ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

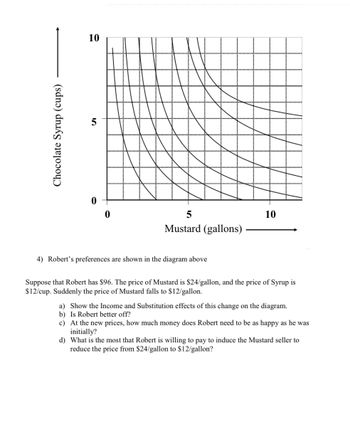

Transcribed Image Text:Chocolate Syrup (cups)

10

5

Mustard (gallons)

4) Robert's preferences are shown in the diagram above

10

Suppose that Robert has $96. The price of Mustard is $24/gallon, and the price of Syrup is

$12/cup. Suddenly the price of Mustard falls to $12/gallon.

a) Show the Income and Substitution effects of this change on the diagram.

b) Is Robert better off?

c) At the new prices, how much money does Robert need to be as happy as he was

initially?

d) What is the most that Robert is willing to pay to induce the Mustard seller to

reduce the price from $24/gallon to $12/gallon?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: State the information given

VIEW Step 2: a. Determine the income and substitution effect for the given scenario.

VIEW Step 3: b. Determine whether Robert gets better off

VIEW Step 4: c. Determine the overall budget needed to remain at the same utility function

VIEW Step 5: d. Determine the maximum willingness to pay to induce mustard seller to reduce prices

VIEW Solution

VIEW Step by stepSolved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The table below represents Sue's preferences for bottled water and soft drinks, the combination of which yields the same level of utility. Combination of Bottled Water and Soft Drinks ABCDE Bottled Water per month 5 10 15 20 25 Sue's monthly budget for bottled water and soft drinks the price of soft drinks is $2.00 per bottle. Soft Drinks per month 11 7 4 2 1 Marginal Rate of Substitution of Soft Drinks for Bottled Water 0.80 0.60 0.40 0.20 $20.00. The price of bottled water is $0.80 per bottle, and If water is on the horizontal axis and soft drinks are on the vertical axis, the slope of Sue's budget constraint is minus sign if necessary.) (Enter your response rounded to two decimal places and include Given the information on Sue's budget constraint and her preferences, the combination of goods that satisfies her utility-maximizing problem isarrow_forward6. The figure below shows a consumer maximizing utility at two different prices (the left panel) and the consumer's demand for good X at the same two prices of good X (the right panel). The price of good Y is $4.50. When the price of X increases from point S to point R along the demand curve, the substitution effect of the price increase is and the income effect is Quantity of Y 60 48 B A 18 24 - Quantity of X Price of X 6 R S 24 Demand for X Quantity demanded of X Qaarrow_forwardPlease see the attached question.arrow_forward

- CS 11 Economicsarrow_forward36arrow_forwardSuppose that with a budget of $210, Fatima spends $126 on sushi and $84 on bagels when sushi costs $2 per piece and bagels cost $2 per bagel. Then, after the price of bagels falls to $1 per bagel. Instructions: Enter your answers as a whole number. How many pieces of sushi and how many bagels did Fatima consume before the price change? pieces of sushi and bagels At the new prices, how much money would it have cost Fatima to buy those same quantities (that is, the quantities that she consumed before the price change)? Given that it used to take Fatima's entire $210 to buy those quantities, how big is the income effect caused by the lower price of bagels?arrow_forward

- 12. Five consumers have the following marginal utility of apples and pears: Marginal Utility Marginal Utility of Apples of Pears Claire 6 12 Phil 6 6 Haley 6 3 Alex 3 6 Luke 3 12 The price of an apple is $1, and the price of a pear is $2. Which, if any, of these consumers are optimizing their choices of fruit? For those who are not, how should they change their spending?arrow_forwardOnly typing answer Please explain step by steparrow_forwardConsider the increase in the price of a can of soda and assume that soda is a normal good. Describe how the income and substitution effects impact on the demand for the cola if its price increases. Also describe how these two effects interact for inferior goods if there is a fall in the price of the good. Use bullet pointsarrow_forward

- Consider the two questions about utility. The table refers to the first question only. Tod loves to travel, and he takes several river cruises per year. The table contains information about the utility Tod gets from the river cruises. Number of river cruises Total utility Marginal utility 0 0 1 12 12 2 20 8 3 25 5 From this information, it can be concluded that the number of river cruises Tod takes is indeterminable without knowing Tod’s income or the price of the cruises. that total utility is maximized when Tod takes one river cruise. that Tod will take two river cruises. that Tod will take three river cruises. Suppose that Jim has $4 to spend on a snack and that the only thing available is tea and scones. Jim’s marginal utility of the first cup of tea is 30 and his marginal utility of the second cup of tea is 20. Each cup of tea costs $1. Jim’s marginal utility of the first scone is 80 and his marginal utility of the second scone is 60. Each scone costs…arrow_forward6.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education