FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

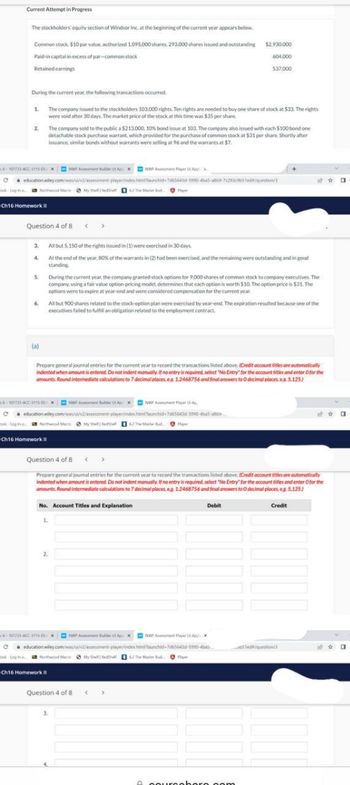

Transcribed Image Text:Current Attempt in Progress

The stockholders' equity section of Windsor Inc. at the beginning of the current year appears below.

Common stock, $10 par value, authorized 1.095,000 shares, 293,000 shares issued and outstanding

Paid-in capital in excess of par-common stock

Retained earnings

1

During the current year, the following transactions occurred.

The company issued to the stockholders 103,000 rights. Ten rights are needed to buy one share of stock at $33. The rights

were void after 30 days. The market price of the stock at this time was $35 per share.

2

Question 4 of 8 < >

3.

4.

6-107733-ACC-3115-xNWP Ant bulder ApxNPA Player App

C

education wiley.com/was/ui/2/assessment-player/index.htmlaunchid-7665643d-5990-4ba5-ab69-7c291c65ed/question/3

ook Login Northwood Macro My Shelfedha 6 The Master Bud

Ch16 Homework II

5.

(a)

The company sold to the public a $213.000, 10% bond issue at 103. The company also issued with each $100 bond one

detachable stock purchase warrant, which provided for the purchase of common stock at $31 per share. Shortly after

issuance, similar bonds without warrants were selling at 96 and the warrants at $7.

Ch16 Homework II

6.

All but 900 shares related to the stock-option plan were exercised by year-end. The expiration resulted because one of the

executives failed to fulfill an obligation related to the employment contract

All but 5.150 of the rights issued in (1) were exercised in 30 days.

At the end of the year. 80% of the warrants in (2) had been exercised, and the remaining were outstanding and in good

standing.

-10772-ACC-115-xent Blder AxNWP Ant Player Ap

C education wiley.com/was/ui/v2/assessment-player/index.htmiaunchid-7055643d-5990-4a5-a

ook Login Northwood Macro My Shelf Redel62 The Mate Bud Play

Prepare general journal entries for the current year to record the transactions listed above. (Credit account tities are automatically

indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the

amounts. Round intermediate calculations to 7 decimal places.es 1.2468756 and final answers to O decimal places. e. 5.125)

$2.930,000

604.000

During the current year, the company granted stock options for 9,000 shares of common stock to company executives. The

company, using a fair value option pricing model, determines that each option is worth $10. The option price is $31. The

options were to expire at year-end and were considered compensation for the current year.

2.

537,000

1.

Question 4 of 8

Prepare general journal entries for the current year to record the transactions listed above. (Credit account titles are automatically

indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the

amounts. Round intermediate calculations to 7 decimal places, eg 1.2468756 and final answers to O decimal places, eg. 5,125)

Debit

Credit

No. Account Titles and Explanation

>

6-107733 ACC-315- XNWP Ant Buker AXNWP Assement Player App

C education wiley.com/was/ui/v2/assessment-player/index.htmlaunched-7065643d-9990-ba

ook-Log in

Nothwood MaceMyShehe 62 The Master Bud

Ch16 Homework II

Question 4 of 8 <

A coursohore.com

1ed/question/

0

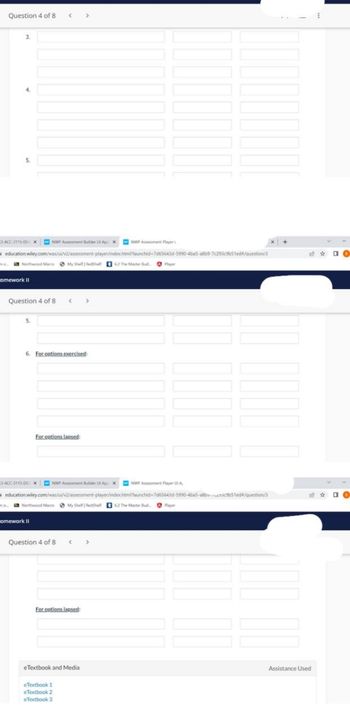

Transcribed Image Text:Question 4 of 8

3.

4.

5.

-ACC-3115-DUxNWP Assessment Builder Upx

ina

NWP Assement Player

education wiley.com/was/ui/v2/assessment-player/index.html?launchid-7d65643d-5990-4ba5-a8b9-7c293c9b51ed/question/3

ne... Northwood MacMy Shelf RedShell 62 The Master Bud ✪ Player

omework II

Question 4 of 8 < >

5.

