FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

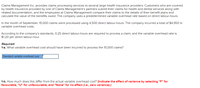

Transcribed Image Text:Total variable overhead variance

2. Break down the difference computed in requirement 1-b above into a variable overhead spending variance and a variable overhead

efficiency variance. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no

effect (i.e., zero variance). Do not round intermediate calculations.)

Variable overhead spending variance

Variable overhead efficiency variance

Transcribed Image Text:Claims Management Inc. provides claims processing services to several large health insurance providers. Customers who are covered

by health insurance provided by one of Claims Management's partners submit their claims for health and dental services along with

related documentation, and the employees at Claims Management compare their claims to the details of their benefit plans and

calculate the value of the benefits owed. The company uses a predetermined variable overhead rate based on direct labour-hours.

In the month of September, 15,000 claims were processed using 4,500 direct labour-hours. The company incurred a total of $4,950 in

variable overhead costs.

According to the company's standards, 0.25 direct labour-hours are required to process a claim, and the variable overhead rate is

$1.20 per direct labour-hour.

Required.

1-a. What variable overhead cost should have been incurred to process the 15,000 claims?

Standard variable overhead cost

1-b. How much does this differ from the actual variable overhead cost? (Indicate the effect of variance by selecting "F" for

favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mia works in both the jewelry department and the cosmetics department of a retail store. She assists customers in both departments and organizes merchandise in both departments. The store allocates her wages between the two departments based on the time worked in the two departments in each two-week pay period. Mia reports the following hours and activities spent in the two departments in the most recent two weeks. Allocate Mia's $2,400 of wages for two weeks to the two departments. Activities Selling in jewelry department Organizing in Jewelry department Selling in cosmetics department Organizing in Cosmetics department Total Department Hours worked Jewelry Cosmetics Totals Hours 39 18 14 5 76 Percent of Hours worked Numerator Denominator Percent of hours Wages Cost Allocatedarrow_forwardQuikCard processes credit card receipts for local banks. QuikCard processed 1,300,000 receipts in October. All receipts are processed the same day they are received. October costs were labor of $14,000 and overhead of $25,000. What is the cost to process 1,800 receipts? Multiple Choice $54.00 O $19.38 $38.77 O $21.67arrow_forwardThe law firm of Furlan and Benson accumulates costs associated with individual cases, using a job order cost system. The following transactions occurred during July: July 3. Charged 175 hours of professional (lawyer) time at a rate of $150 per hour to the Obsidian Co. breech of contract suit to prepare for the trial 10. Reimbursed travel costs to employees for depositions related to the Obsidian case, $12,500 14. Charged 260 hours of professional time for the Obsidian trial at a rate of $185 per hour 18. Received invoice from consultants Wadsley and Harden for $30,000 for expert testimony related to the Obsidian trial 27. Applied office overhead at a rate of $62 per professional hour charged to the Obsidian case 31. Paid administrative and support salaries of $28,500 for the month 31. Used office supplies for the month, $4,000 31. Paid professional salaries of $74,350 for the month 31. Billed Obsidian $172,500 for successful defense of the case a. Provide the…arrow_forward

- In October, Temptations Event Planners (TEP) planned events for two clients. TEP worked 144 hours for Ward Corporation and 244 hours for Girardin Industries. TEP bills clients at the rate of $370 per hour; labor cost for its planning staff is $160 per hour. The total number of hours worked in October was 388, and overhead costs were $15,800. Overhead is applied to clients at $32 per planner- hour. In addition, TEP had $28,000 in marketing and administrative costs. All transactions are on account. All services were billed. Transaction (a) (b) (c) (d) Description Record labor cost Record applied service overhead Record cost of services billed Record actual service overhead Required: a. Show labor and overhead cost flows through T-accounts. b. Prepare an income statement for the company for October.arrow_forwardSwifty's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $269500, $157800, and $74100, respectively. Information on the hours used are as follows: Hours in Acct Hours in Admin Hours in HR Acct O $287494. O $285454. O $276148. O $0. 16 8 Admin 20 4 HR 48 8 Surgery 360 120 65 ER 220 80 130 What are the total costs allocated from the accounting department to the operating units? (Do not round the intermediate calculations.) 00 los " earrow_forwardBright Star Incorporated is a job-order manufacturer. The company uses predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours were 134,000 and estimated factory overhead was $1,085,400. The following information was for September. Job X was completed during September, while Job Y was started but not finished.arrow_forward

