FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

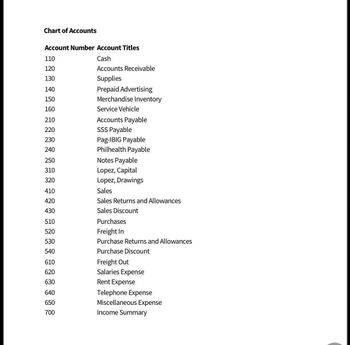

Transcribed Image Text:Chart of Accounts

Account Number Account Titles

Cash

Accounts Receivable

Supplies

Prepaid Advertising

Merchandise Inventory

110

120

130

140

150

160

210

220

230

240

250

310

320

410

420

430

510

520

530

540

610

620

630

640

650

700

Service Vehicle

Accounts Payable

SSS Payable

Pag-IBIG Payable

Philhealth Payable

Notes Payable

Lopez, Capital

Lopez, Drawings

Sales

Sales Returns and Allowances

Sales Discount

Purchases

Freight In

Purchase Returns and Allowances

Purchase Discount

Freight Out

Salaries Expense

Rent Expense

Telephone Expense

Miscellaneous Expense

Income Summary

Transcribed Image Text:12:14

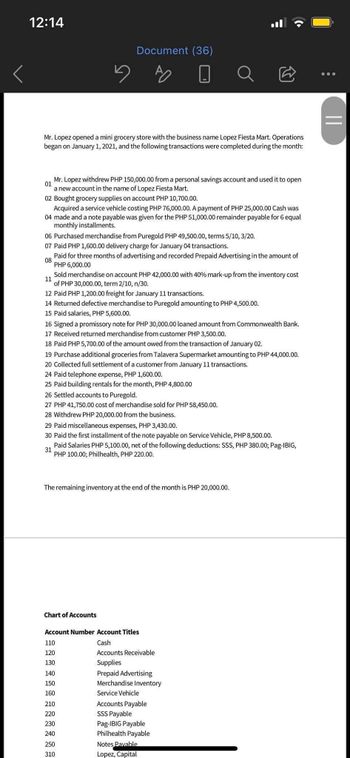

Mr. Lopez opened a mini grocery store with the business name Lopez Fiesta Mart. Operations

began on January 1, 2021, and the following transactions were completed during the month:

01

Mr. Lopez withdrew PHP 150,000.00 from a personal savings account and used it to open

a new account in the name of Lopez Fiesta Mart.

02 Bought grocery supplies on account PHP 10,700.00.

Acquired a service vehicle costing PHP 76,000.00. A payment of PHP 25,000.00 Cash was

04 made and a note payable was given for the PHP 51,000.00 remainder payable for 6 equal

monthly installments.

Document (36)

06 Purchased merchandise from Puregold PHP 49,500.00, terms 5/10, 3/20.

07 Paid PHP 1,600.00 delivery charge for January 04 transactions.

08

Paid for three months of advertising and recorded Prepaid Advertising in the amount of

PHP 6,000.00

11

Sold merchandise on account PHP 42,000.00 with 40% mark-up from the inventory cost

of PHP 30,000.00, term 2/10, n/30.

12 Paid PHP 1,200.00 freight for January 11 transactions.

14 Returned defective merchandise to Puregold amounting to PHP 4,500.00.

15 Paid salaries, PHP 5,600.00.

16 Signed a promissory note for PHP 30,000.00 ed amount from Commonwealth Bank.

17 Received returned merchandise from customer PHP 3,500.00.

18 Paid PHP 5,700.00 of the amount owed from the transaction of January 02.

19 Purchase additional groceries from Talavera Supermarket amounting to PHP 44,000.00.

20 Collected full settlement of a customer from January 11 transactions.

24 Paid telephone expense, PHP 1,600.00.

25 Paid building rentals for the month, PHP 4,800.00

26 Settled accounts to Puregold.

27 PHP 41,750.00 cost of merchandise sold for PHP 58,450.00.

28 Withdrew PHP 20,000.00 from the business.

29 Paid miscellaneous expenses, PHP 3,430.00.

30 Paid the first installment of the note payable on Service Vehicle, PHP 8,500.00.

31

Paid Salaries PHP 5,100.00, net of the following deductions: SSS, PHP 380.00; Pag-IBIG,

PHP 100.00; Philhealth, PHP 220.00.

The remaining inventory at the end of the month is PHP 20,000.00.

Chart of Accounts

a

Account Number Account Titles

Cash

Accounts Receivable

Supplies

Prepaid Advertising

Merchandise Inventory

110

120

130

140

150

160

210

220

230

240

250

310

Service Vehicle

Accounts Payable

SSS Payable

Pag-IBIG Payable

Philhealth Payable

Notes Pavable

Lopez, Capital

Ⓡ.

||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Cash Discount and Remittance calculations For each of the following May Paz Abad Retailers purchases, assume that credit terms are 2/10, n/30 and that any credit memorandum was issued and known before Mary Paz Abad Retailers made the payments. Prepaid Purchases Shipping Terms Freight Credit a P 12,000 FOB shipping point (by seller) Memo b. 24,000 FOB destination P 1,000 P 3,000 c. 28,000 FOB shipping point 2,400 2,000 d. 40,000 FOB shipping point 4,000 Required: 1. Determine the cash discount available. 2. Determine the cash remitted if the payment is made within the discount period.arrow_forwardFrom the general journal, record to the accounts receivable subsidiary ledger and post to the general ledger accounts as appropriate. Record to the accounts receivable subsidiary ledger. Use transaction dates as posting references. Accounts Receivable Subsidiary Ledger Henry Co. Lincoln Co. Now post to the partial general ledger. Use transaction dates as posting references. Partial General Ledger Accounts Receivable 112 Merchandise Inventory 142 Sales 411 Cost of Goods Sold 505arrow_forwardPurchase-Related Transactions The Stationery Company purchased merchandise on account from a supplier for $17,400, terms 1/10, n/30. The Stationery Company returned merchandise with an invoice amount of $2,300 and received full credit. a. If The Stationery Company pays the invoice within the discount period, what is the amount of cash required for the payment? b. Under a perpetual inventory system, what account is credited by The Stationery Company to record the return?arrow_forward

- 5. Sales on account, with 2/10, n/30 cash discount terms. (a) Merchandise is sold on account for $450. (b) The balance is paid within the discount period. (c) Merchandise is sold on account for $280. (d) The balance is paid after the discount period. Cash Accounts Receivable Sales Sales Discountsarrow_forwardSales Transactions Journalize the following merchandise transactions: a. Sold merchandise on account, $23,950 with terms 2/10, n/30. The cost of the merchandise sold was $14,370. If an amount box does not require an entry, leave it blank. Sale Accounts Receivable Sales Cost Cost of Merchandise Sold Merchandise Inventory b. Received payment less the discount. If an amount box does not require an entry, leave it blank. Cash Accounts Receivable c. Issued a $1,100 credit memo for damaged merchandise. The customer agreed to keep the merchandise. If an amount box does not require an entry, leave it blank. Customer Refunds Payable Accounts Receivablearrow_forwardCalculate the missing information for the purchase. Item SellingPrice(in $) SalesTaxRate SalesTax(in $) ExciseTax Rate ExciseTax TotalPurchase Price Book $ 8 $ 0 0 $19.44arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education