FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

p6 please help.......

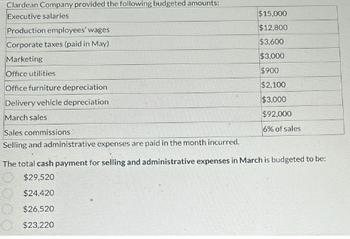

Transcribed Image Text:Clardean Company provided the following budgeted amounts:

Executive salaries

$15,000

Production employees' wages

$12,800

Corporate taxes (paid in May)

$3,600

Marketing

Office utilities

$3,000

$900

Office furniture depreciation

Delivery vehicle depreciation

March sales

$2,100

$3,000

$92,000

6% of sales

Sales commissions

Selling and administrative expenses are paid in the month incurred.

The total cash payment for selling and administrative expenses in March is budgeted to be:

$29,520

$24,420

$26,520

$23,220

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardⒸ O D O H < UB Unblockit - Proxies to acce X C Solved P11-1A Gão Limited X b Home | bartleby C (4) How to study fo... Dropbox- 1st B.tec... (10) Lil Jaico - Toma Dropbox - 1st B.tec... (10) Lil Would you like to make Opera GX your everyday browser? How do I do that? www.chegg.com/homework-help/questions-and-answers/journalize-transactions-b-post-equity-accounts-use-j5-posting-refrence-c-prepare-share-cap-q90903484 Jaico-Toma (17) Liverpool reacti... (1) How To Study fo... (6) HABITS of SUCC... AMARIA BB - Slow... Type here to search MARM O x + Chegg Books Jan. 10 Mar. 1 Apr. 1 May 1 Aug. 1 Sept. 1 Nov. 1 Study Career Find solutions for your homework business/accounting / accounting questions and answers/p11-1a gão limited was organized on january 1, 2017, it is... Question: P11-1A Gão Limited Was Organized On January 1, 2017. It Is Authorized To Issue 10,000 8%, HK$1,000 Par Value Preference Share... P11-1A Gão Limited was organized on January 1, 2017. It is authorized to issue 10,000…arrow_forwardThe following information is provided for the first month of operations for Legal Services Inc.: A. The business was started by selling $103,000 worth of common stock. B. Six months' rent was paid in advance, $4,100. C. Provided services in the amount of $1,500. The customer will pay at a later date. D. An office worker was hired. The worker will be paid $277 per week. E. Received $520 in payment from the customer in "C". F. Purchased $300 worth of supplies on credit. G. Received the electricity bill. We will pay the $120 in thirty days. H. Paid the worker hired in "D" for one week's work. I. Received $130 from a customer for services we will provide next week. J. Dividends in the amount of $1,800 were distributed. Prepare the necessary journal entries to record these transactions. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. A. B. 111arrow_forward

- 1. EX. 14.01.ALGO 2. EX.14.02 3. EX.14.03 4. EX.14.04 5. EX.14.05.BLANKSHEET.AL... 6. EX.14.06.BLANKSHEET.AL... 7. EX.14.07.BLANKSHEET.AL... 8. EX.14.08.BLANKSHEET.AL... 9. EX.14.09.BLANKSHEET.AL... 10. EX.14.11.BLANKSHEET.A... 11. EX.14.14.ALGO 12. PR.14.04.BLANKSHEET.A... 13. PR.14.02.BLANKSHEET.A... C Effect of Financing on Earnings per Share Henriksen Co., which produces and sells biking equipment, is financed as follows: Bonds payable, 10% (issued at face amount) $1,000,000 Preferred $2 stock, $20 par 1,000,000 Common stock, $25 par 1,000,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is (a) $470,000, (b) $570,000, and (c) $670,000. Enter answers in dollars and cents, rounding to two decimal places. a. Earnings per share on common stock $ b. Earnings per share on common stock $ c. Earnings per share on common stock $ JAN 20 A I 0.28 1.3 W X Parrow_forwardJ 7 Choose from list of answer choices and show/explain work.arrow_forwardHow to solve:S= 1/1.06[1-1/(1.06)^20]/1-1/1.06arrow_forward

- On January 1, 2025, Blossom Company has the following defined benefit pension plan balances. Projected benefit obligation $4,454,000 Fair value of plan assets 4,140,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2026, the company amends its pension agreement so that prior service costs of $509,000 are created. Other data related to the pension plan are as follows. 2025 2026 Service cost $149,000 $177,000 Prior service cost amortization -0- 92,000 Contributions (funding) to the plan 237,000 283,000 Benefits paid 196,000 274,000 Actual return on plan assets 248,400 260,000 Expected rate of return on assets 6% 8% (a) Prepare a pension worksheet for the pension plan for 2025 and 2026. (Enter all amounts as positive.) BLOSSOM COMPANY Pension Worksheet-2025 and 2026 General Journal Entries OCI-Prior Service Cost OCI-Gain/ Pel Lossarrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education