Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

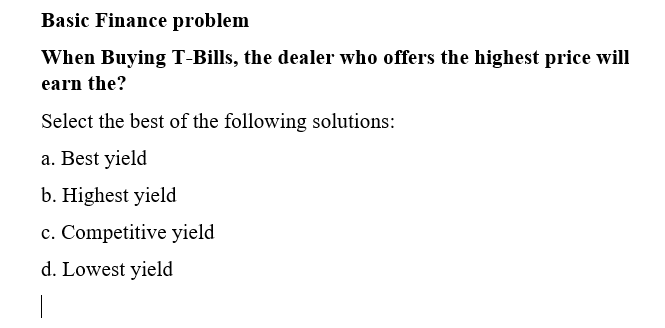

Transcribed Image Text:Basic Finance problem

When Buying T-Bills, the dealer who offers the highest price will

earn the?

Select the best of the following solutions:

a. Best yield

b. Highest yield

c. Competitive yield

d. Lowest yield

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The return payable on equity is called Select one: a. Brokerage b. Interest c. None of the options d. Commission e. Discountarrow_forwardonds are issued at discount Select one: a. When market rate of interest is equal to coupon rate b. None of the options is right c. When market rate of interest is less than coupon rate d. When market rate of interest is greater than coupon ratearrow_forward. 1. In general, financial assets that have a(n) higher; higher lower; higher higher; lower equal; higher 2. The more liquid markets are the: lower the interest rates, and the lower the amount of investment. higher the interest rates, and the higher the amount of investment. lower the interest rates, and the higher the amount of investment. higher the interest rates, and the lower the amount of investment. 3. When purchasing a future contract, the buyer of a futures contract: • agrees to pay the seller later where the payment is based on the future price of some asset. assumes very little risk of the future price fluctuation of some asset. must pay a set amount to the seller regardless of what the future price turns out to be. none of these are true. 4. Those who believe that market prices always incorporate all available information believe: in the efficient-market hypothesis. • that randomly choosing a stock is not as effective as technical or fundamental analysis. that current stock…arrow_forward

- How might a sudden decrease in people's expectations of future real estate prices affect interest rates? O A. Interest rates would increase because real estate would have a relatively lower rate of return compared to bonds, which would cause the demand for bonds to increase. B. Interest rates would increase because real estate would have a relatively higher rate of return compared to bonds, which would cause the demand for bonds to decrease. OC. Interest rates would decrease because real estate would have a relatively higher rate of return compared to bonds, which would cause the demand for bonds to decrease. O D. Interest rates would decrease because real estate would have a relatively lower rate of return compared to bonds, which would cause the demand for bonds to increase.arrow_forwardThe lower the discount rate used: Select one: A. the bigger the present value of future cash flows and the shorter the payback time. B. the smaller the present value of future cash flows and the shorter the payback time. C. the bigger the present value of future cash flows and the longer the payback time. D. the smaller the present value of future cash flows and the longer the payback time.arrow_forwardPut–Call Parity - A put and a call have the same maturity and strike price. If they have the same price, which one is in the money? Prove your answer and provide an intuitive explanation.arrow_forward

- The constant rupee value plan requires a. Investors to fix the expected value of their portfolio b. Investors to fix their periodical installments c. Investors to fix their rebalancing points d. All of the mentionedarrow_forwardWhich of the following statements is true? Multiple Choice When NPV is 0, the IRR is equal to the discount rate. When NPV is 0, the investment is not making a profit. In calculating IRR, we make the assumption all cash flows are reinvested at the discount rate. NPV is a good measure to use when comparing investments of different sizes.arrow_forwardSolve this practice problemarrow_forward

- answer for part Darrow_forwardYou have a choice among three types of loan (discount loan, interest - only loan, and amortized loan), and wish to pay the LEAST expensive cost of borrowing. An amortized loan will the cheapest option. true or falsearrow_forwardPlease step by step solutionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education