FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Question attached in the SS

thanks appreciate it

itj2jy2o4jy2404

h04h0hje0hh

d0

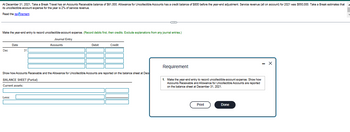

Transcribed Image Text:At December 31, 2021, Take a Break Travel has an Accounts Receivable balance of $91,000. Allowance for Uncollectible Accounts has a credit balance of $800 before the year-end adjustment. Service revenue (all on account) for 2021 was $550,000. Take a Break estimates that

its uncollectible-account expense for the year is 2% of service revenue.

Read the requirement.

Make the year-end entry to record uncollectible-account expense. (Record debits first, then credits. Exclude explanations from any journal entries.)

Journal Entry

Accounts

Dec

Date

Less:

31

Debit

Credit

Show how Accounts Receivable and the Allowance for Uncollectible Accounts are reported on the balance sheet at Dec

BALANCE SHEET (Partial)

Current assets:

O

Requirement

1. Make the year-end entry to record uncollectible-account expense. Show how

Accounts Receivable and Allowance for Uncollectible Accounts are reported

on the balance sheet at December 31, 2021.

Print

Done

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blackboard Learn Bb 2193555 + i learn-us-east-1-prod-fleet02-xythos.content.blackboardcdn.com/5f7ce11c673e5/2193555?X-Blackboard-Expiration=1648004400000&X-Blackboard-Signature=9lhjClppXf7wSeUqx.. E * O w WordCounter - Cou... y! Yahoo A Regions Bank | Che.. Welcome, Justin – B. * eBooks, Textbooks... O Jefferson State Co... Electronics, Cars, Fa. C Home | Chegg.com 2193555 1 / 1 100% + | PR 14-4B Entries for bonds payable and installment note transactions The following transactions were completed by Montague Inc., whose fiscal year is the calendar year: оВJ. 3, 4 V 3. $61,644,484 Year 1 Еxcel July 1. Issued $55,000,000 of 10-year, 9% callable bonds dated July 1, Year 1, at a market (effective) rate of 7%, receiving cash of $62,817,040. Interest is payable semiannually on December 31 and June 30. General Ledger Oct. 1. Borrowed $450,000 by issuing a six-year, 8% installment note to Intexicon Bank. The note requires annual payments of $97,342, with the first payment occurring on…arrow_forwardⒸ O D O H < UB Unblockit - Proxies to acce X C Solved P11-1A Gão Limited X b Home | bartleby C (4) How to study fo... Dropbox- 1st B.tec... (10) Lil Jaico - Toma Dropbox - 1st B.tec... (10) Lil Would you like to make Opera GX your everyday browser? How do I do that? www.chegg.com/homework-help/questions-and-answers/journalize-transactions-b-post-equity-accounts-use-j5-posting-refrence-c-prepare-share-cap-q90903484 Jaico-Toma (17) Liverpool reacti... (1) How To Study fo... (6) HABITS of SUCC... AMARIA BB - Slow... Type here to search MARM O x + Chegg Books Jan. 10 Mar. 1 Apr. 1 May 1 Aug. 1 Sept. 1 Nov. 1 Study Career Find solutions for your homework business/accounting / accounting questions and answers/p11-1a gão limited was organized on january 1, 2017, it is... Question: P11-1A Gão Limited Was Organized On January 1, 2017. It Is Authorized To Issue 10,000 8%, HK$1,000 Par Value Preference Share... P11-1A Gão Limited was organized on January 1, 2017. It is authorized to issue 10,000…arrow_forwardmation |x A Assignmenta: Corp Fin Reprtn x Question 2 Graded Assignme x HExam1-ep6778a@student.am x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%252F%252FIms.mheducation.com%252F... M (no subject) - ellse.patipewe@ x signment #4 (Leases) i Saved Help es At the beginning of 2021, VHF Industries acquired a machine with a fair value of $9,415,785 by signing a four-year lease. The lease is payable in four annual payments of $3.1 million at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. What is the effective rate of interest implicit in the agreement? 2-4. Prepare the lessee's journal entries at the beginning of the lease, the first lease payment at December 31, 2021 and the second lease payment at December 31, 2022. 5. Suppose the fair value of the machine and the lessor's implicit rate were unknown at the time of the lease, but that…arrow_forward

- u Online Cour X (78) Whats x M Your AccoL X M Inbox (2,74 X SP2021-AC X Answered: Ek My Home * CengageN X Bartleby Q x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10. M Gmail > YouTube Fourth Homework O eBook Patents 6. MC.12.06 Instructions Chart Of Accounts General Journal 7. MC.12.07 Instructions 8. MCС.12.08 Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, $72,000. The patent has a remaining legal life of 9 years. 9. МC.12.09 Required: 10. MC.12.10 Prepare the journal entries to record the acquisition and the amortization for 2019, assuming Mystic Pizza amortizes its patents using the 11. RE.12.01.BLANKSHEET straight-line method over the life of the asset. 12. RE.12.02 13. RE.12.03.BLANKSHEET 14. RE.12.04.BLANKSHEET 15. RE.12.05.BLANKSHEET 16. RE.12.06.BLANKSHEET 17. RE.12.07.BLANKSHEET 18. RE.12.08 O V I 12:52arrow_forwardJ 7 Choose from list of answer choices and show/explain work.arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forward

- Il Ter x G wileyplus - Google Search ww Ch10 Homework F21: Margrette x O NWP Assessment Player UI App x on.wiley.com/was/ui/v2/assessment-player/index.html?launchld3697735de-d478-43cf-9a0f-57f95a21595e#/question/10 -k F21 Question 11 of 20 0/ View Policies Show Attempt History Current Attempt in Progress X Your answer is incorrect. A truck was purchased for $184000 and it was estimated to have a $36000 salvage value at the end of its useful life. Monthly depreciation expense of $3700 was recorded using the straight-line method. The annual depreciation rate is O 3%. O 10%. O 30%. O 24%. eTextbook and Media Save for Later Attempts: 1 of 2 used Submit Answer & 7arrow_forwardano X M Gmail .wiley.com/was/ui/v2/assessment-player/index.html?launchld=96bacef2-13fb-44ea-b6d0-66f66b100cbd#/question/3 O search WP SCS0984 Midterm Hudovernik m Hudovernik $2 W YouTube 13 3 Maps W NWP Assessment Player Ul Appli X X View Policies E Question 4 of 11 Index of /software New Tab requires an understanding of the company's operations and the inter-relationship of accounts. is only required for accounts that do not have a normal balance. is optional when financial statements are prepared. is straight-forward because the accounts that need adjustment will be out of balance. 55 % f6 D T https://checkout.wileyplus.com/cx Immigration and Ci... 6 f7 Y Ps W & 7 hp f8 7 D U f9 * 8 + 00 f10 9 9 2 ☆ f11 .../5 > [P→ Attempts: 1 of 1 used O = : M f12 Activate W Go to Settings -1°C Mostly clear A 30arrow_forwardent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education