FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Give this question answer

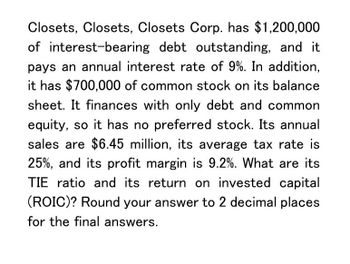

Transcribed Image Text:Closets, Closets, Closets Corp. has $1,200,000

of interest-bearing debt outstanding, and it

pays an annual interest rate of 9%. In addition,

it has $700,000 of common stock on its balance

sheet. It finances with only debt and common

equity, so it has no preferred stock. Its annual

sales are $6.45 million, its average tax rate is

25%, and its profit margin is 9.2%. What are its

TIE ratio and its return on invested capital

(ROIC)? Round your answer to 2 decimal places

for the final answers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The W.C. Pruett Corp. has $1,000,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 8%. In addition, it has $600,000 of common equity on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $5.4 million, its average tax rate is 25%, and its profit margin is 3%. What are its TIE ratio and its return on invested capital (ROIC)? Round your answers to two decimal places. TIE: × ROIC: %arrow_forwardThe W.C. Corp. has $600,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 5%. In addition, it has $500,000 of common stock on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its net income after taxes (NIAT) is $135,000, its average tax rate is 40%. What is its time interest earned (TIE) ratio?arrow_forwardThe W.C. Pruett Corp. has $500,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 11%. In addition, it has $800,000 of common equity on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $1.95 million, its average tax rate is 25%, and its profit margin is 2%. What are its TIE ratio and its return on invested capital (ROIC)? Round your answers to two decimal places.arrow_forward

- The W.C. Pruett Corp. has $600,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 7%. In addition, it has $600,000 of common equity on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $2.7 million, its average tax rate is 25%, and its profit margin is 7%. What are its TIE ratio and its return on invested capital (ROIC)?arrow_forwardPlease given answer general accountingarrow_forwardThe W.C. Pruett Corp. has $600,000 of interest-bearing debt outstanding,and it pays an annual interest rate of 7%. In addition, it has $600,000 of commonstock on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $2.7 million, its average tax rate is 35%, and its profitmargin is 7%. What are its TIE ratio and its return on invested capital (ROIC)?arrow_forward

- Lilly Inc has a DSO of 20 days, and its annual sales are $3,550,000. What is its accounts receivable balance? Assume that it uses a 365-day year. Lilly's Tax has a market/book ratio equal to 1. its stock price is $13 per share and it has 4.6 million shares outstanding. The firm's total capital is $115 million and its finances with only debt and common equity. what is its debt-to-capital ratio? Lilly's Tax has an ROA of 11%, a 5% profit margin, and an ROE of 23%. What is its total assets turnover? What is its equity multiplier? Lilly's Tax has an EPS of $2.40, a book value per share of $22.84, and a market/book ratio of 27X. What is its P/E ratio?arrow_forwardGive true answerarrow_forwardBolero Corporation has one long term loan (interest bearing debt) of $700,000 at an interest rate of 8%. The company has accounts payable of $300,000 (non-interest bearing) and equity of $1,000,000. It estimates that its cost of equity is 16%. Its tax rate is 35%. A. What is the company’s weighted average cost of capital on interest bearing debt and equity? B. What is Bolero Corporation’s weighted average cost of capital on all liabilities and equity (or total invested capital)?arrow_forward

- PLEASE HELP ME FINISH ASAP!arrow_forwardBroward Manufacturing recently reported the following information: Net income ROA BEP: Interest expense $184,800 Accounts payable and accruals $1,000,000 Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). Do not round intermediate calculations. Round your answers to two decimal places. ROE: ROIC: *% % $528,000 % 8%arrow_forwardCha Cha Corporation has three long term loans (interest bearing debt): a loan of $100,000 at 6% interest, a loan of $100,000 at 8% interest, and a loan of $100,000 at 14% interest. The company has accounts payable of $50,000 (non-interest bearing) and equity of $200,000. It estimates that its cost of equity is 12%. Its tax rate is 35%. A. What is Cha Cha Corporation’s weighted average after tax cost of interest-bearing debt? B. What is Cha Cha Corporation’s weighted average cost of capital on interest bearing debt and equity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education