FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

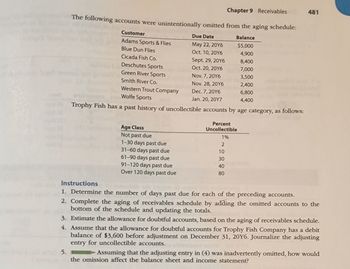

Transcribed Image Text:Chapter 9 Receivables

The following accounts were unintentionally omitted from the aging schedule:

Balance

$5,000

4,900

8,400

7,000

3,500

2,400

6,800

4,400

Customer

Adams Sports & Flies

Blue Dun Flies

Cicada Fish Co.

Sept. 29, 2016

Deschutes Sports

Oct. 20, 20Y6

Nov. 7, 2016

Green River Sports

Smith River Co.

Nov. 28, 20Y6

Western Trout Company

Dec. 7, 20Y6

Wolfe Sports

Jan. 20, 20Y7

Trophy Fish has a past history of uncollectible accounts by age category, as follows:

Age Class

Not past due

1-30 days past due

31-60 days past due

61-90 days past due

91-120 days past due

Over 120 days past due

Due Date

May 22, 20Y6

Oct. 10, 20Y6

Percent

Uncollectible

1%

2

10

30

40

80

481

Instructions

1. Determine the number of days past due for each of the preceding accounts.

2. Complete the aging of receivables schedule by adding the omitted accounts to the

bottom of the schedule and updating the totals.

3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit

balance of $3,600 before adjustment on December 31, 20Y6. Journalize adjusting

entry for uncollectible accounts.

5.

Assuming that the adjusting entry in (4) was inadvertently omitted, how would

the omission affect the balance sheet and income statement?

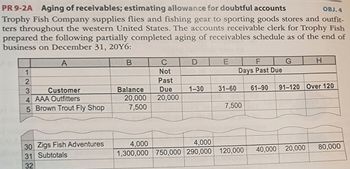

Transcribed Image Text:OBJ.4

PR 9-2A Aging of receivables; estimating allowance for doubtful accounts

Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfit-

ters throughout the western United States. The accounts receivable clerk for Trophy Fish

prepared the following partially completed aging of receivables schedule as of the end of

business on December 31, 20Y6:

A

1

2

3

Customer

4 AAA Outfitters

5 Brown Trout Fly Shop

30 Zigs Fish Adventures

31 Subtotals

32

C

Not

Past

Balance Due

20,000 20,000

7,500

B

DE

1-30 31-60

F

Days Past Due

7,500

4,000

4,000

1,300,000 750,000 290,000 120,000

61-90

G

H

91-120 Over 120

40,000 20,000

80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vaibhav Subject: acountingarrow_forwardInstructions 1 Record entry to write off the $15,000 receivable which is over 75 days outstanding 2 Calculate the desired credit balance in the Allowance for Doubtful Account using the chart above 3 Assuming prior to any adjusting entries the balance in the Allowance for Doubtful Accounts had a credit balance of $40,000, record the year ending adjusting entry for bad debts.arrow_forwardbled: Assignment 1 i Craigmont uses the allowance method to account for uncollectible accounts. Its year-end unadjusted trial balance shows Accounts Receivable of $142,500 and sales of $1,115,000. If uncollectible accounts are estimated to be 0.9% of sales, what is the amount of the bad debts expense adjusting entry? Multiple Choice $10,035 $8,990 $11,080arrow_forward

