Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

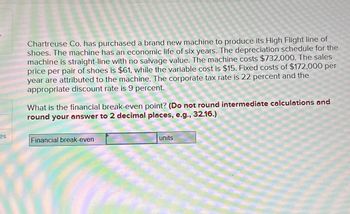

Chartreuse Co. has purchased a brand new machine to produce its High Flight line of

shoes. The machine has an economic life of six years. The depreciation schedule for the

machine is straight-line with no salvage value. The machine costs $732,000. The sales

price per pair of shoes is $61, while the variable cost is $15. Fixed costs of $172,000 per

year are attributed to the machine. The corporate tax rate is 22 percent and the

appropriate discount rate is 9 percent.

What is the financial break-even point? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

Financial break-even

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Crane Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over a five-year period. The sales and expenses (excluding depreciation) for the next five years are shown in the following table. The company’s tax rate is 34 percent. Year 1 Year 2 Year 3 Year 4 Year 5 Sales $127,450 $176,875 $247,455 $254,440 $271,125 Expenses $141,410 $128,488 $137,289 $145,112 $139,556 Crane will accept all projects that provide an accounting rate of return (ARR) of at least 45 percent. (a1) Calculate accounting rate of return. (Round answer to 1 decimal place, e.g. 15.2%.) Accounting rate of return enter the Accounting rate of return in percentages rounded to 1 decimal place %arrow_forwardAyden's Toys, Inc.. just purchased a $530,000 machine to produce toy cars. The machine will be fully depreciated by the straight-line method over its 5-year economic life. Each toy sells for $30. The variable cost per toy is $14 and the firm incurs fixed costs of $390,000 per year. The corporate tax rate for the company is 24 percent. The appropriate discount rate is 12 percent. What is the financial break-even point for the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Financial break-even point unitsarrow_forwardA $63,000 machine with a 6-year class life was purchased 2 years ago. The machine will now be sold for $50,000 and replaced with a new machine costing $91,000, with a 10-year class life. The new machine will not increase sales, but will decrease operating costs by $7,000 per year. Simplified straight line depreciation is employed for both machines, and the marginal corporate tax rate is 34 percent. What is the incremental annual cash flow associated with the project?arrow_forward

- Thurston Petroleum is considering a new project that complements its existing business. The machine required for the project costs $4.35 million. The marketing department predicts that sales related to the project will be $2.45 million per year for the next four years, after which the market will cease to exist. The machine will be depreciated to zero over its 4-year economic life using the straight-line method. Cost of goods sold and operating expenses related to the project are predicted to be 25 percent of sales. The company also needs to add net working capital of $175,000 immediately. The additional net working capital will be recovered in full at the end of the project’s life. The tax rate is 25 percent and the required return for the project is 10 percent. What is the value of the NPV for this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)arrow_forwardThe manufacture of folic acid is a competitive business. A new plant costs $100,000 and lasts for three years. The cash flow from the plant is as follows: Year-1: +43,300, Year-2: $43,300 and Year-3 = 58,300. (Assume there is no tax.) If the salvage value of the plant at the end of year is $66,700, would you scrap the plant at the end of year one?arrow_forwardMedavoy Company is considering a new project that complements its existing business. The machine required for the project costs $4.5 million. The marketing department predicts that sales related to the project will be $2.67 million per year for the next four years, after which the market will cease to exist. The machine will be depreciated to zero over its 4-year economic life using the straight-line method. Cost of goods sold and operating expenses related to the project are predicted to be 30 percent of sales. The company also needs to add net working capital of $190,000 immediately. The additional net working capital will be recovered in full at the end of the project’s life. The corporate tax rate is 23 percent and the required return for the project is 13 percent. What is the value of the NPV for this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)arrow_forward

- Your company has to liquidate some equipment that is being replaced. The originally cost of the equipment is $100,000. The firm has deprecated 65% of the original cost. The salvage value of the equipment today is $50,000. The firm has a tax rate of 30%. What is the equipment’s after-tax net salvage value? Please show your work.arrow_forwardYour Corporation bought a stamping machine to make the cans. The cost of the machine was $60,000. The machine has a useful life of 5 years and a salvage value of zero at the end of those five years. The variable manufacturing cost of producing the cans is $0.05 per can. The only fixed manufacturing cost is the annual depreciation of $12,000 on the stamping machine. Your Corporation needs 200,000 cans annually. Another Company recently offered to supply all of the can needs for the next four years at $0.07 per can. If Your Company buys the cans, it can sell the stamping machine right now for $35,000. If Your Company buys the cans, what will be the total dollar increase or decrease in income for the total four years? Enter an incrase as a positve number. Enter a decrease with a minus sign in front.arrow_forwardA $76,000 machine with a 10-year class life was purchased 3 years ago. The machine will now be sold for $31,000 and replaced with a new machine costing $51,000, with a 5-year class life. The new machine will not increase sales, but will decrease operating costs by $ 16,000 per year. Simplified straight line depreciation is employed for both machines, and the marginal corporate tax rate is 34 percent. What is the initial outlay for the project? ALTHOUGH THE INITIAL OUTLAY IS NEGATIVE, PLEASE ENTER YOUR ANSWER AS A POSITIVE SIGN. IN OTHER WORDS, IF YOUR ANSWER IS-10,000, ENTER IT AS 10,000. DO NOT ENTER THE DOLLAR SIGNarrow_forward

- Vijay shiyalarrow_forwardCari Heat (CH) Ltd. is currently faced with a critical decision regarding its production equipment. Cari Heat (CH) is evaluating two options for its production equipment: upgrading or replacing. The company manufactures and sells 7,500 heaters every year, each priced at $920. The current production equipment, which was acquired at a cost of $2,150,000, has been in use for just two years and is subject to straight-line depreciation over a five-year useful life. Furthermore, it possesses no terminal disposal value, but it can be currently sold for $650,000. The following table presents data for the two alternatives: ABC 1 Choice Upgrade Replace 2 One-time equipment costs $3,500,0003 Variable manufacturing cost per Heater $180 $90 4 Remaining useful life of equipment (years) 3 3 5 Terminal disposal value of equipment 0 0 Required 1. Prepare a schedule, for the remaining 3 years, reflecting whether CH should upgrade its production line or replace it?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education