FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completio

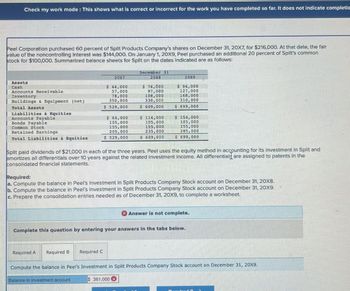

Peel Corporation purchased 60 percent of Split Products Company's shares on December 31, 20X7, for $216,000. At that date, the fair

value of the noncontrolling interest was $144,000. On January 1, 20X9, Peel purchased an additional 20 percent of Split's common

stock for $100,000. Summarized balance sheets for Split on the dates Indicated are as follows:

20X7

Assets

Cash

Accounts Receivable

Inventory

Buildings & Equipment (net)

$ 44,000

57,000

78,000

350,000

Total Assets

Accounts Payable

Bonds Payable

$ 529,000

Liabilities & Equities

Common Stock

Retained Earnings

Total Liabilities & Equities

December 31

20X8

20X9

$ 64,000

105,000

155,000

205,000

$ 74,000

97,000

108,000

330,000

$ 609,000

$ 114,000

105,000

155,000

235,000

$ 94,000

127,000

168,000

310,000

$ 699,000

$ 154,000

105,000

155,000

285,000

$ 529,000

S 609 000

$ 699,000

Split paid dividends of $21,000 in each of the three years. Peel uses the equity method in accounting for its investment in Split and

amortizes all differentials over 10 years against the related investment income. All differentials are assigned to patents in the

consolidated financial statements.

Required:

a. Compute the balance in Peel's Investment in Split Products Company Stock account on December 31, 20x8.

b. Compute the balance in Peel's Investment in Split Products Company Stock account on December 31, 20X9.

c. Prepare the consolidation entries needed as of December 31, 20X9, to complete a worksheet.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required A

Required B Required C

Compute the balance in Peel's Investment in Split Products Company Stock account on December 31, 20x9.

Balance in investment account

$ 361,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 26. On January 1, B company paid $2,295,000 to acquire 90,000 shares of O company's voting common stock, which represents a 30 percent investment. No allocations to goodwill or other specific accounts were made. Significant influence over O company is achieved by this acquisition, and so B company applies the equity method. O company declared a $1 per share dividend during the year and reported net income of $750,000. What is the balance in the Investment in O company account found in B company's financial records as of December 31?arrow_forwardRyan Company purchased 80% of Chase Company for $270,000 when Chase's book value was $300,000. Ryan paid no premium. Chase has 50,000 shares outstanding and currently has a book value of $400,000. Assume Chase issues 30,000 additional shares common stock solely to Ryan for $12 per share. After acquiring the additional shares, what adjustment is needed for Ryan's investment in Chase account? No adjustment is necessary. $70,000 increase. $12,188 increase. $12,188 decrease. $70,000 decrease.arrow_forwardOn January 3, 2023, Sheppard Corporation purchased 15% of Meredith Corporation's common stock for $62,000. Meredith's net income for the years ended December 31, 2023 and 2024 were $18,000 and $56,000 respectively. Meredith declared no dividends during 2023; however, during 2024, the company declared a $70,000 dividend. On December 31, 2023, the fair value of Meredith's stock that Sheppard Corporation owned had increased to $73,000; in 2024, it increased again to $79,000. What will be the carrying value of the investment at the end of December 31, 2024? Group of answer choices $79,000 $135,000 $73,000 $62,000arrow_forward

