Determining transfer pricing

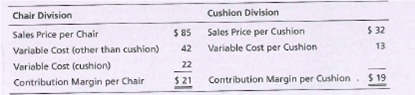

The Harris Company is decentralized, and divisions are considered investment centers. Harris has one division that manufactures oak dining room chairs with upholstered seat cushions. The Chair Division cuts, assembles, and finishes the oak chairs and then purchases and attaches the seat cushions. The Chair Division currently purchases the cushions for $22 from an outside vendor. The Cushion Division manufactures upholstered seat cushions that are sold to customers outside the company. The Chair Division currently sells 800 chairs per quarter, and the Cushion Division is operating at capacity, which is 800 cushions per quarter. The two divisions report the following information:

Requirements

- Determine the total contribution margin for Harris Company for the quarter.

- Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current sales price. What is the total contribution margin for each division and the company?

- Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company?

- Review your answers for Requirements 1, 2, and 3. What is the best option for Harris Company?

- Assume the Cushion Division has capacity of 1,600 cushions per quarter and can continue to supply its outside customers with 800 cushions per quarter and also supply the Chair Division with 800 cushions per quarter. What transfer price should Harris Company set? Explain your reasoning. Using the transfer price you determined, calculate the total contribution margin for the quarter.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

- sarrow_forwardTransfer Pricing Aulman Inc. has a number of divisions, including a Furniture Division and a Motel Division. The Motel Division owns and operates a line of budget motels located along major highways. Each year, the Motel Division purchases furniture for the motel rooms. Currently, it purchases a basic dresser from an outside supplier for $40. The manager of the Furniture Division has approached the manager of the Motel Division about selling dressers to the Motel Division. The full product cost of a dresser is $29. The Furniture Division can sell all of the dressers it makes to outside companies for $40. The Motel Division needs 10,000 dressers per year; the Furniture Division can make up to 50,000 dressers per year. Also, assume that the company policy is that all transfer prices are negotiated by the divisions involved. Required: 1. What is the maximum transfer price? Which division sets it? 2. What is the minimum transfer price? Which division sets it? 3. Conceptual Connection: If…arrow_forwardCalculating Transfer PriceBurt Inc. has a number of divisions, including the Indian Division, a producer of liquid pumps,and Maple Division, a manufacturer of boat engines.Indian Division produces the h20-model pump that can be used by Maple Division in theproduction of motors that regulate the raising and lowering of the boat engine’s stern drive unit.The market price of the h20-model is $720, and the full cost of the h20-model is $540.Required:1. If Burt has a transfer pricing policy that requires transfer at full cost, what will the transferprice be? Do you suppose that Indian and Maple divisions will choose to transfer at thatprice? 2. If Burt has a transfer pricing policy that requires transfer at market price, what wouldthe transfer price be? Do you suppose that Indian and Maple divisions would choose totransfer at that price?3. Now suppose that Burt allows negotiated transfer pricing and that Indian Divisioncan avoid $120 of selling expense by selling to Maple Division. Which…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education