Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

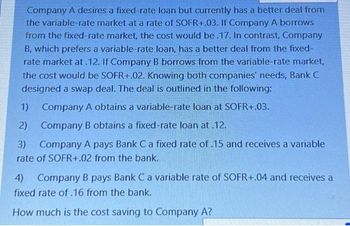

Transcribed Image Text:Company A desires a fixed-rate loan but currently has a better deal from

the variable-rate market at a rate of SOFR+.03. If Company A borrows

from the fixed-rate market, the cost would be .17. In contrast, Company

B, which prefers a variable-rate loan, has a better deal from the fixed-

rate market at .12. If Company B borrows from the variable-rate market,

the cost would be SOFR+.02. Knowing both companies' needs, Bank C

designed a swap deal. The deal is outlined in the following:

Company A obtains a variable-rate loan at SOFR+.03.

2)

Company B obtains a fixed-rate loan at .12.

3) Company A pays Bank C a fixed rate of .15 and receives a variable

rate of SOFR+.02 from the bank.

1)

4) Company B pays Bank C a variable rate of SOFR+.04 and receives a

fixed rate of .16 from the bank.

How much is the cost saving to Company A?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- c. What are the interest tax shields from the project? What is their present value? d. Show that the APV of Alcatel-Lucent's project matches the value computed using the WACC method Make sure to provide in TEXT. No to SNIP AND HANDRWRITING. MAKE SURE IT IS CORRECT ALSO. NOT FROM CHAT GOT. Clean format. Thank you. I’ll rate you uplikearrow_forwardWhat are the two best arguments favor debt reduction (i.e., the pros)?arrow_forwardAn impaired loan is: O a. Is one that has not made a payment in the last 30 days. b. Is one that has not made a payment in the last 90 days. O C. Is one that will be unlikely to make all payments as contracted on time. d. Is one that operates in an industry that has an expected reduction in its future prospects.arrow_forward

- You have a choice among three types of loan (discount loan, interest - only loan, and amortized loan), and wish to pay the LEAST expensive cost of borrowing. An amortized loan will the cheapest option. true or falsearrow_forwardIn a CDO structure, when economic condition turns out to be better than previously expected, the cash flow from the pool of underlying assets (such as mortgage loans or consumer loans) is more than the level reflected in the original(previous) pricing of the tranches. In this scenario, which tranche’ rate of return will turn out to be higher than others? → (1) Senior tranche; (2) Mezzanine tranche; (3) Junior tranche;arrow_forwardWhy is credit risk management important and what are the features of a loan or debt instrument it determines? What is the difference between a spot loan and revolving loan? What is loan commitment? What are the different rates that have replaced LIBOR and in what countries/economic blocs are they used in? What are the borrower and market specific factors that impact the return on a loan for a financial institution? Are higher interest rates a restrictive or stimulative form of monetary policy and explain your answer?arrow_forward

- Which of the following is nota reason why some companies lease rather than buy? A. Leasing may allow you to borrow with little or no down payment. B. Leasing can improve the balance sheet by reducing long-term debt. C. Leasing can lower income taxes. D. Leasing transfers the title to the lessee at the beginning of the lease.arrow_forwardblank options are margins, payment caps, points, variable investmentsarrow_forwardAccording to the trade-off theory, the optimal capital structure is the level of debt that O minimizes the financial distress costs. equates the present values of the incremental interest tax shield and the incremental financial distress costs. maximizes the after-tax cash flows that are internally generated. maximizes the present value of the interest tax shield.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education