- On January 2, Koo Company purchased a 25 percent interest in Poo Company for $240,000. On this date, the book value of Poo’s stockholders’ equity was $400,000. The carrying amounts of Poo’s identifiable net assets approximated fair values, except for land, whose fair value exceeded its carrying amount by $150,000. Poo reported net income of $100,000 and paid no dividends. Koo accounts for this investment using the equity method. In its December 31 balance sheet, what amount should Koo report for this investment? Question 4Answer a. $265,000 b. $280,000 c. $240,000 d. $210,000arrow_forwardOn January 1, 20X9, Ute Company acquired 70 percent of Cougar Company's common shares at the underlying book value. Ute paid $70,000 for the 70% ownership. Ute uses the equity method in accounting for its ownership of Standard. During the year, Ute sold $200K inventory to Cougar. Ute’s original price on the inventory was $150K. At the end of the year Cougar had $30K in ending inventory. Prepare all the equity and eliminating entries needed as of December 31, 20X9, and complete the attached consolidated worksheet (Please fill out the cells with bolded question marks within the consolidated worksheet as well, if you can not find some of the values to replace the question marks, that is ok, but indicate which specific cell you are answering for the ones you do know, thank you).arrow_forwardOn January 1, 20X1, Payne Corp. purchased 70% of Shayne Corp.'s $10 par common stock for $900,000. On this date, the carrying amount of Shayne's net assets was $1,000,000. The fair values of Shayne's identifiable assets and liabilities were the same as their carrying amounts except for plant assets (net), which were $200,000 in excess of the carrying amount. For the year ended December 31, 20X1, Shayne had net income of $150,000 and paid cash dividends totaling $90,000. Excess attributable to plant assets is amortized over 10 years. In the December 31, 20X1, consolidated balance sheet, noncontrolling interest should be reported at ____. Check Number – Excess of FV over BV = $285,714 a. $282,714 b. $300,500 c. $397,714 d. $345,500arrow_forward

- Acker Company bought 100% of Howell Company on 1/1/X1 for $1,440,000 and began applying the equity method. The book value of Howell's equity on that date was $1,440,000. In year X1, Howell reported net income of $100,000 and paid $40,000 in dividends. During year X1, Howell sold 1,000 units of inventory to Acker for $20,000 that had cost $10,000. On 12/31/X1, 400 of the units remained in Acker's inventory. How much investment income should Acker report in year X1arrow_forwardi need the answer quicklyarrow_forwardOn 1/1/20x1, Petwoud Company exchanged 25,000 shares of its $1 par value common stock and $150,000 cash to acquire 80% of the outstanding voting common stock of Supagud, Inc. At the acquisition date, the fair value of Petwoud Company’s common stock was $20 per share. Petwoud’s payment includes a control premium of $15,000. Other investors, unrelated to Petwoud Company, hold the remaining 20% of the outstanding common stock of Supagud. After the acquisition, Supagud, Inc. will continue as a separate operating company. In its separate accounting records, Petwoud Company will apply the equity method to account for their investment in Supagud. The pre-acquisition trial balance for Supagud at 1/1/20x1 was: Cash 50,000 Accounts receivable 125,000 Other current assets 105,000 Buildings 510,000 Land 217,000 Accounts Payable 35,000 Long-term debt 300,000 Common stock 420,000 Retained earnings…arrow_forward

- Novak Limited owns a 26% interest in the shares of Marigold Corporation. During the year, Marigold pays $10600 in dividends to Novak and reports $104000 net income. Novak's investment in Marigold will increase Novak's net income by $10600. $27040. $2756. $29796. Please give correct option or incorrect all sub partarrow_forwardOn January 1, 20X1, Cleo Company purchased an 80% interest in Sai Inc. for $1,000,000. The equity balances of Sai at the time of the purchase were as follows: Common stock ($10 par) $100,000 Paid-in capital in excess of par 400,000 Retained earnings 500,000 Any excess of cost over book value is attributable to goodwill. No dividends were paid by either firm during 20X6. The following trial balances were prepared for CLeo Company and its subsidiary, Sai Inc., on December 31, 20X6: Pinto Sands Cash 120,000 70,000 Accounts receivable 240,000 197,000 Inventory 200,000 176,000 Land 600,000 180,000 Buildings and equipment 1,100,000 800,000 Accumulated depreciation (180,000) (120,000) Investment in Sands 1,000,000 Accounts payable (110,000) (50,000) Common stock, $10 par (800,000) (100,000) Paid-in capital in excess of par…arrow_forwardOn January 2, 20Y4, Whitworth Company acquired 40% of the outstanding stock of Aloof Company for $340,000. For the year ended December 31, 20Y4, Aloof Company earned income of $180,000 and paid dividends of $10,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $405,000. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase Dec. 31, 20Y4 - Income Dec. 31, 20Y4 - Dividends Jan. 31, 20Y5 - Salearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education