Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

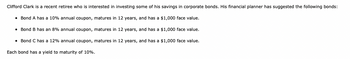

Transcribed Image Text:Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds:

• Bond A has a 10% annual coupon, matures in 12 years, and has a $1,000 face value.

Bond B has an 8% annual coupon, matures in 12 years, and has a $1,000 face value.

• Bond C has a 12% annual coupon, matures in 12 years, and has a $1,000 face value.

Each bond has a yield to maturity of 10%.

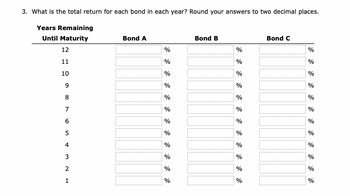

Transcribed Image Text:3. What is the total return for each bond in each year? Round your answers to two decimal places.

Years Remaining

Until Maturity

12

11

10

9

8

7

6

5

4

3

2

1

сл

Bond A

%

%

%

%

%

%

%

%

%

%

%

%

Bond B

%

%

%

%

%

%

%

%

%

%

%

%

Bond C

%

%

%

%

%

%

%

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 7arrow_forwardSingtel recently issued a graded investment bond. The bond has a $1,000 par value which will mature in 12 years’ time. It has a coupon interest rate of coupon of 11% and pays interest annually. As an investor, you are to determine the following: i. Calculate the value of the bond if the required rate of return is 11 percent. ii. Calculate the value of the bond if the required rate of return is 15 percent. iii. Based on the above findings in part (i) and (ii) above, and discuss the relationship between the coupon interest rate on a bond and the required return and the market value of the bond relative to its par value. iv. Identify two possible reasons that could cause the required return to differ from the coupon interest rate.arrow_forwardSilvia is thinking about investing money into a bond to diversify her investments. Company X issued 12 bonds at a face value of $43500 and a 17.5% nominal interest rate paid semiannually to raise capital for an upcoming factory expansion. The face value of the bond is $43500. The bond is a 10 year bond. As the bond was issued, the current nominal interest rate in the market is 7.0% compounded monthly. What is the maximum price Silvia should be pay for a single bond from company X?arrow_forward

- c. The investments officer for Sillistine Savings is concerned about interest rate risk lowering the value of the institution's bonds. A check of the bond portfolio reveals an average duration of 4.5 years. How could this bond portfolio be altered in order to minimize interest rate risk within the next year?arrow_forwardAs a bond fund manager, you are considering corporate bonds issued by Super Buy (SB). Each SB bond is a 4-year bond with a par value of $1 million. Its interest payments are based on the following schedule: $50,000 in year 1, $60,000 in years 2, $70,000 in year 3, and $80,000 in year 4. You estimate SB's current interest rate is 6%. What is the estimated new bond price using the duration model if the YTM increases by 100 basis points? OA. $1.0149 million OB. $1.0496 million OC.$0.9802 million OD. $0.9795 millionarrow_forwardThanks for helping.arrow_forward

- Vic Zaloom bought a corporate bond from IBEM Corporation for $100,000. The face value of the bond is $100,000 and will mature in twenty years. A $2,500 dividend is expected to be paid every quarter. If Vic plans to keep the bond until maturity, determine the effective rate of return he is getting on this investment. A. 10.38% B. 10.00% C. 12% D. 9.15%arrow_forwardLatasha would like to invest a certain amount of money for two years and considers investing in a one-year bond that pays 5 percent and a two-year bond that pays 9 percent. Latasha is considering the following investment strategies: Strategy A: Buy a one-year bond that pays 5 percent and in year one, then buy another one-year bond that pays the forward rate in year two. Strategy B: Buy a two-year bond that pays 9 percent in year one and 9 percent year two. If the one-year bond purchased in year two pays 11 percent, and the liquidity premium on a two-year bond is 0.7 percent, Latasha will choose Strategy B Which of the following describes conditions under which Latasha would be indifferent between Strategy A and Strategy B? The rate on the one-year bond purchased in year two is 11.862 percent. The rate on the one-year bond purchased in year two is 12.486 percent. The rate on the one-year bond purchased in year two is 12.861 percent. The rate on the one-year bond purchased in year two is…arrow_forwardMs. White has started her job and wanted to save her money in one way or other. But instead ofsaving money in the bank, she wished to invest it so that money could earn a return. She isintimidated by her friend's investment growth and decides to do the same. She decided topurchase a bond with face value $1,000. The annual coupon payment for the cond is 9%. Theinterest rate of the bond is 13% and maturity 2. She knew that the maturity levels and interestrate of the bond impact its price. So to test the same statement, she purchased 2 more bondswith the same specifications, except, one with maturity 2 and interest rate 10% while the otherwith maturity 3 and interest rate 13%. Determine the impact of change in the value of the bond.A: The bond selling price is $773.98 when interest rate decrease to 10% and $819.01 whenmaturity increases to 3.B: The bond selling price is $796.46 when interest rate decrease to 10% and $853.63 whenmaturity increases to 3.C: The bond selling price is $982.64…arrow_forward

- Jenna bought a bond that was issued by Sherlock Watson Industries (SWI) three years ago. The bond has a $1,000 maturity value, a coupon rate equal to 9%, a market rate (yield to maturity) of 10%, and it matures in 17 years. Interest is paid every six months; the next interest payment is scheduled six months from today.arrow_forwardCalifornia Resource Corporation has a bond outstanding with a coupon interest rate of 6 percent that will mature in 7 years. The investors who have purchased the bonds are requiring a rate of return of 11.41 percent! Compute the value of the bonds for the current investors. Earning a 11.41 percent rate of return is fantastic-sure beats government Treasury bond rates. So why would many investors choose not to invest in these bonds unless they can receive a really high rate of return for bonds?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education