Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

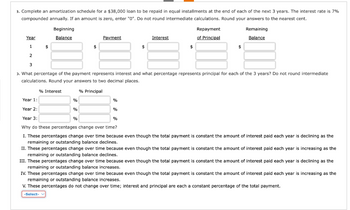

Transcribed Image Text:3. Complete an amortization schedule for a $38,000 loan to be repaid in equal installments at the end of each of the next 3 years. The interest rate is 7%

compounded annually. If an amount is zero, enter "0". Do not round intermediate calculations. Round your answers to the nearest cent.

Beginning

Balance

$

% Interest

Year

1

2

3

ɔ. What percentage of the payment represents interest and what percentage represents principal for each of the 3 years? Do not round intermediate

calculations. Round your answers to two decimal places.

% Principal

Payment

$

%

%

%

%

Interest

$

%

Repayment.

of Principal

$

Year 1:

Year 2:

Year 3:

%

Why do these percentages change over time?

I. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the

remaining or outstanding balance declines.

Remaining

Balance

$

II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the

remaining or outstanding balance declines.

III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the

remaining or outstanding balance increases.

IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the

remaining or outstanding balance increases.

V. These percentages do not change over time; interest and principal are each a constant percentage of the total payment.

-Select-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Determine the annual financing cost of a 1-year (365 day), $13,000 discounted bank loan at a stated annual interest rate of 9.0 percent. Assume that no compensating balance is required. Round your answer to two decimal places. %arrow_forwardLoan payment Determine the equal, annual, end-of-year payment required each year over the life of the loan shown in the following table to repay it fully during the stated term of the loan. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Principal $7,000 Interest rate 13% ... The amount of the equal, annual, end-of-year payment, CF, is $ Term of loan (years) 29 (Round to the nearest cent.)arrow_forwardWrite out a complete schedule for the amortization of a $50,000 loan with payments every 6 months at 14% interest compounded semiannually for 1 year. Complete the schedule below. Payment number Amount Interest 1 $ $ 2 S $ (Round to the nearest cent as needed.) Applied to principal $ $ Unpaid Balance $ $arrow_forward

- Calculate the principal and interest portions of the specified payment for this ordinary annuty, and give the balance remaining after that payment For full marks your answer should be rounded to the nearest cont Payment Principal Interest Balance Payment Frequency Term Number to Find Interest Payment Loan Principal Paid Paid After Payment 4. 0.00 0.00 0.00 $45,000.00 3.50 % compounded quarterly $3,250.97 Semi-annual 8 yearsarrow_forwardYou have taken a loan of $78,000.00 for 20 years at 4.9% compounded quarterly. Fill in the table below, rounding all values to the nearest cent. Note that the principal column is listed before the interest column even though the interest calculation is done first. Many lending institutions use this order in the amortization schedules they provide to their customers. Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) $ S $ $ s Balance $78,000.00 $arrow_forwardPrepare an amortization schedule for a five-year loan of $47,000. The interest rate is 7% per year, and the loan calls for equal annual payments. (Do not round intermediate calculations. Enter all amount as positive value. Round the final answers to 2 decimal places. Leave no cells blank - be certain to enter "O" wherever required.) Year 1 Beginning Balance $ 2 2 3 4 5 Total Payment $ Interest Payment Principal Payment Ending Balance $ How much interest is paid in the third year? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Interest paid $ How much total interest is paid over the life of the loan? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Total interest $arrow_forward

- What are the repayment schedules for each of the following five-year, 9 percent $11,000 term loans? Use Appendix D to answer the questions. Do not leave any cells blank. If the answer is zero, enter "0". Do not round intermediate calculations. A. Equal annual payments that amortize (retire) the principal and pay the interest owed on the declining balance. Round your answers to the nearest cent. Balance Interest Principal Year payment repayment on loan $ $ $ $ $ 1 2 3 4 5 $ $ $ $ $ Interest Principal Balance Year payment repayment on loan 1 $ $ 2 is B. Equal annual principal repayment, with interest calculated on the remaining balance owned. Round your answers to the nearest dollar. $ $ 3 $ $ $ 4 5 es $ $ $ $ $ $ $ $ $ $ $ $ $arrow_forwardSuppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forwardConstruct the amortization schedule for a $17,000.00 debt that is to be amortized in 10 equal semiannual payments at 6% interest per half-year on the unpaid balance. Fill out the amortization schedule below. Round all values to the nearest cent. Unpaid Balance Reduction Payment Number 0 1 2 Payment Interest $ $ $ $ $ $ Unpaid Balance $ $ WEEKERarrow_forward

- Crab State Bank has offered you a $1,500,000 5-year loan at an interest rate of 9.25 percent, requiring equal annual end-of-year payments that include both principal and interest on the unpaid balance. Develop an amortization schedule for this loan. Round your answers to the nearest dollar. Do not round intermediate calculations. End of Year Payment Interest (9.25%) Principal Reduction Balance Remaining 0 - - - $1,500,000 1 $ $ $ 2 3 4 5arrow_forwardPlease don't provide handwritten solution..arrow_forwardDetermine the amount of money in a savings account at the end of 4 years, given an initial deposit of $13,000 and a 4 percent annual interest rate when interest is compounded: Use Appendix A for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) a. Annually b. Semiannually c. Quarterly Future Valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education