FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

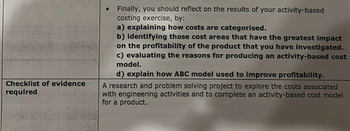

Transcribed Image Text:Checklist of evidence

required

Finally, you should reflect on the results of your activity-based

costing exercise, by:

a) explaining how costs are categorised.

b) identifying those cost areas that have the greatest impact

on the profitability of the product that you have investigated.

c) evaluating the reasons for producing an activity-based cost

model.

d) explain how ABC model used to improve profitability.

A research and problem solving project to explore the costs associated

with engineering activities and to complete an activity-based cost model

for a product.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- n your initial post, summarize the key concepts and benefits of economic order quantity (EOQ). Illustrate the computations and underlying assumptions associated with the use of this tool. Hypothesize how EOQ could conflict with a manager’s performance evaluation goals.arrow_forwardTrue or 2. Reasons for using standard costing include: A) Comparing projected costs against actual costs B) Planning and budgeting purposes C) Setting prices in advance D) Identifying specific areas for process improvement E) All of the abovearrow_forwardEstimating costs requires information • analysis, interpretation, decision-making • measurement, creation of data, negotiation • utilization, historical trends, fixed costs • projection, estimation, monitoring Cost structures are used by managers in __________. Group of answer choices planning, control, decision making activity-based costing, relative value unit method, variable cost rating estimating, forecasting, projecting allocating, averaging costs, performance testing Costs that are unique to a particular department, and would disappear if the department was abolished are known as ____. Group of answer choices indirect costs fixed costs direct costs variable As a manager you must consider _______. Group of answer choices benefits vs. costs benefits vs. overhead benefits vs. cost drivers benefits vs. time Even though fixed costs remain the constant, total costs will _______. Group of answer choices vary based on total fixed costs never vary vary based on volume always be more than…arrow_forward

- Decisions where relevant cost analysis might be used effective is Segment Elimination. Explain IN YOUR OWN WORDS what "Segment elimination" is AND MUST USE EXAMPLES IN YOUR DESCRIPTION.arrow_forwardValue streams are useful in decision-making because: Multiple Choice Special orders can be evaluated within the context of the value stream. They help to highlight improved efficiency in the plant. Irrelevant costs are identified. They identify all value-added products and services. Lean thinking produces costlier products.arrow_forwardAs we have discussed in previous chapters, product costs are made up of Direct Materials, Direct Labor and Manufacturing Overhead. In making a decision as to whether we should outsource the production of a product, do we take all of the product costs into consideration or do we make adjustment based on the type of cost behaviors? Please give examples.arrow_forward

- Process costing is an effective method to identify resource and logistics costs. Please respond to the following: Discuss the specific steps you would take to design a process costing system that effectively identifies resource and logistics costs of a manufactured product.arrow_forward4) Design ABC system for EON and Brothers (discuss steps) 5) What are the Costs per unit of Alfa and Beta under traditional and ABC costing systems?What would be the prices of Alpha and Beta traditional and ABC costing systems? Comparethe costs and prices calculated in the two systems (Calculations should be shown in theappendix) and for analysis 6) Discuss your recommendation on the viability of ABC for EON and Brothers Ltd., given thefinancial director's concerns.arrow_forwardMastery Problem: Contribution Margin, Cost-Volume-Profit Analysis and Break-Even Point (Overview) Fixed, Variable and Mixed Costs An appreciation of cost behavior is needed in order for management to understand and predict profitability as the costs of material, labor and other operating expenses and levels of production and sales change. It's important to review the cost behavior of fixed, variable and mixed costs before contribution margins, cost-volume-profit analysis, and break-even points. 1. In the table below, Have-A-Seat Inc. has outlined many of the costs associated with producing office chairs. With respect to the production and sale of office chairs, classify each cost as: a.fixed b.mixed c.variable. a. Pressure-molded plastic for chair frames b. Pension cost: $0.50 per employee hour on the job c. Insurance premiums for inventory: $2,100 per month plus $0.01 for each dollar of inventory over $2 million d. Property taxes: $120,000 per year for…arrow_forward

- Decisions where relevant cost analysis might be used effective is Make or Buy Decision. Explain IN YOUR OWN WORDS what "Make or Buy Decision" is AND MUST USE EXAMPLES IN YOUR DESCRIPTION.arrow_forwardContribution Margin, Cost-Volume-Profit Analysis and Break-Even Point (Overview) Fixed, Variable and Mixed Costs An appreciation of cost behavior is needed in order for management to understand and predict profitability as the costs of material, labor and other operating expenses and levels of production and sales change. It's important to review the cost behavior of fixed, variable and mixed costs before contribution margins, cost-volume-profit analysis, and break-even points. 1. In the table below, Have-A-Seat Inc. has outlined many of the costs associated with producing office chairs. With respect to the production and sale of office chairs, classify each cost as fixed, mixed, or variable. a. Pressure-molded plastic for chair frames b. Pension cost: $0.50 per employee hour on the job c. Insurance premiums for inventory: $2,100 per month plus $0.01 for each dollar of inventory over $2 million d. Property taxes: $120,000 per year for the factory building and…arrow_forwardDecisions where relevant cost analysis might be used effective is Sell or process decisions. Explain IN YOUR OWN WORDS what "sell or process decision" is AND MUST USE EXAMPLES IN YOUR DESCRIPTION.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education