FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

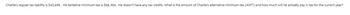

Transcribed Image Text:Charlie's regular tax liability is $43,695. His tentative minimum tax is $58,304. He doesn't have any tax credits. What is the amount of Charlie's alternative minimum tax (AMT) and how much will he actually pay in tax for the current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- This year Lloyd, a single taxpayer, estimates that his tax liability will be $13,000. Last year, his total tax liability was $17,0 He estimates that his tax withholding from his employer will be $9,700. Required: a. How much does Lloyd need to increase his withholding by (for the year), in order to avoid the underpayment penalty b. Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume short-term rate is 5 percent. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Complete this question by entering your answers in the tabs below. Required A Required B Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the federal short-term rate is 5 percent. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Required Withholding Penalty Per Quarter Dates April 15th June 15th September 15th January 15th Total…arrow_forwardFor 2023 Tax Period: Lucy is 17 years old and a dependent of her parents. She receives $9,000 of wages from a part-time job and $10,400 of taxable interest from regular bonds she inherited. Lucy saves all income she makes and doesn't use it for her support. Determine the amount of the tax liability applicable to Lucy, including any possible kiddie tax. Her parents' marginal rate of taxation is 24%.arrow_forward(d) What is Kevone's taxable income? (e) Kevone paid $16,300 in taxes last year. Will Kevone get a refund? If so, how much? If not, how much does he owe?arrow_forward

- Nonearrow_forwardTimmy Tappan is single and had $189,000 in taxable income. Use the rates from Table 2.3. a. Calculate his income taxes. (Do not round intermediate calculations.) b. What is the average tax rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the marginal tax rate? (Do not round intermediate calculations.) Answer is complete but not entirely correct. $ a. Income taxes b. Average tax rate c. Marginal tax rate 47,843 X 478.43 X % 32 %arrow_forwardConsider the following hypothetical income tax brackets for a single taxpayer. Assume for simplicity there are no exemptions or deductions. Income $0-$10,000 $10,000-$40,000 $40,000-$100,000 Over $100,000 Is this tax regressive, progressive, or proportional? The income tax is progressive Suppose Susan's income is $30,000. How much will she pay in income taxes? Susan will pay $ in income taxes. (Enter your response as an integer) Tax Rate 10% 20 35 50arrow_forward

- Chuck, a single taxpayer, earns $75,400 in taxable income and $10,400 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate % %arrow_forwardTina taxpayer makes $75000 a year. what are her average and marginal tax rates if she required to pay lum - sum tax of $ 30000.arrow_forwardChuck, a single taxpayer, earns $77,200 in taxable income and $12,400 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate 53.58% 30.56 %arrow_forward

- 1arrow_forwardChuck, a single taxpayer, earns $79,000 in taxable income and $14,700 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: A. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? B. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places.arrow_forwardIn 2021, Patricia (age 10) received $7,880 from a corporate bond. Patricia lives with her parents and she is claimed as a dependent in their tax return. Assuming her parent's marginal tax rate is 24%, what is Patricia's gross tax liability? 2021 Tax Rate Schedules.pdf O $0. $110. O $1473. O $999.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education