FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

E8-4A, 5A

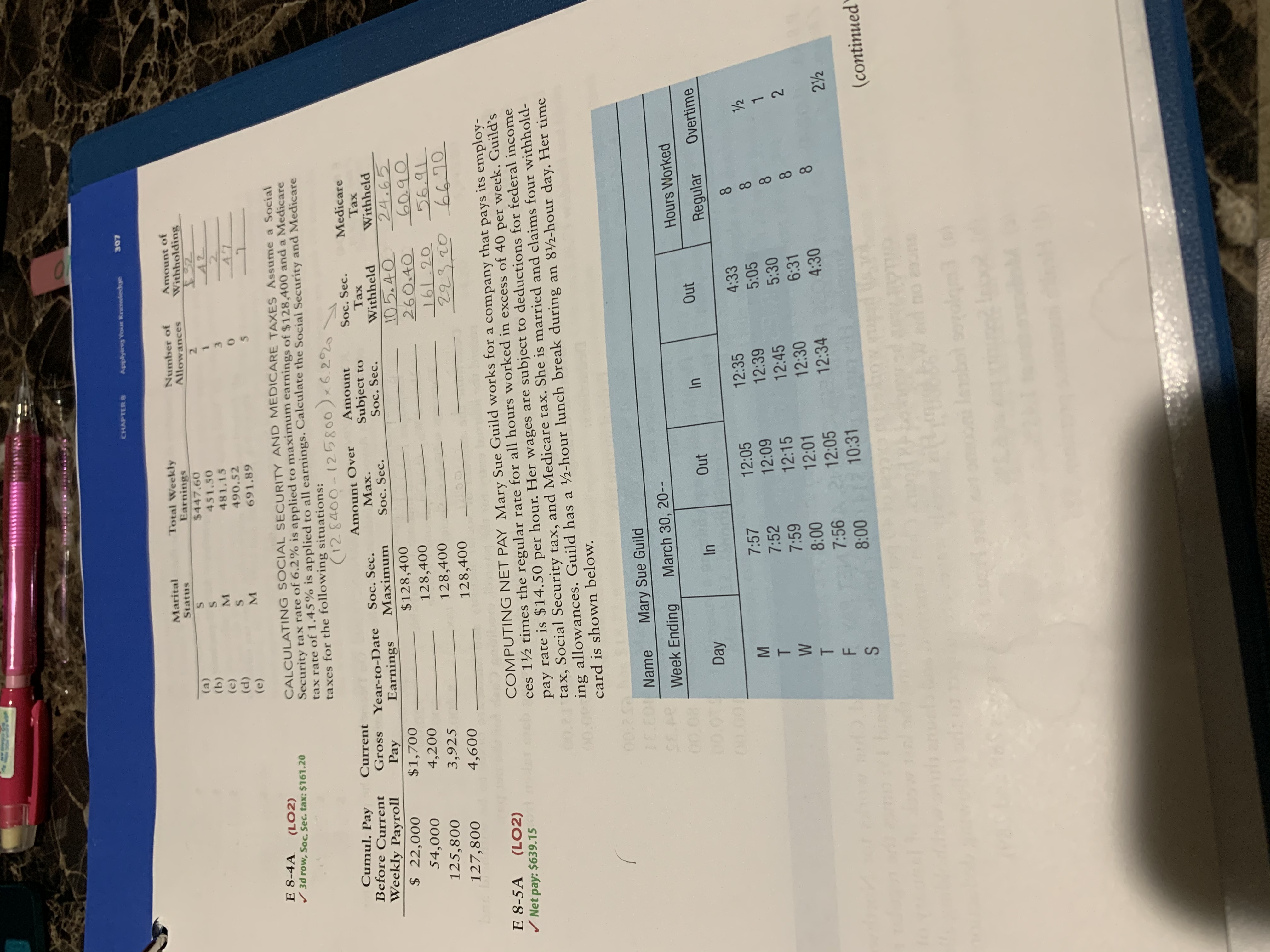

Transcribed Image Text:CHAPTER 8

Applying Youn Knowledge

307

Marital

Total Weekly

Earnings

$447.60

Number of

Allowances

Amount of

Withholding

Status

(a)

(b)

(c)

(d)

2.

451.50

M.

481.15

490.52

2.

(e)

691.89

E 8-4A

/ 3d row, Soc. Sec. tax: $161.20

(LO2)

CALCULATING SOCIAL SECURITY AND MEDICARE TAXES Assume a Social

Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare

tax rate of 1.45% is applied to all earnings. Calculate the Social Security and Medicare

taxes for the following situations:

(128400-125800)x6.22

Cumul. Pay

Before Current

Current

Amount COver

Amount

Medicare

Soc. Sec.

Тах

Subject to

Soc. Sec.

Gross

Soc. Sec.

Maximum

Year-to-Date

Max.

Тах

Weekly Payroll

$ 22,000

Withheld

Withheld

Pay

$1,700

Earnings

Soc. Sec.

105.40

260.40

161.20

223.20 6670

24.65

60.90

56.91

$128,400

54,000

4,200

128,400

125,800

3,925

128,400

127,800

4,600

128,400

nig

COMPUTING NET PAY Mary Sue Guild works for a company that pays its employ-

ees 1½ times the regular rate for all hours worked in excess of 40 per week. Guild’s

pay rate is $14.50 per hour. Her wages are subject to deductions for federal income

00.21 tax, Social Security tax, and Medicare tax. She is married and claims four withhold-

000ing allowances. Guild has a 2-hour lunch break during an 8½-hour day. Her time

E 8-5A

/ Net pay: $639.15

(LO2)

card is shown below.

