FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

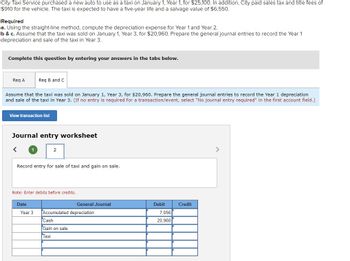

Transcribed Image Text:City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $25,100. In addition, City paid sales tax and title fees of

$910 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $6,550.

Required

a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2.

b & c. Assume that the taxi was sold on January 1, Year 3, for $20,960. Prepare the general journal entries to record the Year 1

depreciation and sale of the taxi in Year 3.

Complete this question by entering your answers in the tabs below.

Req A

Req B and C

Assume that the taxi was sold on January 1, Year 3, for $20,960. Prepare the general journal entries to record the Year 1 depreciation

and sale of the taxi in Year 3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

<

2

Record entry for sale of taxi and gain on sale.

Note: Enter debits before credits.

Date

Year 3 Accumulated depreciation

General Journal

Cash

Gain on sale

Taxi

Debit

7,056

20,960

Credit

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Martin Company purchases a machine at the beginning of the year at a cost of $126,000. The machine is depreciated using the double-declining-balance method. The machine’s useful life is estimated to be 4 years with a $10,500 salvage value. The machine’s book value at the end of year 3 is:arrow_forwardSwann Company sold a delivery truck on April 1, Year 5. Swann had acquired the truck on January 1, Year 1, for $44,000. At acquisition, Swann had estimated that the truck would have an estimated life of 5 years and a residual value of $3,000. Swann uses the straight-line method of depreciation. At December 31, Year 4, the truck had a book value of $11,200. 1b. Prepare the necessary journal entries on April 1, Year 5 to record: 1. Depreciation expense of the delivery truck for Year 5 2. The sale of the truck, assuming it sold for $7,600arrow_forwardMohr Company purchases a machine at the beginning of the year at a cost of $42,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 8 years with a $4,000 salvage value. The book value of the machine at the end of year 2 is:arrow_forward

- On January 1, 20x0, a company purchased a delivery truck for $30,000. They estimated the useful life of the truck to be 6 years, and the salvage value to be $6,000. On July 1, 20x5, they sold the truck for $7,400. Assuming the company uses straight line depreciation and records depreciation expense monthly, calculate the gain or loss associated with selling the truck.arrow_forwardOn January 1, Year 1, Marino Moving Company paid $48,000 cash to purchase a truck. The truck was expected to have a four-year useful life and an $8,000 salvage value. If Marino uses the straight-line method, the amount of depreciation expense recognized on the Year 2 income statement isarrow_forwardYear 1 account. January 1 Paid $262,000 cash plus $10,480 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $26,200 salvage value. Loader costs are recorded in the Equipment January 3 Paid $7,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $2,100. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $4,300 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. February 17 Paid $1,075 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events. View transaction list Journal entry worksheet > 1 2 3 4 5 6 Recorded annual straight-line depreciation on the…arrow_forward

- The Black Limo Company (BLC) purchased a limo on January 1 of Year 1. The limo cost $48,000. It had an expected useful life of 4 years and a $8,000 salvage value. At the start of Year 2, BLC determined the salvage value should be changed to $11,000. Based on this, the depreciation expense recorded in Year 2 will be $arrow_forwardMohr Company purchases a machine at the beginning of the year at a cost of $31,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 5 years with a $4,000 salvage value. The book value of the machine at the end of year 2 is: Multiple Choice $5,400. $10,800. $16,200. $20,200.arrow_forwardAt the beginning of Year 1, Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a five-year life and a $7,000 salvage value. Required a. Compute the depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. (2) Double-declining-balance depreciation. b. Record the purchase of the computer system and the depreciation expense for the first year under straight-line and double- declining-balance methods in a financial statements model. Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Compute the depreciation for each of the five years, assuming that the company uses straight-line depreciation.arrow_forward

- Becker Office Service purchased a new computer system on January 1, Year 1, for $36,100. It is expected to have a five-year useful life and a $3,800 salvage value Becker Office Service expects to use the computer system more extensively in the early years of its life. Required a. Calculate the depreciation expense for each of the five years, assuming the use of straight-line depreciation. b. Calculate the depreciation expense for each of the five years, assuming the use of double-declining balance depreciation. d. Assume that Becker Office Service sold the computer system at the end of the fourth year for $20.500 Compute the amount of gain or loss using each depreciation method. Complete this question by entering your answers in the tabs below. Required A Required B Calculate the depreciation expense for each of the five years, assuming the use of straight-line depreciation. Year 1 2 3 4 5 Required D Annual Depreciation Required B >arrow_forwardA truck was purchased via a bank loan for a cost of $75,000 with an estimated life of 10 years and a residual value of $1,000.Prepare the journal entries to record the purchase of the vehicle andprepare a journal entry for 1 month of depreciationarrow_forwardBecker Office Service purchased a new computer system on January 1, Year 1, for $37,700. It is expected to have a five-year useful life and a $4,000 salvage value. Becker Office Service expects to use the computer system more extensively in the early years of its life. Required Calculate the depreciation expense for each of the five years, assuming the use of straight-line depreciation. Calculate the depreciation expense for each of the five years, assuming the use of double-declining-balance depreciation. Assume that Becker Office Service sold the computer system at the end of the fourth year for $20,000. Compute the amount of gain or loss using each depreciation method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education