- Compute the bonuses paid in each half year of 2017 to the Philadelphia and Baltimore medical group presidents.arrow_forwardA mortgage service office has the following four activities involved in approving a loan application. Note that a working day is 8 hours and there are 60 minutes in one hour. Activity Time (minutes) A. Property survey 23 B. Credit report 21 C. Title search 42 D. Final decision 20 Activities B and Care combined together and assigned to two emplayees, while the other two employees are responsible for activities A and D respectively. What is the mortgage office's direct labor utilization (DLU) under this setting? Numbers only (e.g. 0.445 is acce either round up or down is ok ble, but NOT 44.5%), keep three decimals if nOt exact.arrow_forwardRutland Business Services (RBS) provides miscellaneous consulting and services to local businesses. In August, RBS worked for three clients. It worked 270 hours for Selden Contracting, 170 hours for Moenhart Insurance, and 230 hours for Englewood Medical Center. RBS bills clients at $500 an hour; its labor costs are $125 an hour. A total of 750 hours were worked in August with 80 hours not billable to clients. Overhead costs of $60,000 were incurred and were assigned to clients on the basis of direct labor-hours. Because 80 hours were not billable, some overhead was not assigned to jobs. RBS had $57,000 in marketing and administrative costs. All transactions were on account. Required: What are the revenue and cost per client? Prepare an income statement for August.arrow_forward

- Lambie Custodial Services (LCS) offers residential and commercial janitorial services. Clients are billed monthly but can cancel the service at the end of any month. In addition to the employees who do the actual cleaning, the firm employs two managers who handle the administrative tasks (human resources, accounting, and so on) and one dispatcher, who assigns the cleaning employees to jobs on a daily basis. On average, residential clients pay $600 per month for weekly cleaning services and the commercial clients pay $2,600 per month for daily service (weekdays only). A typical residential client requires 15 hours a month for cleaning and a typical commercial client requires 69 hours a month. In September, LCS had 75 commercial clients and 80 residential clients. Cleaners are paid $20 per hour and are only paid for the hours actually worked. Supplies and other variable costs are estimated to cost $10 per hour of cleaning. Other monthly costs (all fixed) are $29,000 selling, general, and…arrow_forwardFor the month of July, UP Payroll Services worked 3,000 hours for Dune Motors, 900 hours for Jake’s Charters, and 1,500 hours for Mission Hospital. UP bills clients at $128 an hour; its labor costs are $48 an hour. A total of 6,000 hours were worked in July with 600 hours not billable to clients. Overhead costs of $72,000 were incurred and were assigned to clients on the basis of direct labor-hours. Because 600 hours were not billable, some overhead was not assigned to jobs. UP had $48,000 in marketing and administrative costs. All transactions were on account. Required: a. What are the revenue and cost per client? b. Prepare an income statement for July.arrow_forwardDraper Bank uses activity-based costing to determine the cost of servicing customers. Thereare three activity pools: teller transaction processing, check processing, and ATM transactionprocessing. The activity rates associated with each activity pool are $3.50 per teller transaction,$0.12 per canceled check, and $0.10 per ATM transaction. Corner Cleaners Inc. (a customer ofDraper Bank) had 12 teller transactions, 100 canceled checks, and 20 ATM transactions duringthe month. Determine the total monthly activity-based cost for Corner Cleaners Inc. during themonth.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education