Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Thanks for helping.

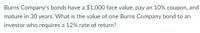

Transcribed Image Text:Burns Company's bonds have a $1,000 face value, pay an 10% coupon, and

mature in 30 years. What is the value of one Burns Company bond to an

investor who requires a 12% rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Explain what you think each of the following statements means in the context of moral development.a. How far are you a. willing to go to do the right thing?b. How much are you willing to give up to do what you believe is right?c. We may say that we would do the right thing, but when it requires sacrifice, how much are we willing to give up?arrow_forwardEmergency Fund Ratio reveals: Group of answer choices How readily a client would be able to meet all current obligations immediately A person's level of preparedness for job loss or short-term disability The level of debt that has been used to finance the present lifestyle The client's savings and spending patterns over a period of time.arrow_forwardHow might the receipt of a gift affect therelationship between the giver and the receiver?arrow_forward

- To effectively manage risk, the first step is to: Multiple Choice purchase liability insurance. create an emergency cash fund. establish prevention programs. eliminate all international risks. identify and eliminate all strategic risks. Xarrow_forwardIn what way you can be an advocate to help others be aware of the plight of the workers both from the local and abroad.arrow_forwardExplain the steps that apply your own sense of right and wrong to ethical dilemmas.arrow_forward

- Which type of account can be used as a retirement savings account? Section 529 Plan. Health Savings Account. Flexible Spending Account. Coverdell Education Savings Account.arrow_forwardWrite A little introduction on home depot.arrow_forwardIm having an issue with this problem. Thank you!arrow_forward

- Thank you. I don't see an answers for questions 4, 5 and 6. In particular if you could provide me the answer to question 6 that you be really helpful.arrow_forwardExercise 14-7 (Algo) Net Present Value Analysis of Two Alternatives [LO14-2] Perit Industries has $115,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are: Project A Project B Cost of equipment required $ 115,000 $ 0 Working capital investment required $ 0 $ 115,000 Annual cash inflows $ 21,000 $ 69,000 Salvage value of equipment in six years $ 8,700 $ 0 Life of the project 6 years 6 years The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries’ discount rate is 15%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. Compute the net present value of Project B. (Enter negative values with a minus sign. Round your…arrow_forward2. Within the framework of the Rokeach value survey, what are terminal values? a.goals that individuals would like to achieve during their lifetime b.principles that guide behavior and inform us whether actions are right or wrong c. preferable ways of behaving d. convictions or beliefs that guide our decisions and evaluations of how to behave e. fixed or predetermined policies or modes of actionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education