FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Now that I need answer for a which is 5, 146,810 I need help with b. I want to know how can I find the amount for convertible preferred stock still outstanding in order to solve for b

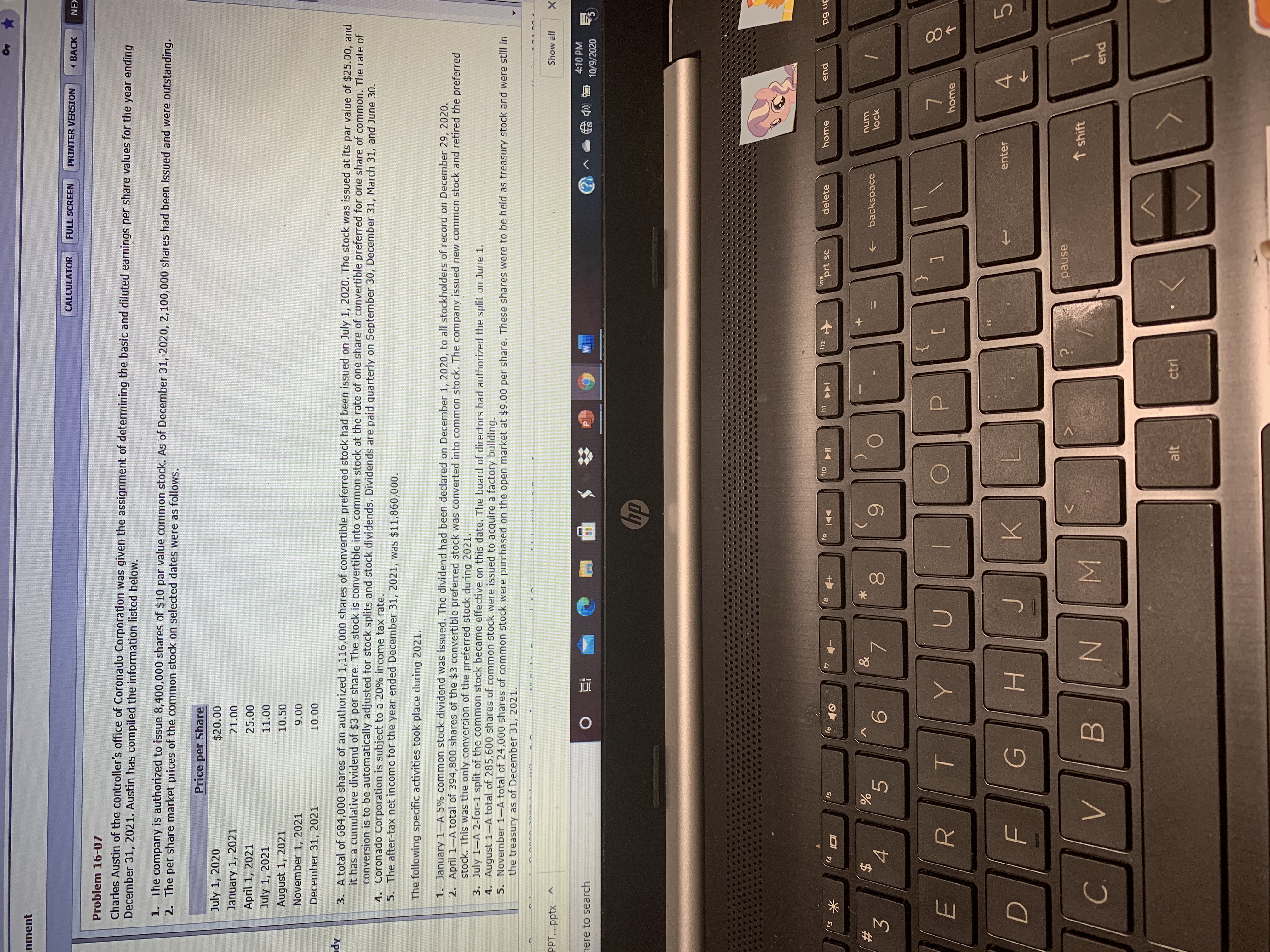

Transcribed Image Text:Charles Austin of the controller's office of Coronado Corporation was given the assignment of determining the basic and diluted earnings per share values for the year ending

December 31, 2021. Austin has compiled the information listed below.

1. The company is authorized to issue 8,400,000 shares of $10 par value common stock. As of December 31, 2020, 2,100,000 shares had been issued and were outstanding.

