FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Compute the total cost per unit for each product under ABC. (Round answer to 2 decimal places, eg. 12.25.)

Commercial Model

Home Model

Total cost per unit

24

eTextbook and Media

Classify each of the activities as a value-added activity or a non-value-added activity.

Activity

Receiving

Forming

Assembling

Testing

Painting

Packing and shipping

>

>

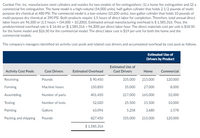

Transcribed Image Text:Combat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a

commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-

purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of

multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct

labor hours are 96,300 or (1.5 hours x (54,000 + 10,200)). Estimated annual manufacturing overhead is $ 1,585,316. Thus, the

predetermined overhead rate is $ 16.46 or ($ 1,585,316 - 96,300) per direct labor hour. The direct materials cost per unit is $18.50

for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the

commercial models.

The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows.

Estimated Use of

Drivers by Product

Estimated Use of

Activity Cost Pools

Cost Drivers

Estimated Overhead

Cost Drivers

Home

Commercial

Receiving

Pounds

$ 90,450

335,000

215,000

120,000

Forming

Machine hours

150,850

35,000

27,000

8,000

Assembling

Number of parts

401,450

217,000

165,000

52,000

Testing

Number of tests

52,020

25,500

15,500

10,000

Painting

Gallons

63,096

5,258

3,680

1,578

Packing and shipping

Pounds

827,450

335,000

215,000

120,000

$1,585,316

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- Thompson Industrial Products Inc. (TIPI) is a diversified industrial-cleaner processing company. The company's Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 945,000 ounces of chemical input are processed at a cost of $213,000 into 630,000 ounces of floor cleaner and 315,000 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $244,200, Floor Shine sells at $20 per 30-ounce bottle. The table cleaner can be sold for $21 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 315,000 ounces of another compound (TCP) to the 315,000 ounces of table cleaner. This joint process will yield 315,000 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $102,000. Both…arrow_forwardElite Products Inc. manufactures fuel injection systems for high performance V8 engines. The systems can be used on any make of car by installing the correct software chip for that make. The company is currently at 80% of capacity manufacturing 30,000 systems per year. The systems sell for $1,200 each and are sold to independent high performance retail auto part stores. Elite Products Inc. has been approached by HighSpeed Auto Inc. a large auto parts chain to provide them with the fuel injection system. In contract negotiation the chain has agree to purchase 7,500 systems which will get Elite Product's production to full capacity. However, HighSpeed Auto Inc. wants a ten percent quaintly discount on the additional 7,500 systems it purchases or it will not enter into the contract. The current manufacturing costs for the systems are as follows: Raw material: $575/unit Direct labor $150/unit Variable Mfg. OH: $ 80/unit Fixed Mfg OH: $9,000,000/year Other costs of the company are as…arrow_forwardLamothe Kitchen and Bath makes products for the home, which it sells through major retailers and remodeling (do-it-yourself, or DIY) outlets. One product that has had varying success is a ceiling fan for the kitchen. The fan comes in three sizes (36-Inch, 44-Inch, and 54-Inch), which are designed for various kitchen sizes and cooling requirements. The chief financial officer (CFO) at Lamothe has been looking at the segmented income statement for the fan and is concerned about the results for the 36-inch model. Revenues Variable costs Fixed costs allocated to products Operating profit (loss) 36 Inch $ 372,200 231,600 147,230 $ (6,630) If the 36-Inch model is dropped, the revenue associated with it would be lost and the related variable costs saved. In addition, the company's total fixed costs would be reduced by 25 percent. Required A Required B Required: a. Prepare a differential cost schedule to support your recommendation. b. Should Lamothe Kitchen and Bath should drop the 36-Inch…arrow_forward

- Waterway has recently started to manufacture RecRobo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a mobile phone. The cost structure to manufacture 19,900 RecRobos is as follows: Cost Direct materials ($45 per robot) $895,500 Direct labor ($31 per robot) 616,900 Variable overhead ($8 per robot) 159,200 Allocated fixed overhead ($23 per robot) 457,700 Total $2,129,300 Waterway is approached by Cinrich Inc., which offers to make RecRobo for $83 per unit or $1,651,700. Using incremental analysis, determine whether Waterway should accept this offer under this following independent assumption: (see attachement). In attachement: see dropdown options. Please don't forget to answer: should the offer be accepted or not.arrow_forwardGlassworks makes products for the sandblasting industry. One of the products they make is bags of high-grade sandblasting media that is made from a combination of quartz-sand and recycled ground-glass (cullet). Standard costs and quantities to produce one bag of sandblasting media are as follows: Quantity Cost Quartz-sand 20 kg $4.00 Cullet 5 kg $3.00 80,000 bags of sandblasting media were produced. Actual purchases and inventories were: Beginning Ending Purchases Purchases Inventory Inventory (in kg) ( in $) Quartz-sand 0 kg 0 kg 1,610,000 kg $322,161 Cullet 0 kg 120,000 kg 550,000 kg $286,000 Required: Calculate the following variances: a)Total direct material efficiency variance. b)Total direct material mix variance.…arrow_forwardYoungstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $160,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $353 $253 $133 Unit variable cost (278) (207) (117) Unit contribution margin $ 75 $ 46 $ 16 Autoclave hours per unit 6 4 2 Total process hours per unit 12 8 6 Budgeted units of production 2,600 2,600 2,600 a. Determine the contribution margin by glass type and the total company operating income for the budgeted units of production. Large Medium Small Total Units…arrow_forward

- California Circuits Company (3C) manufactures a variety of components. Its Valley plant specializes in two electronic components used in circuit boards. These components serve the same function and perform equally well. The difference in the two products is the raw material. The XL-D chip is the older of the two components and is made with a metal that requires a wash prior to assembly. Originally, the plant released the wastewater directly into a local river. Several years ago, the company was ordered to treat the wastewater before its release, and it installed relatively expensive equipment. While the equipment is fully depreciated, annual operating expenses of $260,000 are still incurred for wastewater treatment. Two years ago, company scientists developed an alloy with all of the properties of the raw materials used in XL-D that generates no wastewater. Some prototype components using the new material were produced and tested and found to be indistinguishable from the old…arrow_forwardCombat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours × (54,000 + 10,200)]. Estimated annual manufacturing overhead is $ 1,585,316. Thus, the predetermined overhead rate is $ 16.46 or ($ 1,585,316 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models.The company’s managers identified six activity cost pools and related…arrow_forwardO Hedwig Optical makes three models of binoculars: Travel, Sport, and Pro. The models differ by the size of the casing and the quality of the optics. The binoculars are produced in two departments. The Assembly Department purchases components from vendors and assembles them into binoculars. The Travel and Sport models are complete and ready for sale after completing the assembly process. The Pro model undergoes further processing in the Calibration Department, which is actually just a small area in the same building as the Assembly Department. Conversion costs in both the Assembly Department and Calibration Department are based on the number of units produced. There are never any work-in-process inventories. Data for production in January are shown in the following table: Units produced Materials cost Conversion costs Assembly Calibration Total conversion costs Travel Sport Pro Total 35,000 $ 1,645,000 Cost Per Unit $ 440,000 44,400 $ 484,400 Travel 17,500 Sport 13,125 4,375 $ 305,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education