonessential information to decrease file size. Reduce the size of the file without losing any information and the original file can be reconstructed from a compressed version. d Joint Photographic Experts Group JPEG) is a compressed image. O O O Carrow_forward

- zoom for a better viewarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardThe easiest way to change the order in a chart is in the __________. Multiple Choice underlying spreadsheet slicer chart options chart itselfarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education