FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

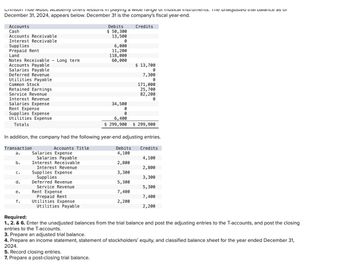

Transcribed Image Text:Crimson Tide Music Academy oners lessons in playing a wide range of musical instruments. The unaujusted Midi Daidlice as on

December 31, 2024, appears below. December 31 is the company's fiscal year-end.

Accounts

Cash

Accounts Receivable

Debits

$ 50,300

13,500

Credits

Interest Receivable

Supplies

6,000

Prepaid Rent

11,200

Land

118,000

Notes Receivable - Long term

60,000

Accounts Payable

$ 13,700

Salaries Payable

0

Deferred Revenue

Utilities Payable

Common Stock

Retained Earnings

Service Revenue

Interest Revenue

Salaries Expense

Rent Expense

Supplies Expense

7,300

0

171,000

25,700

82,200

0

34,500

0

0

6,400

Utilities Expense

Totals

$ 299,900 $ 299,900

In addition, the company had the following year-end adjusting entries.

Transaction

Accounts Title

Debits

Credits

a.

Salaries Expense

4,100

Salaries Payable

4,100

b.

Interest Receivable

2,800

Interest Revenue

2,800

C.

Supplies Expense

3,300

Supplies

3,300

d.

Deferred Revenue

5,300

Service Revenue

5,300

e.

Rent Expense

7,400

Prepaid Rent

7,400

f.

Utilities Expense

2,200

Utilities Payable

2,200

Required:

1., 2. & 6. Enter the unadjusted balances from the trial balance and post the adjusting entries to the T-accounts, and post the closing

entries to the T-accounts.

3. Prepare an adjusted trial balance.

4. Prepare an income statement, statement of stockholders' equity, and classified balance sheet for the year ended December 31,

2024.

5. Record closing entries.

7. Prepare a post-closing trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- View Policies Current Attempt in Progress Vaughn Bikes Ltd. reports cash sales of $6,600 on October 1. (a) Record the sales assuming they are subject to 13% HST. (b) Record the sales assuming they are subject to 5% GST and 9.975% QST. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to 0 decimal places, e.g. 5,275.) No. Date Account Titles and Explanation Debit Credit (a) Oct. 1 (b) Oct. 1 eTextbook and Media List of Accountsarrow_forwardWisconsin Bank lends Local Furniture Company question 40 attached in sss below thanks for help prwhpwohkwtphowkp wtwarrow_forwardJohn Lee Wholesale provides the following information: Accounts Receivable - 01/07/2020 $150 Accounts Receivable - 30/06/2021 900 Cash received from accounts receivable 8,050 What would be the credit sales for the year? Select one: 8,950 750 8,800 1,050arrow_forward

- Kelly Jones and Tami Crawford borrowed $10,500 on a 7-month, 8% note from Gem State Bank to open their business, Oriole’s Coffee House. The money was borrowed on June 1, 2022, and the note matures January 1, 2023. Prepare the entry to accrue the interest on June 3 Date Account Titles and Explanation Debit Credit June 30arrow_forwardBramble Corp. lends Sheffield Corp. $50400 on April 1, accepting a four-month, 9% interest note. Bramble Corp. prepares financial statements on April 30. What adjusting entry should be made before the financial statements can be prepared? O Interest Receivable 378 Interest Revenue 378 Interest Revenue 80 Cash Note Receivable Cash Interest Receivable Interest Revenue Type here to search 378 50400 1134 S 378 50400 1134 17arrow_forwardEntries for Discounted Note Payable A business issued a 60-day note for $60,000 to a bank. The note was discounted at 8%. Assume a 360-day year. a. Journalize the entry to record the issuance of the note. For a compound transaction, if an amount box does not require an entry, leave it blank. Cash ✔ 0✔ Interest Expense✔ Notes Payable ✔ Feedback 0 0 0 600,000 X Check My Work a. Why is the company issuing the note? What type of note is being issi (interest-bearing or discounted)? Hot much will the company owe on the maturity date? b. Journalize the entry to record the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Notes Payable ✓✔ 0 ✓ Casharrow_forward

- Entries for Notes Payable A business issued a 45-day, 6% note for $235,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360-day year. Round your final answers to the nearest dollar. If an amount box does not require an entry, leave it blank. a. b.arrow_forwardWisconsin Bank lends Local Furniture Company $80,000 on November 1. Local Furniture Company signs a $80,000, 6%, 4 - month note. The fiscal year end of Local Furniture Company is December 31. The journal entry made by Local Furniture Company on December 31 is: A. debit Interest Expense and credit Cash for $800 B. debit Interest Payable and credit Interest Expense for $800 C. debit Interest Expense and credit Interest Payable for $800 D. debit Interest Payable and credit Cash for $800 thanks for help apapreciatedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education