FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

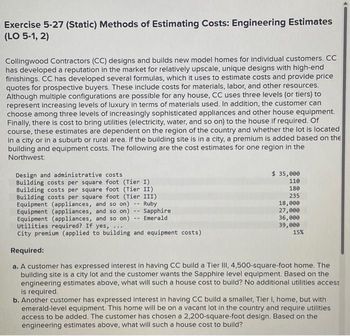

Transcribed Image Text:Exercise 5-27 (Static) Methods of Estimating Costs: Engineering Estimates

(LO 5-1, 2)

Collingwood Contractors (CC) designs and builds new model homes for individual customers. CC

has developed a reputation in the market for relatively upscale, unique designs with high-end

finishings. CC has developed several formulas, which it uses to estimate costs and provide price

quotes for prospective buyers. These include costs for materials, labor, and other resources.

Although multiple configurations are possible for any house, CC uses three levels (or tiers) to

represent increasing levels of luxury in terms of materials used. In addition, the customer can

choose among three levels of increasingly sophisticated appliances and other house equipment.

Finally, there is cost to bring utilities (electricity, water, and so on) to the house if required. Of

course, these estimates are dependent on the region of the country and whether the lot is located

in a city or in a suburb or rural area. If the building site is in a city, a premium is added based on the

building and equipment costs. The following are the cost estimates for one region in the

Northwest:

Design and administrative costs

Building costs per square foot (Tier I)

Building costs per square foot (Tier II)

Building costs per square foot (Tier III)

Equipment (appliances, and so on) -- Ruby

Equipment (appliances, and so on) Sapphire

Equipment (appliances, and so on)

Utilities required? If yes, ...

Emerald

City premium (applied to building and equipment costs)

Required:

$ 35,000

110

180

235

18,000

27,000

36,000

39,000

15%

a. A customer has expressed interest in having CC build a Tier III, 4,500-square-foot home. The

building site is a city lot and the customer wants the Sapphire level equipment. Based on the

engineering estimates above, what will such a house cost to build? No additional utilities access

is required.

b. Another customer has expressed interest in having CC build a smaller, Tier I, home, but with

emerald-level equipment. This home will be on a vacant lot in the country and require utilities

access to be added. The customer has chosen a 2,200-square-foot design. Based on the

engineering estimates above, what will such a house cost to build?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Thermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Activity Rate $18 per direct labor-hour $ 192 per order $ 256 per custom design $432 per customer Selling price per glider Direct materials cost per glider The company's direct labor rate is $22 per hour. Customer margin Standard Model 12 2 0 28.50 $ 1,800 $456 Custom Design 3 3 3 32.00 $ 2,480 $ 576 Required: Using the company's…arrow_forwardLamothe Kitchen and Bath makes products for the home, which it sells through major retailers and remodeling (do-it-yourself, or DIY) outlets. One product that has had varying success is a ceiling fan for the kitchen. The fan comes in three sizes (36-Inch, 44-Inch, and 54-Inch), which are designed for various kitchen sizes and cooling requirements. The chief financial officer (CFO) at Lamothe has been looking at the segmented income statement for the fan and is concerned about the results for the 36-inch model. Revenues Variable costs Fixed costs allocated to products Operating profit (loss) 36 Inch $ 372,200 231,600 147,230 $ (6,630) If the 36-Inch model is dropped, the revenue associated with it would be lost and the related variable costs saved. In addition, the company's total fixed costs would be reduced by 25 percent. Required A Required B Required: a. Prepare a differential cost schedule to support your recommendation. b. Should Lamothe Kitchen and Bath should drop the 36-Inch…arrow_forwardComplete the requirements <><>arrow_forward

- College Life produces sweatshirts for college organizations and uses hybrid costing. It reports the following for its fabrication process. Customers choose screen-printed or embroidered logos. Direct materials Conversion Fabrication process costs Customer choices-Logo types Screen-printed Embroidered Required: a. Compute the cost per unit for both the screen-printed and embroidered sweatshirts. b. If the company has a target markup of 30% above cost, compute the selling price for each type of sweatshirt. c. For the current period, the company added direct materials into production that should have produced 5,700 sweatshirts. Actual production was 5,415 (nondefective) sweatshirts. Compute the yield for this period. Express the answer in percent. Required 1 Required 2 Required 3 Per Unit $ 26 13 Complete this question by entering your answers in the tabs below. $39 $ 6 $ 12 Yield For the current period, the company added direct materials into production that should have produced 5,700…arrow_forwardMercedes is assessing which of two windshield suppliersprovides a better environmental design for disassembly. Usingthe tables below, select between PG Glass and Glass Unlimited.arrow_forwardCole Company sells both designer and moderately priced fashion accessories. Top management is deciding which product line to emphasize. Accountants have provided the following data: (Click the icon to view the data.) Prepare an analysis to show which product the company should emphasize. (Enter the units displayed per square foot and the contribution marain per square foot to two decimal places.) Units displayed per square foot: Designer Moderately priced Contribution margin per unit Contribution margin per square foot of display space Capacity-Square feet of display space Total contribution margin at capacity Show Transcribed Text Data table CO Average sale price Average variable costs Average contribution margin Average fixed costs (allocated) Average operating income. Designer $ $ Ĉ Product Moderately Priced Per Item Designer Moderately Priced 210 $ 100 110 15 95 $ 85 21 64 5 59 The Cole Company store in Grand Junction, Colorado, has 15,000 square feet of floor space. If Cole…arrow_forward

