Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General accounting

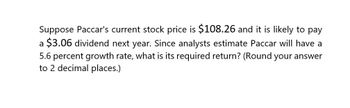

Transcribed Image Text:Suppose Paccar's current stock price is $108.26 and it is likely to pay

a $3.06 dividend next year. Since analysts estimate Paccar will have a

5.6 percent growth rate, what is its required return? (Round your answer

to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the required return??arrow_forwardPaccar’s current stock price is $48.20 and it is likely to pay a $0.80 dividend next year. Since analysts estimate Paccar will have an 8.8 percent growth rate, what is its required return? (Round your answer to 2 decimal places.)arrow_forwardPaccar's current stock price is $95.47, and it is likely to pay a $2.79 dividend next year. Because analysts estimate Paccar will have an 9.5 percent growth rate, what is its required return? Note: Round your answer to 2 decimal places.arrow_forward

- financial accountingarrow_forwardUniversal Forest’s current stock price is $64.00 and it is likely to pay a $0.47 dividend next year. Since analysts estimate Universal Forest will have a growth rate of 13.6 percent, what is its required return? (Round your answer to 2 decimal places.)arrow_forwardIf next years dividend, D = $1.25, g (which is constant) = 5.5%, and the current price, P = $28, what is the stock’s expected total return for the coming year?arrow_forward

- Abcarrow_forwardThe market price of a stock is $21.90 and it is expected to pay a dividend of $1.52 next year. The required rate of return is 11.04%. What is the expected growth rate of the dividend? Submitarrow_forwardgrey manufacturing is expected to pay a dividend of $1.25 per share at the end of the year (D1=$1.25). The stock sells fo $27.50 per share, and its required rate of return is 10.5%. The dividend is expected to grow at some constant rate, g, forever. What is the equilibrium expected growth rate?arrow_forward

- You are considering purchasing stock in a company that is expected to pay a $ 3.34 dividend later this year and you require a return of 7.79%. Assume the dividend will continue to be paid each year thereafter and will grow every year as described below. C What is the maximum price you would be willing to pay if you expect a growth rate of 2%? $ 58.84 (Enter as a whole number with two decimal places, such as 10.19.) What is the maximum price you would be willing to pay if you expect a growth rate of 5%? $ 125.70 What is the maximum price you would be willing to pay if you expect a growth rate of 7%? $452.38 What is the relationship between the price of a stock and the firm's growth rate? O A. The stock price is exactly equal to the growth rate times the dividend. B. As the growth rate investors expect increases, the price they are willing to pay also increases. OC. As the growth rate investors expect increases, the price they are willing to pay decreases. O D. There is no relationship.arrow_forwardSuppose currently Samsung's common stock is selling for $182. The company announced that it will give $1.19 dividend next year and it plans to grow the dividend by 4% every year. Given the information what is the market's required rate of return for the stock? (Round your answer to two decimal points)arrow_forwardHarvey Specter's estimated year-end dividend is D1 P1.60, its required return is rs = 11.00%, its dividend yield is 6.00%, and its future growth rate is expected to remain constant. What is Connolly's expected stock price in 7 years, i.e., what is ? * !3! Your answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning