FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Companies in the tire manufacturing business use a lot of property, plant, and equipment. Tyrell Rubber and Tire Corporation and Maxwell Rubber and Tire Manufacturing are two of the leading manufacturers. In additiion, Maxwell also operates over 1,000 tire service center outlets.

Tyrell Rubber & Tire Maxwell Rubber & Tire

Sales $2,918 $15,585

Depreciation and depletion costs 185 950

Property, plant, and equipment (net of accumulated depreciation ) 976 6,146

Total assets 2,633 16,982

Depreciation method Straight-line Straight-line

Depletion method Units of production Units of production

Estimated life of assets

Buildings 10 to 40 years 3 to 45 years

Machinery and equipment 2 to 14 years 3 to 40 years

Net income $105 $875

Required

a .Calculate depreciation costs as a percentage of sales for each company.

b.Calculate property, plant, and equipment as a percentage of total assets for each company.

c.Based only on the percentages calculated in Requirements a and b, which company appears to be using its assets most efficiently?

d.Calculate the return-on-assets ratio for each company. Based on this ratio, which company appears to be using its assets most efficiently?

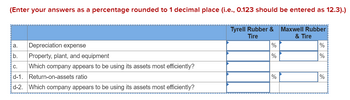

Transcribed Image Text:(Enter your answers as a percentage rounded to 1 decimal place (i.e., 0.123 should be entered as 12.3).)

a.

Depreciation expense

b. Property, plant, and equipment

C.

Which company appears to be using its assets most efficiently?

d-1. Return-on-assets ratio

d-2. Which company appears to be using its assets most efficiently?

Tyrell Rubber & Maxwell Rubber

Tire

& Tire

%

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Double Island Ltd constructed a Whizbang Machine and incurred the following costs in doing so: Amounts paid to employees to build the machine $120 000 Raw materials consumed in building the machine $45 000 Depreciation of manufacturing equipment attributed to the construction of the Whizbang Machine $25 000 REQUIRED Provide the journal entries that Double Island Ltd would use to account for the construction of the asset. Assume that immediately after the journal entries in part (a) have been made, new information becomes available that indicates that the recoverable amount of the Whizbang Machine is only $160 000. Provide the adjusting journal entriesarrow_forwardDorman company purchased a new machine for its production process. The following costs were incurred for the new machine. Training costs for workers who will operate the machine $15,000 Wages paid to workers who operate the machine during production 109,000 Ordinary repairs to the machine before the first production run 1,000 1 Cost of platform used to properly secure the machine 30,000 Costs of tests run which took place before the first production run 8,000 WHICH COSTS SHOULD BE ADDED TO THE COST OF MACHINE?arrow_forwardAuto purchased a $500,000 tract of land that is intended to be the site of a new office complex. The company incurred additional costs and realized salvage proceeds as follows: Demolilitipn of existing building on site: $75,000 Legal and other fees to close escrow: $15,000 Proceeds from sale of demolition scrap: $10,000 What would be the cost of land? A. $500,000 B. $575,000 C. $580,000 D. $590,000arrow_forward

- Lancaster Company decides to build its own factory on land owned by the firm. It cost Lancaster $186,000 to do this. When the factory was completed, a professional appraisal showed the market value of the building to be $220,000 sitting on a piece of land worth $50,000 that was acquired years ago for $15,500. Required 1: What amount is reported in the balance sheet as the value of the land on Lancaster's book? $ Required 2: What value should the new constructed building be shown at on Lancaster's books? $ Required 3: If the building constructed will be depreciated in 50 years with no residual value (assume straight-line depreciation is used), what is the depreciation expense for the first full year of use? $arrow_forward1 account treatment opotiom: capitalized/ depreciated or expensedarrow_forwardWhich of the following are the capitalized coats of the land and the new building, respectively?arrow_forward

- On January 6, Year 1, Mount Jackson Corporation purchased a tract of land for a factory site for $845,000. An existing building on the site was demolished and the new factory was completed on October 11, Year 1. Additional cost data are shown below: Construction cost of new building $ 1,032,000 Real estate and attorney fees Architect fees Cost to demolish old building Salvage recovery from old building What is the capitalized cost of the new building? O $1,205,900 O $1,120,000 O $1,105,000 O $1,184,900 21,000 88,000 79,900 (15,000)arrow_forwardThe Madison Sign Company purchased land as a factory site for $75,000. Prior to construction of the new building, the land had to be cleared of trees and brushConstruction costs incurred during the first year are listed belowarrow_forwardRequired information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $520,000. The ovens originally cost $712,000, had an estimated service life of 10 years, had an estimated residual value of $42,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. 4. Determine the financial statement effects of the sale of the ovens at the end of the second year. Note: Amounts to be deducted should be indicated by a minus sign. Assets Balance Sheet Liabilities Stockholders' Equity Common Retained Stock Earnings Revenues Income Statement Expenses Net Incomearrow_forward

- This is business algebra please show your work so I can understand the question. Thank youarrow_forwardRequired information [The following information applies to the questions displayed below.] New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $259,000. The ovens originally cost $345,000, had an estimated service life of 10 years, had an estimated residual value of $20,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. 4. Record the sale of the ovens at the end of the third year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the disposal of equipment. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Expert Answers to Latest Homework Questions

Q: 10:38 PM P

4136 54

A man

Homework

was due west

for

and

4km. He then changes directies

walks on a…

Q: What is the net sales revenue of this financial accounting question?

Q: Solve this question accounting

Q: Provide accurate solution for this general accounting question

Q: Get correct answer this general accounting question

Q: Solve

Q: General accounting question

Q: 3. A room has a large circular table with ten seats, numbered 1 to 10, such that to the right of…

Q: Brightwoodę Furniture provides the following financial data for a

given enod:

Sales

Less Variable E…

Q: Kindly help me with accounting questions

Q: Charlotte Metals' operating activities for

the year are listed below:

Beginning inventory $950,600…

Q: Quick answer of this accounting questions

Q: If image is blurr then comment i will write values in comment .

dont amswer with unclear data i will…

Q: None

Q: Do fast answer of this general accounting question

Q: charity

savings

Budget for May

travel

food

Peter earned $700 during May. The graph

shows how the…

Q: Need help with this question solution general accounting

Q: Q2) Determine the bar forces and reactions of the truss. ABD= 4 in², A= 2 in² and

E=30000 kips/in².…

Q: Hi expert please give me answer general accounting question

Q: Do fast answer of this accounting questions

Q: General accounting question