<

6. For options exercised:

NWP Assement Par

education.wiley.com/was/ui/v2/assessment-player/index.html?launchid-7d65643d-5990-4ba5-a8bcb51ed#/question/3

Northwood Macro My Shell RedShell 62 The Master Bud

For options lansed:

3-ACC-3115-DExNWP Assessment Builder Upx

omework II

Question 4 of 8

< >

For options lapsed:

eTextbook 1

eTextbook 2

eTextbook 3

eTextbook and Media

Player

Assistance Used

DO

DO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Current Attempt in Progress Concord Corporation has 43,500 shares of $12 par value common stock outstanding. It declares a 15% stock dividend on December 1 when the market price per share is $19. The dividend shares are issued on December 31. • Prepare the entries for the declaration and issuance of the stock dividend. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation ◆ Debit Credit 1000arrow_forwardAlma Corp. issues 1,120 shares of $7 par common stock at $15 per share. When the transaction is journalized, credits are made to a.Common Stock, $7,840 and Paid-In Capital in Excess of Par—Common Stock, $8,960. b.Common Stock, $16,800. c.Common Stock, $8,960 and Paid-In Capital in Excess of Stated Value, $7,840. d.Common Stock, $7,840 and Retained Earnings, $8,960.arrow_forwardInstructions The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 2% Stock, $100 par (100,000 shares authorized, 80,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $5 par (5,000,000 shares authorized, 4,000,000 shares issued) Paid-In Capital in Excess of Par-Common Stock Retained Earnings $8,000,000 440,000 20,000,000 2,280,000 115,400,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Issued 220,000 shares of common stock at $14, receiving cash. b. Issued 12,000 shares of preferred 2% stock at $110. c. Purchased 160,000 shares of treasury common for $10 per share. d. Sold 105,000 shares of treasury common for $16 per share. e. Sold 40,000 shares of treasury common for $8 per share. f. Declared cash dividends of $2.00 per share on preferred stock and $0.08 per share on common stock. g.…arrow_forward

- (R) please answer asap.. The stockholders’ equity section of Jun Company’s balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 20% stock dividend. The stock’s per share market value on April 2 is $10 (prior to the dividend). Common stock—$5 par value, 555,000 sharesauthorized, 290,000 shares issued and outstanding$ 1,450,000Paid-in capital in excess of par value, common stock670,000Retained earnings923,000Total stockholders' equity$ 3,043,000Prepare the stockholders’ equity section immediately after the stock dividend is distributed.arrow_forwardRefer to the following The stockholders equity section of Peter Corporation's balance sheet at December 31, 20X2, was as follows: Ordinary shares (P10 par value, authorized 1,000,000 shares, issued and outstanding 900,000 shares) Share premium Retained earnings P 9,000,000 2,700,000 1,300,000 On January 2, 20X3, Peter purchased and retired 100,000 shares of its stock for P1,800.000, Immediately after retirement of these 100,000 shares, the balances in the share premium and retained earnings accounts should be Share premium? Retained earnings? P 900,000 P1,300,000 P1,900,000 P1,300,000 O P2,400,000 P 800,000 P1,400,000 P 800,000arrow_forwardhelp fill inarrow_forward

- On January 1, Pharoah Company had 87000 shares of $10 par value common stock outstanding. On May 7, the company declared a 5% stock dividend to stockholders of record on May 21. Market value of the stock was $16 on May 7. The stock was distributed on May 24. The entry to record the transaction of May 24 would include aarrow_forwardTop-Value Corporation has 900,000 shares of $26 par common stock outstanding. On September 2, Top-Value Corporation declared a 3% stock dividend to be issued November 30 to stockholders of record on October 3. The market price of the stock was $44 per share on September 2. Required: Journalize the entries required on September 2, October 3, and November 30. If no entry is required, simply skip to the next transaction.arrow_forwardAlex Corporation reports the following components of stockholders' equity at December 31 of the prior year. Common stock-$25 par value, 60,000 shares authorized, 37,000 shares i issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 925,000 74,000 364,000 $ 1,363,000 During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 3,700 shares of its own stock at $25 cash per share. January 7 February 28 July 9 August 27 September 9 October 22 December 31 Directors declared a $1.50 per share cash dividend payable on February 28 to the February 9 stockholders of record. Paid the dividend declared on January 7. Sold 1,480 of its treasury shares at $30 cash per share. Sold 1,850 of its treasury shares at $21 cash per share. Directors declared a $2 per share cash dividend payable on October 22 to the September 23 stockholders of record. Paid the dividend declared on…arrow_forward

- On October 10, the stockholders' equity section of Sherman Systems appears as follows. Common stock-$10 par value, 90,000 shares authorized, issued, and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity 1. Prepare journal entries to record the following transactions for Sherman Systems. a. Purchased 6,800 shares of its own common stock at $43 per share on October 11. b. Sold 1,450 treasury shares on November 1 for $49 cash per share. c. Sold all remaining treasury shares on November 25 for $42 cash per share. 2. Prepare the stockholders' equity section after the October 11 treasury stock purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the following transactions for Sherman Systems. a. Purchased 6,800 shares of its own common stock at $43 per share on October 11. b. Sold 1,450 treasury shares on November 1 for $49 cash per share. c. Sold all…arrow_forwardgarrow_forwardCurrent Attempt in Progress On January 1, Ivanhoe Corporation had 91,000 shares of no-par common stock issued and outstanding. The stock has a stated value of $6 per share. During the year, the following occurred. Apr. 1 Issued 21,000 additional shares of common stock for $17 per share. June 15 July 10 Dec. 1 (a) 15 Declared a cash dividend of $1 per share to stockholders of record on June 30. Paid the $1 cash dividend. Issued 2,500 additional shares of common stock for $18 per share. Declared a cash dividend on outstanding shares of $2.30 per share to stockholders of record on December 31. Prepare the entries to record these transactions. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education