FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

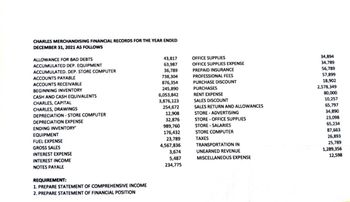

Transcribed Image Text:CHARLES MERCHANDISING FINANCIAL RECORDS FOR THE YEAR ENDED

DECEMBER 31, 2021 AS FOLLOWS

ALLOWANCE FOR BAD DEBTS

ACCUMULATED DEP. EQUIPMENT

ACCUMULATED. DEP. STORE COMPUTER

ACCOUNTS PAYABLE

ACCOUNTS RECEIVABLE

BEGINNING INVENTORY

CASH AND CASH EQUIVALENTS

CHARLES, CAPITAL

CHARLES, DRAWINGS

DEPRECIATION-STORE COMPUTER

DEPRECIATION EXPENSE

ENDING INVENTORY

EQUIPMENT

FUEL EXPENSE

GROSS SALES

INTEREST EXPENSE

INTEREST INCOME

NOTES PAYALE

REQUIREMENT:

1. PREPARE STATEMENT OF COMPREHENSIVE INCOME

2. PREPARE STATEMENT OF FINANCIAL POSITION

43,817

63,987

36,789

738,304

876,354

245,890

6,053,842

3,876,123

254,672

12,908

32,876

989,760

176,432

23,789

4,567,836

3,674

5,487

234,775

OFFICE SUPPLIES

OFFICE SUPPLIES EXPENSE

PREPAID INSURANCE

PROFESSIONAL FEES

PURCHASE DISCOUNT

PURCHASES

RENT EXPENSE

SALES DISCOUNT

SALES RETURN AND ALLOWANCES

STORE ADVERTISING

STORE-OFFICE SUPPLIES

STORE-SALARIES

STORE COMPUTER

TAXES

TRANSPORTATION IN

UNEARNED REVENUE

MISCELLANEOUS EXPENSE

34,894

34,789

56,789

57,899

18,902

2,578,349

80,000

10,257

65,797

34,890

23,098

65,234

87,663

26,893

25,789

1,289,356

12,598

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 1: Below is the financial information for Justin Bieber's Merchandising company for the year 2020: Cash and Cash Equivalents Accounts Receivable Merchandise Inventory Machinery and Equipment Furnitures and Fixtures Total Assets 513,374 312,745 112,038 1,039,782 59,744 2,037,683 Suppose that the total current assets of the company for the year 2019 is P1,317,873 and the total fixed asset for the same year is P687,369 plus there is a prepaid expenses for 2020 of P35,000 for insurance. Compute for the financial leverage ratio assuming that the value of the total liabilities for the company is P856,971.arrow_forwardc. On 9/12 Year 7 $2,000 of ACCOUNTS PAYABLE is paid after the discount period. Phrase 1st: 2nd: Phrase 1st: Account 2nd: Accounts Account Category AL SER E contra AL SER E contra + Accounts Debit Affect d. On 9/28 Year 7 INVENTORY originally purchased for $4,000 on 9/1 Year 7 and was paid for on 9/10 Year 7 is returned by the purchaser and a debit memorandum (a debit to A/P) is received from the seller. [Hint: the amount of cash involved in this transaction must take the 2% discount into account.] Debit + Category AL SE RE contra AL SE RE contra + - + Affect Dr. or Cr. Dr Cr Dr Cr Credit Dr. or Cr. Credit Dr Cr Dr Crarrow_forwardMultiple-Step Income Statement and Report Form of Balance Sheet The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2019: Cash $120,200 Gerri Faber, Drawing $72,000 Accounts Receivable 326,200 Sales 4,344,900 Merchandise Inventory 365,300 Cost of Merchandise Sold 2,546,100 Estimated Returns Inventory 14,450 Sales Salaries Expense 716,000 Office Supplies 11,300 Advertising Expense 196,900 Prepaid Insurance 8,800 Depreciation Expense—Store Equipment 38,400 Office Equipment 264,500 Miscellaneous Selling Expense 16,800 Accumulated Depreciation—Office Equipment 179,700 Office Salaries Expense 390,900 Store Equipment 825,600 Rent Expense 57,700 Accumulated Depreciation—Store Equipment 264,500 Insurance Expense 17,900 Accounts Payable 183,000 Depreciation Expense—Office Equipment 28,900 Customer Refunds Payable 28,900 Office Supplies Expense 10,600 Salaries Payable…arrow_forward

- Journalize this transactions for 2024, before starting the company for the journal entries uses the allowance method I added more imformation in the image for the background data and imformation. Transactions for 2024 1-Sales revenue on account, $113,600 (ignore Cost of Goods Sold). 2-Collections on account, $92,895 3-Write-offs of uncollectibles, $760. 4- The Company accepted a 90-day, 9%, $13,500 note receivable from a customer in exchange for 4 his account receivable. a Journalize the issuance of the note. b Journalize the collection of the principal and interest at maturity. (use 360 days) 5 Bad debts expense of $?? was recorded. (Refer to requirement 3)(about the write off) -attached is an image to the context the journal entries should be placed inarrow_forwardPrepare Statement of Financial Position as of December 31, 2019.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education