Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Pls if u can't do all parts or skip. options are -

Conversion Ratio - 13.55; 24.50; 20.42; 18.96

Straight debt value - 1,200; 663.18; 505.22; 928.45

Value of the convertible - 336.82; 494.78; 71.55; -200.00

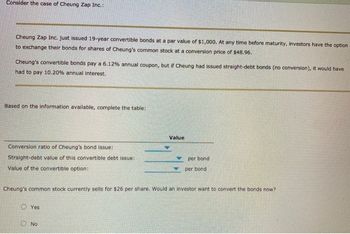

Transcribed Image Text:Consider the case of Cheung Zap Inc.:

Cheung Zap Inc. just issued 19-year convertible bonds at a par value of $1,000. At any time before maturity, Investors have the option

to exchange their bonds for shares of Cheung's common stock at a conversion price of $48.96.

Cheung's convertible bonds pay a 6.12% annual coupon, but if Cheung had issued straight-debt bonds (no conversion), it would have

had to pay 10.20% annual interest.

Based on the information available, complete the table:

Conversion ratio of Cheung's bond issue:

Straight-debt value of this convertible debt issue:

Value of the convertible option:

OYes

Value

Cheung's common stock currently sells for $26 per share. Would an investor want to convert the bonds now?

No

per bond

per bond

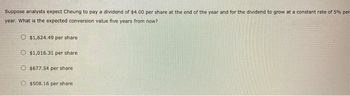

Transcribed Image Text:Suppose analysts expect Cheung to pay a dividend of $4.00 per share at the end of the year and for the dividend to grow at a constant rate of 5% per

year. What is the expected conversion value five years from now?

O $1,624.49 per share

O $1,016.31 per share

$677.54 per share.

O $508.16 per share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Q2 (Exercise 9.9) Suppose call and put prices are given by Strike 50 55 Call premium 16 10 Put premium 7 14 What no-arbitrage property is violated? What spread position would you use to effect arbitrage? Demonstrate that the spread position is an arbitrage.arrow_forwardBond Price ($) 50 3,300 3,000- 2,500- 2,000- 1,500- 1,000 810.71- 500- 0 5 10 8 Interest Rate (%) Convexity 15 6 717) The shape of the curve implies that an increase in the interest rate results in a price decline that is smaller than the price gain resulting from a decrease of equal magnitude in the 8 interest rate. This property of bond price is called? 19 20 Duration G 118) The Tangent line represented on the chart is a representation of an estimation of bond price change relative to a change in interest rate. It is known as? 52 Higher H 53 54 55 19) If Duration is estimation of an approximate change in price relative to a change in interest rate, the error in approximation will be (Higher/Same/Lower) for abond with higher 56 convexity? 57 58 coarrow_forward1 ences The bonds of Generic Labs Inc. have a conversion premium of $60. Their conversion price is $25. The common stock price is $21.00. What is the price of the convertible bond? (Do not round intermediate calculations and round your answer to 2 decimal places.) Mc Graw Hill Convertible bond price Prev 2 of 10 MacBook Air Next >arrow_forward

- E3arrow_forwardPlease help me sir correct step by step ill rate the solution.arrow_forwardWich blank woting all diectors p for electics same time in one 20. A bank with long-term fixed-rate assets fundded with short-term rate-sensitive labilities could do which of the following to limit their interest rate risk? L Buy a cap II. Buy an interest rate swap II1. Buy a floor IV. Sell an interest rate swap A. I and II only B. III cely C. I and IV only D. II and IIl only E. IIl and IV cnly at a floating rate of interest. What kind of risk does the subsidiary have? What kind of vwap Be specific. 21. A U.S. firm has a European subsidiary that earns euros. The subsidiary has berowed delarsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education