FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

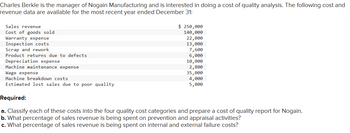

Transcribed Image Text:Charles Berkle is the manager of Nogain Manufacturing and is interested in doing a cost of quality analysis. The following cost and

revenue data are available for the most recent year ended December 31:

Sales revenue

Cost of goods sold

Warranty expense

Inspection costs

Scrap and rework

Product returns due to defects

Depreciation expense

Machine maintenance expense

Wage expense

Machine breakdown costs

Estimated lost sales due to poor quality

$ 250,000

140,000

22,000

13,000

7,600

6,000

10,000

2,800

35,000

4,000

5,000

Required:

a. Classify each of these costs into the four quality cost categories and prepare a cost of quality report for Nogain.

b. What percentage of sales revenue is being spent on prevention and appraisal activities?

c. What percentage of sales revenue is being spent on internal and external failure costs?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Walton Company measured its quality costs for the past two years and summarized those costs using the four categories shown below: Prevention costs Appraisal costs Internal failure costs External failure costs Last Year $ 324,900 $ 409,400 $ 869,000 $ 1,188,000 This Year $ 689,000 $ 545,000 $ 550,000 $ 673,200 Required: 1. Calculate the total cost of quality last year and this year. 2. For last year, calculate the cost in each of the four categories as a percent of the total cost of quality. 3. For this year, calculate the cost in each of the four categories as a percent of the total cost of quality. 4-a. Calculate the change in total cost of quality over the two-year period. 4-b. Is performance trending in a favorable or unfavorable direction?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardQuality Control Activities Product testing Assessing vendor quality Recalls Rework Scrap disposal Product design Training machine operators Warranty work Process audits Schedule of Activity Costs LA From the provided schedule of activity costs, determine the external failure costs. S Activity Cost $55,000 26,000 18,000 29,000 8,000 30,000 46,000 12,000 22,000arrow_forward

- At the end of their fiscal year Western Industries Ltd. reported the following selected, unadjusted balances:Raw Materials Inventory - $6,000Work in Process Inventory - $62,250Finished Goods Inventory - $74,700Cost of Goods Sold - $278,050Manufacturing Overhead - $2,850 creditWestern Industries uses the proration method to eliminate any balance in Manufacturing Overhead. Which of the following is the correct journal entry to eliminate the balance in Manufacturing Overhead? Select answer from the options below Manufacturing Overhead 2,850.00 Raw Materials Inventory 80.00 Work in Process Inventory 415.00 Finished Goods Inventory 499.00 Cost of Goods Sold 1,856.00 Work in Process Inventory 427.50 Finished Goods Inventory 513.00 Cost of Goods Sold 1.909.50 Manufacturing Overhead 2,850.00 Manufacturing Overhead 2,850.00 Finished Goods Inventory 603.50 Cost of Goods Sold 2,246.50 Manufacturing Overhead 2,850.00 Work in…arrow_forwardBonita Company produced 10,200 units during the past year but sold only 8,700 of the units. The following additional information is also available: Direct materials used Direct labour incurred Variable manufacturing overhead Fixed manufacturing overhead Fixed selling and administrative expenses Variable selling and administrative expenses $88,740 34,170 22,440 46,410 (a) 69,400 10,200 There was no work in process inventory at the beginning of the year. Bonita did not have any beginning finished goods inventory either. Calculate Bonita Company's finished goods inventory cost on December 31 under variable costing. (Round per unit calculations to 2 decimal places, e.g. 15.25 and final answer to 0 decimal places, e.g. 125.)arrow_forwardQuality Motor Company is an auto repair shop that uses standards to control its labor time and labor cost. The standard labor cost for a motor tune-up is given below: Motor tune-up Standard Hours 2.50 Standard Rate Standard Cost $ 29.00 $ 72.50 The record showing the time spent in the shop last week on motor tune-ups has been misplaced. However, the shop supervisor recalls that 54 tune-ups were completed during the week, and the controller recalls the following variance data relating to tune-ups: Labor rate variance $ 120 F Labor spending variance $ 170 U Required: 1. Determine the number of actual labor-hours spent on tune-ups during the week. 2. Determine the actual hourly pay rate for tune-ups last week. Note: Round your answer to 2 decimal places. 1. Actual labor hours 2. Actual hourly rate hours per hourarrow_forward

- Charles Berkle is the manager of Nogain Manufacturing and is interested in doing a cost of quality analysis. The following cost and revenue data are available for the most recent year ended December 31: Sales revenue Cost of goods sold Warranty expense Inspection costs Scrap and rework Product returns due to defects Depreciation expense Machine maintenance expense Wage expense Machine breakdown costs Estimated lost sales due to poor quality $ 250,000 140,000 22,000 14,000 7,800 6,000 10,000 3,400 35,000 4,000 5,000 Required: a. Classify each of these costs into the four quality cost categories and prepare a cost of quality report for Nogain. b. What percentage of sales revenue is being spent on prevention and appraisal activities? c. What percentage of sales revenue is being spent on internal and external failure costs?arrow_forwardNeed help with this questionarrow_forwardplease provide answer of thie questionarrow_forward

- The president of Mission Inc. has been concerned about the growth in costs over the last several years. The president asked the controller to perform an activity analysis to gain a better insight into these costs. The activity analysis revealed the following: Activities Activity Cost Correcting invoice errors $8,500 Disposing of income materials with poor quality 16,000 Disposing of scrap 28,500 Expediting late production 21,500 Final inspection 19,000 Inspecting incoming materials 5,000 Inspecting work in process 25,000 Preventive machine maintenance 15,000 Producing product 95,500 Responding to customer quality complaints 15,000 Total 249,000 The production process is complicated by quality problems, requiring the production manager to expedite production and dispose of scrap. Prepare a Pareto chart of the company activities. Classify the activities into prevention, appraisal, internal failure,…arrow_forwardPrawitt Company incurred an activity cost of $103,500 for inspecting 30,000 units of production. Management determined that the inspecting objectives could be met without inspecting every unit. Therefore, rather than inspecting 30,000 units of production, the inspection activity was limited to a random selection of 4,000 units out of the 30,000 units of production. Determine the inspection activity cost per unit on 30,000 units of total production both before and after the improvement. If required, round per unit amounts to the nearest cent.Inspection activity before improvement fill in the blank 1 of 2$ per unitInspection activity after improvement fill in the blank 2 of 2$ per unitarrow_forward11 Below is the costs related to quality of conformance for Stone Company (in thousands) for 20xx. Inspection $ 850 Quality engineering 450 Depreciation of test equipment 135 Rework labor 1,080 Statistical process control 180 Cost of field servicing 1,260 Supplies used in testing 450 Systems development 850 Warranty repairs 4,680 Net cost of scrap 720 Product testing 1,080 Product recalls 2,880 Disposal of defective products 900 $ 15,515 What were the total appraisal costs in 20xx? А. $ 1,480 В. $ 1,930 С. $ 2,515 D. $ 1,615 E. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education