00.2

LC0Name

Mary Sue Guild

Week Ending

March 30, 20--

00.08

Hours Worked

00

In

Out

In

Out

Day

Regular

Overtime

00.001

12:35

4:33

8.

7:57

12:05

7:52

12:09

12:39

5:05

12:15

12:45

5:30

7:59

12:30

6:31

8.

8:00

12:01

12:34

4:30

8.

7:56A 2 12:05

22

8:00 10:31

bieg

(continued

d no onS

olge

MTWTES

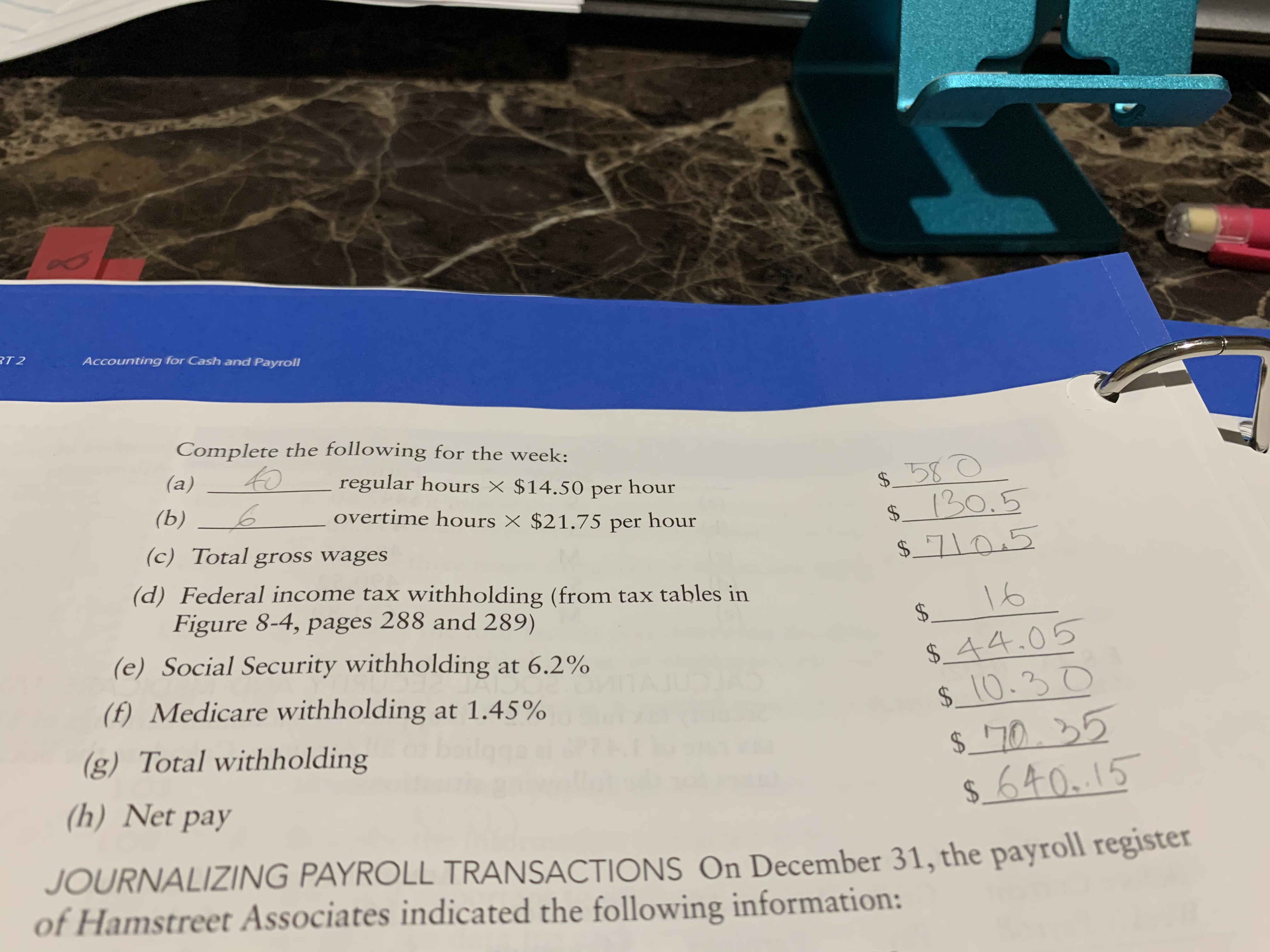

Transcribed Image Text:Accounting for Cash and Payroll

Complete the following for the week:

(a)

to

regular hours × $14.50 per hour

$ _ 580

130.5

(Ь)

overtime hours × $21.75 per hour

%$4

$4

(c) Total gross wages

$_710,5

(d) Federal income tax withholding (from tax tables in

Figure 8-4, pages 288 and 289)

16

24

(e) Social Security withholding at 6.2%

$_44.05

$_10.30

(f) Medicare withholding at 1.45%

TAJ

(g) Total withholding

$_'70.

(h) Net pay

$640.15

JOURNALIZING PAYROLL TRANSACTIONS On December 31, the payroll register

of Hamstreet Associates indicated the following information:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E9.7(a,b2)arrow_forwardQuestion 3: When is an employer NOT required to file a quarterly Form 941? Answer: А. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,000 В. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,500 С. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $2,500 D. When annual tax liability for federal income, Social Security, and Medicare tax is less than $100,000arrow_forwardOther than 1040, what other forms need to be completed?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education