FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

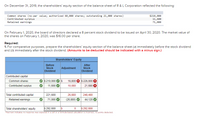

Transcribed Image Text:On December 31, 2019, the shareholders' equity section of the balance sheet of R & L Corporation reflected the following:

Common shares (no-par value; authorized 60,000 shares; outstanding 21,000 shares)

Contributed surplus

Retained earnings

$210,000

11,600

71,000

On February 1, 2020, the board of directors declared a 8 percent stock dividend to be issued on April 30, 2020. The market value of

the shares on February 1, 2020, was $16.00 per share.

Required:

1. For comparative purposes, prepare the shareholders' equity section of the balance sheet (a) immediately before the stock dividend

and (b) immediately after the stock dividend. (Amounts to be deducted should be indicated with a minus sign.)

Shareholders' Equity

Before

Stock

Dividend

After

Stock

Dividend

Adjustment

Contributed capital

$ 210,000

16,800 O s 226,800 8

Common shares

Contributed surplus

11,600

10,080

21,680 O

Total contributed capital

221,600

26,880

248,480

Retained earnings

71,000

(26,880)

44,120

Total shareholders' equity

S 292,600

$ 292,600

*Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Contributed capital: Western Grass, Inc. Equity Section of Balance Sheet December 31, 2823 Preferred shares, $3 cumulative, 10,000 shares authorized, issued and outstanding Common shares, 100,000 shares authorized; 65,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 75,000 552,500 627 500 581 000 $1,208,500 Required: Using the Information provided, calculate book value per common share assuming: (Round the final answers to 2 decimal places.) a. There are no dividends in arrears. b. There are three years of dividends in arrears. Book Value of Common Sharesarrow_forwardPrepare the shar (b) financial position at Decen to shareholders' equity 1. The following information relates Preference Share Capital, 12%, P50 par cumulative, 10,000 shares authorized Ordinary Share Capital, P1 stated value, 2,000,000 shares authorized Share Premium - Preference Paid in Capital in Excess of Stated Value Retained Earnings P 400,000 1,000,000 80,000 1,400,000 1,816,000 40,000 Treasury Shares - Ordinary (10,000 shares) During 2018, the corporation had the following transactions and events pertaining to its shareholders' equity: Issued 20,000 ordinary shares for P100,000 Sold 6,000 treasury shares for P28,000. Issued 5,000 shares of ordinary share capital for a piece of equipment with cash price of P25,000. Purchased 1,000 shares of ordinary for the treasury at a cost of P6,000. Declared the annual dividend on preference share and PO.20 cash dividend on ordinary share. Determined that profit for the year was P377,000 Feb. 1 Apr. 30 Sept. 1 Nov. 2 Dec. 31 31 31 The fair…arrow_forwardThe equity section of Windsor SA appears below as of December 31, 2022. Share capital-preference (6% preference shares, R$50 par value, authorized 94,600 shares, outstanding 84,600 shares) Share capital-ordinary (R$1 par, authorized and issued 10,000,000 shares) Share premium-ordinary Retained earnings Net income Earnings Per Share: Income from continuing operations Discontinued operations, net of tax R$125,960,000 Net income 31,020,000 R$ R$4,230,000 Net income for 2022 reflects a total effective tax rate of 20%. Included in the net income figure is a loss of R$11,280,000 (before tax) as a result of discontinued operations. Preference dividends of R$253,800 were declared and paid in 2022. Dividends of R$ 940,000 were declared and paid to ordinary shareholders in 2022. 10,000,000 Compute earnings per share data as it should appear on the income statement of Windsor SA. (Round answers to 2 decimal places, e.g. 1.48.) 19,270,000 156,980,000 R$190,480,000arrow_forward

- If Dakota Company issues 1,500 shares of $6 par common stock for $75,000, O Common Stock will be credited for $75,000 O Paid-In Capital in Excess of Par will be credited for $9,000 Paid-In Capital in Excess of Par will be credited for $66,000 O Cash will be debited for S66,000arrow_forwardPlease Complete all requirement And do not Give image formatarrow_forwardA Company issued $5,00,000/- new capital divided into $.10/- shares at a premium of $4/- per share payable as On Application $1/- per share On Allotment $4/- per share & $.2/- premium On Final Payment $.5/- per share & $.2/- premium Overpayments on application were to be applied towards sum due on allotment. Where no allotment was made money was to be returned in full. The issue was oversubscribed to the extent of 13,000 shares. Applicants for 12,000 shares were allotted only 1,000 shares and applicants for 2,000 were sent letters of regret. All money due on allotment and final call was duly received. Make the necessary entries in the company‟s book.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education