- The Quality Athletics Company produces a wide variety of outdoor sports equipment. Its newest division, Golf Technology, manufactures and sells a single product: AccuDriver, a golf club that uses global positioning satellite technology to improve the accuracy of golfers' shots. The demand for AccuDriver is relatively insensitive to price changes. The following data are available for Golf TechnoloTotal annual fixed costs $30,000,000 Variable cost per AccuDriver $440 Number of AccuDrivers sold each year 155,000 Average operating assets invested in the division $ 50,000,0001. Compute Golf Technology's ROI if the selling price of AccuDrivers is $ 740 per club. 2. If management requires an ROI of at least 20% from the division, what is the minimum selling price that the Golf Technology Division should charge per AccuDriver club? 3. Assume that Quality Athletics judges the performance of its investment centres on the basis of RI rather than ROI. What is the minimum selling price that Golf…arrow_forwardPart A KM Sdn. Bhd. (KM) produces two different types of high quality handbags, Luxury and Superior. Each design is made in small batches. The bags are all made on the same special equipment that is expected to operate at capacity. The equipment must be switched over to a new design and set up to prepare for the production of each batches of products. When completed, each batch of products is immediately shipped to a wholesaler. Shipping costs vary with the number of shipments. KM uses activity-based costing and provides the following budgeted information for the year ended 31 December 2017: Luxury (RM) Total (RM) Superior (RM) 412,920 120,000 Direct material Direct labour Manufacturing overhead: Set up Shipping Design Plant utilities and administration Total 379,290 98,000 792,210 218,000 65,930 73,910 166,000 243,000 1,559,050 Other information follows: Luxury 6,050 1,450 130 Superior 3,350 2,600 60 Total Number of bags Hours of production Number of batches Number of designs 9,400…arrow_forwardTarget costs, effect of process-design changes on service costs. Solar Energy Systems (SES) sells solar heating systems in residential areas of eastern Pennsylvania. A successful sale results in the homeowner purchasing a solar heating system and obtaining rebates, tax credits, and nancing for which SES completes all the paperwork. The company has identied three major activities that drive the cost of selling heating systems: identifying new contacts (varies with the number of new contacts); traveling to and between appointments (varies with the number of miles driven); and preparing and ling rebates and tax forms (varies with the number of solar systems sold). Actual costs for each of these activities in 2016 and 2017 are:arrow_forward

- Clarke, Inc. manufactures door panels. Suppose Clarke, Inc. is considering spending the following amounts on a new total quality management (TQM) program: View the spending amounts. Clarke, Inc. expects the new program would save costs through the following: View the savings amounts. Requirements 1. Classify each cost as a prevention cost, an appraisal cost, an internal failure cost, or an external failure cost. 2. Should Clarke, Inc. implement the new quality program? Give your reason. Requirement 1. Classify each cost as a prevention cost, an appraisal cost, an internal failure cost, or an external failure cost. Type of Cost Strength-testing one item from each batch of panels Training employees in TQM Training suppliers in TQM Identifying suppliers who commit to on-time delivery of perfect-quality materials Lost profits from lost sales due to disappointed customers Rework and spoilage Inspection of raw materials Warranty costs Savings Avoid lost profits from lost sales due to…arrow_forwardGadubhaiarrow_forwardAqua Company produces two products–Alpha and Beta. Alpha has a high market share and is produced in bulk. Production of Beta is based on customer orders and is custom designed. Also, 55% of Beta's cost is shared between design and setup costs, while Alpha's major portions of costs are direct costs. Alpha is using a single cost pool to allocate indirect costs. Which of the following statements is true of Aqua? Question 6 options: Aqua will overcost Alpha's indirect costs as it is using a single cost pool to allocate indirect costs Aqua will overcost Beta's indirect costs because beta has high indirect costs Aqua will undercost Alpha's indirect costs because alpha has high direct costs. Aqua will overcost Beta's direct costs as it is using a single cost pool to allocate indirect costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education