- Entry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Age Interval Balance Estimated UncollectibleAccounts Percent Estimated UncollectibleAccounts Amount Not past due $902,000 3/4 % $6,765 1-30 days past due 99,200 2 1,984 31-60 days past due 45,100 6 2,706 61-90 days past due 32,500 18 5,850 91-180 days past due 23,500 42 9,870 Over 180 days past due 17,100 65 11,115 Total $1,119,400 $38,290 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $6,890 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31. Dec. 31 - Select - - Select -arrow_forwardQuestion Content Area Estimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as shown below. Age Class PercentUncollectible Not past due 1% 1-30 days past due 5 31-60 days past due 25 61-90 days past due 35 Over 90 days past due 50 Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff IndustriesAging of Receivables Scheduleblank Customer Balance Not PastDue 1-30 DaysPast Due 31-60 DaysPast Due 61-90 DaysPast Due Over 90 DaysPast Due Subtotals 840,000 495,600 184,800 75,600 42,000 42,000 Conover Industries 18,100 18,100 Keystone Company 18,200 18,200 Moxie Creek Inc. 6,600 6,600 Rainbow Company 10,000 10,000 Swanson Company 23,100 23,100 Total receivables 916,000 518,700 194,800 82,200 60,200 60,100 Percentage uncollectible 1% 5% 25% 35% 50% Allowance for Doubtful…arrow_forwardplz help thank youarrow_forward

- Entry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Age Interval Balance Estimated UncollectibleAccounts Percent Estimated UncollectibleAccounts Amount Not past due $878,000 3/4 % $6,585 1-30 days past due 96,600 2 1,932 31-60 days past due 43,900 8 3,512 61-90 days past due 31,600 14 4,424 91-180 days past due 22,800 38 8,664 Over 180 days past due 16,700 75 12,525 Total $1,089,600 $37,642 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $6,775 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31. If an amount box does not require an entry, leave it blank. Dec. 31 - Select - - Select - - Select - - Select -arrow_forwardCornerstone Exercise 5-28 Aging Method On December 31, 2021, Khalid Inc. has the following balances for accounts receivable and allowance for doubtful accounts: Accounts Receivable Allowance for Doubtful Accounts (a credit balance) During 2022, Khalid had $18,500,000 of credit sales, collected $17.945,000 of accounts receivable, and wrote off $60,000 of accounts receivable as uncollectible. At year-end. Khalid performs an aging of its accounts receivable balance and estimates that $52,000 will be uncollectible. Required: 1. Calculate Khalid's preadjustment balance in accounts receivable on December 31, 2022. $1,280,000 44,000 2. Calculate Khalid's preadjustment balance in allowance for doubtful accounts on December 31, 2022. 3. Prepare the necessary adjusting entry for 2022. Dec. 31 (Record adjusting entry for bad debt expense estimate)arrow_forwardBook Hint Ask Print References Mc Graw Hill % 5 At December 31, Folgeys Coffee Company reports the following results for its calendar year. $908,000 308,000 Cash sales Credit sales Its year-end unadjusted trial balance includes the following items. T Accounts receivable Allowance for doubtful accounts Prepare the adjusting entry to record bad debts expense assuming uncollectibles are estimated to be (1) 3% of credit sales, (2) 1 total sales and (3) 6% of year-end accounts receivable. View transaction list Journal entry worksheet prt sc ← ] delete backspace home num lockarrow_forward

- Question 8 Dreadful Behaviour Ltd has credit sales of $400,000 in 2022 and a debit balance of $1,900 in the Allowance for Doubtful Accounts at year end. As of December 31, 2022, $120,000 of accounts receivable remain uncollected. The credit manager of Dangle prepared an aging schedule of accounts abnor receivable and estimates that $4,800 will prove to be uncollectible. On March 3, 2023 the credit manager authorizes a write-off of the $1,000 balance owed by D. Taylor. On April 1, 2023 Mr. Taylor pays his account in full and also pays Dangle $75 interest on his account Required (a) Prepare the adjusting entry to record the estimated uncollectible accounts expense in 2022. (b) Show the statement of financial position presentation of accounts receivable on December 31, 2022. (c) On March 3, 2023 before the write-off, assume the balance of Accounts Receivable account is $160,000 and the balance of Allowance for Doubtful Accounts is a credit of $3,000. Make the appropriate entry to record…arrow_forwarddon't give answer in image formatarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education