FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

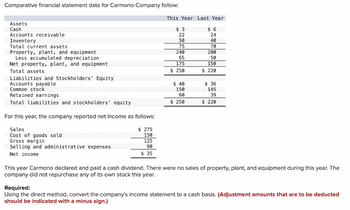

Transcribed Image Text:Comparative financial statement data for Carmono Company follow:

This Year Last Year

Assets

Cash

$3

$ 6

Accounts receivable

22

24

Inventory

50

40

Total current assets

75

70

240

200

65

50

Property, plant, and equipment

Less accumulated depreciation

Net property, plant, and equipment

Total assets

175

150

$ 250

$ 220

Liabilities and Stockholders' Equity

Accounts payable

$ 40

$36

Common stock

150

145

Retained earnings

60

39

Total liabilities and stockholders' equity

$ 250

$ 220

For this year, the company reported net income as follows:

Sales

Cost of goods sold.

Gross margin

Selling and administrative expenses

Net income

This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The

company did not repurchase any of its own stock this year.

Required:

Using the direct method, convert the company's income statement to a cash basis. (Adjustment amounts that are to be deducted

should be indicated with a minus sign.)

$275

22|35|2|

150

125

$35

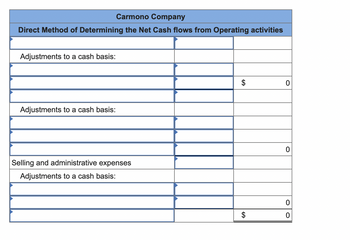

Transcribed Image Text:Carmono Company

Direct Method of Determining the Net Cash flows from Operating activities

Adjustments to a cash basis:

0

Adjustments to a cash basis:

0

Selling and administrative expenses

Adjustments to a cash basis:

GA

$

$

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Measures of liquidity, Solvency and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall Inc. common stock was $ 64 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $ 3,099,650 $ 2,623,250 Net income 681,600 537,300 Total $ 3,781,250 $ 3,160,550 Dividends On preferred stock $ 9,100 $ 9,100 On common stock 51,800 51,800 Total dividends $ 60,900 $ 60,900 Retained earnings, December 31 $ 3,720,350 $ 3,099,650 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 4,210,640 $ 3,879,520 Cost of goods sold 1,554,900 1,430,510 Gross profit $ 2,655,740 $ 2,449,010 Selling expenses $ 893,140 $ 1,089,600 Administrative expenses 760,830…arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $308,600 $240,000 Marketable securities 357,300 270,000 Accounts and notes receivable (net) 146,100 90,000 Inventories 689,000 427,000 Prepaid expenses 355,000 273,000 Total current assets $1,856,000 $1,300,000 Current liabilities: Accounts and notes payable (short-term) $336,400 $350,000 Accrued liabilities 243,600 150,000 Total current liabilities $580,000 $500,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4 3.…arrow_forwardMeasures of liquidity, Solvency and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall Inc. common stock was $ 60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $ 1,024,550 $ 869,250 Net income 233,600 178,000 Total $ 1,258,150 $ 1,047,250 Dividends On preferred stock $ 7,700 $ 7,700 On common stock 15,000 15,000 Total dividends $ 22,700 $ 22,700 Retained earnings, December 31 $ 1,235,450 $ 1,024,550 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 1,456,350 $ 1,341,770 Cost of goods sold 520,490 478,850 Gross profit $ 935,860 $ 862,920 Selling expenses $ 319,920 $ 392,750 Administrative expenses 272,520 230,660 Total…arrow_forward

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $655,500 $520,000 Marketable securities 759,000 585,000 Accounts and notes receivable (net) 310,500 195,000 Inventories 643,500 475,800 Prepaid expenses 331,500 304,200 Total current assets $2,700,000 $2,080,000 Current liabilities: Accounts and notes payable (short-term) $435,000 $455,000 Accrued liabilities 315,000 195,000 Total current liabilities $750,000 $650,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4 3.…arrow_forwardMeasures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 65 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,173,375 $995,425 Net income 259,200 203,900 Total $1,432,575 $1,199,325 Dividends: On preferred stock $8,400 $8,400 On common stock 17,550 17,550 Total dividends $25,950 $25,950 Retained earnings, December 31 $1,406,625 $1,173,375 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $1,622,790 $1,495,130 Cost of goods sold 611,010 562,130 Gross profit $1,011,780 $933,000 Selling expenses $341,930 $416,290 Administrative expenses 291,280 244,490 Total operating…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $594,300 $495,600 Marketable securities 688,200 557,600 Accounts and notes receivable (net) 281,500 185,800 Inventories 852,700 575,800 Prepaid expenses 439,300 368,200 Total current assets $2,856,000 $2,183,000 Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities $394,400 $413,000 285,600 177,000 $680,000 $590,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital 2. Current ratio 3. Quick ratio $ SAarrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,704,000 $3,264,000 Net income $ 600,000 $ 550,000 Dividends: On preferred stock (10,000) (10,000) On common stock (100,000) (100,000) Increase in retained earnings $ 490,000 $ 440,000 Retained earnings, December 31 $4,194,000 $3,704,000 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $ 10,850,000 $10,000,000 Cost of goods sold (6,000,000) (5,450,000) Gross profit $ 4,850,000 $ 4,550,000 Selling expenses $ (2,170,000) $ (2,000,000) Administrative expenses (1,627,500) (1,500,000) Total operating expenses $(3,797,500) $ (3,500,000)…arrow_forwardPlease answer with explanations asset turnover, return on total assets, return on stockholders equity and return on common stockholders equity .Thxarrow_forward

- Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: $104,000 0 34,500 490,000 Notes payable Stockholders' equity: Common stock 590,000 590,000 Retained earnings 1,815,500 1,754,200 Total liabilities and stockholders' equity $3,034,000 $2,948,000 Earnings per share for the year ended December 31, 2024, are $1.25. The closing stock price on December 31, 2 Required: Calculate the following profitability ratios for 2024. (Use 365 days a year. Round your final answers to 1 decima Profitability Ratios 1. Gross profit ratio 2. Return on assets 3. Profit margin 4. Asset turnover 5. Return on equity 6. Price-earnings ratio 38.6% 42.3 % 14.4 % 2.9 times 53.2 % 17.1 1,095,000 (398,000) $3,034,000 1,095,000 (199,000) $2,948,000 $80,000 3,900 29,900 490,000arrow_forwardMeasures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 65 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,173,375 $995,425 Net income 259,200 203,900 Total $1,432,575 $1,199,325 Dividends: On preferred stock $8,400 $8,400 On common stock 17,550 17,550 Total dividends $25,950 $25,950 Retained earnings, December 31 $1,406,625 $1,173,375 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $1,622,790 $1,495,130 Cost of goods sold 611,010 562,130 Gross profit $1,011,780 $933,000 Selling expenses $341,930 $416,290 Administrative expenses 291,280 244,490 Total operating…arrow_forwardDetermining Retained Earnings and Net Income The following information appears in the records of Bock Corporation at year-end: Accounts Receivable $23,000 Retained Earnings ? Accounts Payable 00 Supplies Cash Common Stock 110,000 9,000 8,000 Equipment, net 154,000 a. Calculate the balance in Retained Earnings at year-end $ 0 b. If the amount of the retained earnings at the beginning of the year was $30,000 and $12,000 in dividends is paid during the year, calculate net income for the year. $42,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education