2. The per share market prices of the common stock on selected dates were as follows.

Price per Share

July 1, 2020

$20.00

January 1, 2021

21.00

April 1, 2021

25.00

July 1, 2021

11.00

August 1, 2021

10.50

November 1, 2021

9.00

December 31, 2021

10.00

3. A total of 684,000 shares of an authorized 1,116,000 shares of convertible preferred stock had been issued on July 1, 2020. The stock was issued at its par value of $25.00, and

it has a cumulative dividend of $3 per share The stock is convertible into

clk nt th

Transcribed Image Text:CALCULATO

The following specific activities took place during 2021.

1. January 1-A 5% common stock dividend was issued. The dividend had been declared on December 1, 2020, to all stockholder.

2. April 1-A total of 394,800 shares of the $3 convertible preferred stock was converted into common stock. The company issued

stock. This was the only conversion of the preferred stock during 2021.

3. July 1-A 2-for-1 split of the common stock became effective on this date. The board of directors had authorized the split on Jun

4. August 1-A total of 285,600 shares of common stock were issued to acquire a factory building.

5. November 1-A total of 24,000 shares of common stock were purchased on the open market at $9.00 per share. These shares we

the treasury as of December 31, 2021.

6. Common stock cash dividends-Cash dividends to common stockholders were declared and paid as follows,

April 15-$0.30 per share

October 15-$0.20 per share

7. Preferred stock cash dividends-Cash dividends to preferred stockholders were declared and paid as scheduled.

(a) Determine the number of shares used to compute basic earnings per share for the year ended December 31, 2021. (Round answer

Number of shares to compute basic earnings per share

udy

(b) Determine the number of shares used to compute diluted earnings per share for the year ended December 31, 2021. (Round answer

Number of shares to compute diluted earnings per share

(c) Compute the adjusted net income to be used as the numerator in the basic earnings per share calculation for the year ended December 31

Adjusted net income

Click if you would like to Show Work for this question:

Open Show Work

here to search

%23

h2 +

prt sc

fs

de

米

144

#3

2$

4

&

bac

3

6.

7

8

6.

T

Y

D

F

G

H.

J

K

5

LL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company sells Gizmos to consumers at a price of $117 per unit. The cost to produce Gizmos is $27 per unit. The company will sell 15,000 Gizmos to consumers each year. The fixed costs incurred each year will be $190,000. There is an initial investment to produce the goods $3,400,000 which will be depreciated straight line over the 10-year life of the investment to a salvage value of $0. The opportunity cost of capital is 6% and the tax rate is 34%. What is the operating cash flow each year?arrow_forwardSection B B1 The Equity Premium Puzzle and the Stock Market Participation Puzzle. (a) Explain as best you can what is the Equity Premium Puzzle. (b) Explain as best you can what is the Stock Market Participation Puzzle. (c) Are both Puzzles connected? Why or why not?arrow_forwardShow Attempt History Current Attempt in Progress X Your answer is incorrect. The effect of a stock dividend is to O change the composition of stockholders' equity. O decrease total assets and stockholders' equity. O increase the book value per share of common stock. O decrease total assets and total liabilities. eTextbook and Media Assistance Used Save for Later Attempts: 1 of 2 used Submit Answer %24 %6 3 4. d barrow_forward

- Q5. The following items would be presented in the Statement of Changes in Equity.Answer only TRUE or FALSE for each(i) Revaluation of investment property(ii) Rights issue made in the yeararrow_forwardPlease help me with all answers thankuarrow_forwardX Your answer is incorrect. The effect of a stock dividend is to O change the composition of stockholders' equity. O decrease total assets and stockholders' equity. O increase the book value per share of common stock. O decrease total assets and total liabilities. eTextbook and Media Assistance Us Save for Later Attempts: 1 of 2 used Submit Answ @ %23 %24 8 4. u e d n m Carrow_forward

- Can you help me fill out the chart?arrow_forwardQuestion 77 For the following, fill in the blanks with the appropriate term(s). For questions that give you two or three choices to choose from, circle the most appropriate. (7.1) The return on an investment comes in two forms: the and the two forms: component gain or loss. The return on investment in common stock comes in gains (or losses).. and gains (or losses) for an investment in common stock arise from in the value of the investment. (7.2) The total percentage return for an investment in common stock is the sum of the yield and the [(Pt+1-P)/ Pt] The gains yield. The dividend yield is defined algebraically as gains yield is defined algebraically as (7.3) The debt represented by T-bills is virtually free of any life. We will call the rate of return on such debt the over its short and we will use it as a kind of benchmark. The difference between the rate of return for a risky investment and the return on T-bills is the for the risky asset. som levo (7.4) An investor's portfolio is…arrow_forwardQ2.A company with a stock priced at $50 must be worth more than a company with a stock priced at $5. True Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education