FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Having trouble with this question. Please advise. Thanks

Transcribed Image Text:ework

Saved

Help

Save & Exit Sub

Check my worl

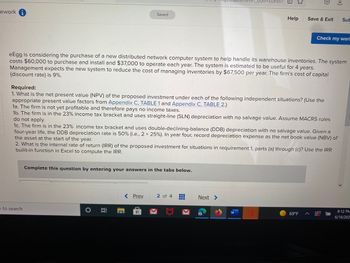

eEgg is considering the purchase of a new distributed network computer system to help handle its warehouse inventories. The system

costs $60,000 to purchase and install and $37,000 to operate each year. The system is estimated to be useful for 4 years.

Management expects the new system to reduce the cost of managing inventories by $67,500 per year. The firm's cost of capital

(discount rate) is 9%.

Required:

1. What is the net present value (NPV) of the proposed investment under each of the following independent situations? (Use the

appropriate present value factors from Appendix C, TABLE 1 and Appendix C, TABLE 2.)

1a. The firm is not yet profitable and therefore pays no income taxes.

1b. The firm is in the 23% income tax bracket and uses straight-line (SLN) depreciation with no salvage value. Assume MACRS rules

do not apply.

1c. The firm is in the 23% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Given a

four-year life, the DDB depreciation rate is 50% (i.e., 2 x 25% ). In year four, record depreciation expense as the net book value (NBV) of

the asset at the start of the year.

2. What is the internal rate of return (IRR) of the proposed investment for situations in requirement 1, parts (a) through (c)? Use the IRR

builit-in function in Excel to compute the IRR.

Complete this question by entering your answers in the tabs below.

< Prev

2 of 4

Next >

‒‒‒

8:12 PM

69°F

6/16/202

e to search

O

II

Transcribed Image Text:Check my wc

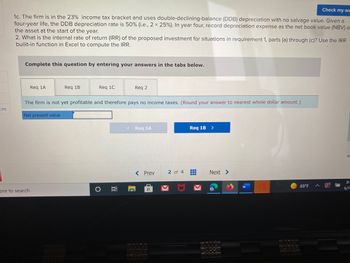

1c. The firm is in the 23% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Given a

four-year life, the DDB depreciation rate is 50% (i.e., 2 x 25% ). In year four, record depreciation expense as the net book value (NBV) o

the asset at the start of the year.

2. What is the internal rate of return (IRR) of the proposed investment for situations in requirement 1, parts (a) through (c)? Use the IRR

builit-in function in Excel to compute the IRR.

Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

Req 1C

Req 2

The firm is not yet profitable and therefore pays no income taxes. (Round your answer to nearest whole dollar amount.)

ces

Net present value

< Req 1A

Req 1B

HH

69°F

ere to search

O Ai

C

< Prev

2 of 4

Next >

S

#

8:

6/1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Im having an issue with this problem. Thank you!arrow_forwardA Framework for decision making: a. can help reduce the unexpected consequences of our actions. b. is not needed if the activity is legal. c. helps identify who gains the most from a decision.arrow_forwardWhat is underpricing? Why is it used? What evidence do we have to support the belief that underpricing is a regular problem?arrow_forward

- Describe the term Legitimized disagreement and skepticism?arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forwardIt says they answers are wrong from your example.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education