Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

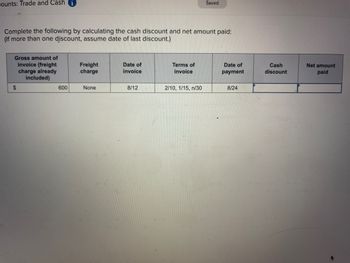

Transcribed Image Text:### Calculating Cash Discounts and Net Amount Paid

Complete the following by calculating the cash discount and net amount paid. (If more than one discount, assume date of last discount.)

| Gross amount of invoice (freight charge already included) | Freight charge | Date of invoice | Terms of invoice | Date of payment | Cash discount | Net amount paid |

|-----------------------------------------------------------|----------------|-----------------|------------------|-----------------|---------------|-----------------|

| $600 | None | 8/12 | 2/10, 1/15, n/30 | 8/24 | | |

#### Explanation

- **Gross Amount of Invoice**: The total invoice amount, including any freight charges.

- **Freight Charge**: Any additional transportation cost associated with the delivery.

- **Date of Invoice**: The date when the invoice was issued.

- **Terms of Invoice**: Describes the discount available if the payment is made within a specific period. For example, "2/10" indicates a 2% discount if paid within 10 days.

- **Date of Payment**: The actual date when the payment was made.

- **Cash Discount**: The amount reduced from the gross invoice amount if conditions are met.

- **Net Amount Paid**: The total amount paid after accounting for any cash discount.

Given the terms "2/10, 1/15, n/30", payment made on 8/24 qualifies for a 1% discount since it is within 15 days of the invoice date (8/12). The calculation needs to be conducted accordingly to find the cash discount and the net amount paid.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- how much is the total credit and debit balances?arrow_forwardDetermine the amount to be paid in full settlement of each invoice, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Freight Paid Returns and Merchandise by Seller Freight Terms Allowances a. $11,200 $224 FOB Shipping Point, 1/10, net 30 $1,100 b. $3,900 $56 FOB Destination, 2/10, net 45 $900 a. 2$ b.arrow_forwardComplete the following by calculating the cash discount and net amount paid: (If more than one discount, assume date of last discount.) Gross amount of invoice (freight charge already included) 650 Freight charge None Date of invoice 8/6 Terms of invoice 3/10, 2/15, n/30 Date of payment 8/17 Cash discount Net amount paidarrow_forward

- Using T accounts for Cash, Accounts Payable, Purchases, Purchases Returns and Allowances, Purchases Discounts, and Freight-In, enter the following purchase transactions. Identify each transaction with its corresponding letter. Use a new set of T accounts for each set of transactions. Purchase of merchandise with freight-in. a) Merchandise is purchased on account, $2,800 plus freight charges of $100. Terms of the sale were FOB shipping point. b) Payment is made for the cost of merchandise and the freight charge.arrow_forwardPlease help me. Thankyou.arrow_forwardCompute the amount to be paid for each of the four separate invoices assuming that all invoices are paid within the discount period. a. b. C. d. Merchandise (gross) $ $ $ $ 5,800 21,200 76,600 12,000 Terms 2/10, n/60 1/15, n/90 1/10, n/30 3/15, n/45 Paymentarrow_forward

- Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. If required, round the answers to the nearest dollar. Credit for Freight Refunds and Merchandise Paid by Seller Freight Terms Allowances $6,300 $600 FOB shipping point, 2/10, n/30 $1,550 a. b. 2,900 600 FOB destination, 1/10, n/30 1,200 a. $ b. $arrow_forwardDetermining Amounts to be Paid on Invoices Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Merchandise Freight Paid by Seller Returns and Allowances a. $17,000 - FOB destination, n/30 $900 b. 10,300 $400 FOB shipping point, 1/10, n/30 1,200 c. 6,300 - FOB shipping point, 1/10, n/30 600 d. 2,500 100 FOB shipping point, 2/10, n/30 400 e. 1,700 - FOB destination, 2/10, n/30 - a. $ b. $ c. $ d. $ e. $arrow_forwardDetermining Amounts to be Paid on Invoices Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period: Merchandise Freight Paid by Seller Customer Returnsand Allowances a. $17,200 - FOB destination, n/30 $900 b. 11,400 $500 FOB shipping point, 2/10, n/30 1,400 c. 8,100 - FOB shipping point, 1/10, n/30 700 d. 3,700 100 FOB shipping point, 1/10, n/30 500 e. 2,500 - FOB destination, 1/10, n/30 - a. $ b. $ c. $ d. $ e. $arrow_forward

- The amount of discount to be recorded if the invoice is paid within the discount period on a purchase of goods having a list price of $1,600, subject to a trade discount of 25 percent with terms 2/10, n/30, is a.$24. b.$30. c.$29.40. d.$21. e.$450.arrow_forwardHow do you find the cash discount and the net amount paid when you know the gross amount of invoice with the freight charge already included is $600, the freight charge is none, the date of invoice is 8/1, the terms of invoice are 3/10, 2/15, and n/30, and the date of payment is 8/13?arrow_forwardreight Terms Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Merchandise FreightPaid by Seller Freight Terms Returns andAllowances a. $90,000 $1,000 FOB shipping point, 1/10, n/30 $15,000 b. 110,000 1,575 FOB destination, 2/10, n/30 8,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education