Question

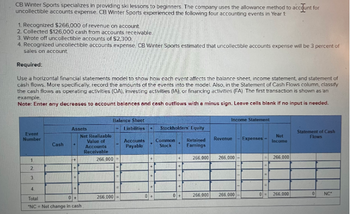

Transcribed Image Text:CB Winter Sports specializes in providing ski lessons to beginners. The company uses the allowance method to account for

uncollectible accounts expense CB Winter Sports experienced the following four accounting events in Year 1:

1. Recognized $266,000 of revenue on account.

2. Collected $126,000 cash from accounts receivable.

3. Wrote off uncollectible accounts of $2,300,

4. Recognized uncollectible accounts expense, CB Winter Sports estimated that uncollectible accounts expense will be 3 percent of

sales on account

Required:

Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of

cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify

the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA) The first transaction is shown as an

example.

Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed.

Balance Sheet

Income Statement

Assets

Liabilities

Stockholders' Equity

Event

Number

Net Realizable

Value of

Accounts

Cash

Accounts

Payable

Common

Stock

Retained

Earnings

Revenue

Expenses-

Net

Income

Statement of Cash

Flows

Receivable

1.

+

266,000

266,000

266,000

266,000

=

2.

3.

4.

Total

+

0+

266,000 =

266,000 266,000

0=

266,000

0

NC

"NC Net change in cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- When estimated future bad debt expense, which account are debited/credited, respectively? Cash, Accounts Receivable Allowance for Uncollectibles, Accounts Receivable Bad Debt Expense: Allowance for Uncollectibles Accounts Receivable, Allowance for Uncollectiblesarrow_forwardThe company uses the allowance method to account for uncollectible receivables. Allowance for doubtful account had 1.500 TL credit balance and account receivable account had 12.000 TL debit balance at the beginning of year. During the year bad debt expense was recorded for 2.000 TL and wrote off bad receivables for 2.500. a. what is the balance of allowance for doubtful account at the year - end? b. what is the net realizable value of account receivable at the vear - end?arrow_forwardWhat is the main reason lenders pay borrowers' property taxes through a pre-paid escrow account? It prevents a tax lien from being applied to the home. The tax lien would be senior to the mortgage lien. It prevents the borrower from refinancing with another lender because they would lose all of their escrow funds. It allows the lender to earn interest on the pre- paid tax money as itsits in the account. It allows the lender to take advantage of corporate tax deductions.arrow_forward

- Describe 3 criteria of the 13 minimum standards on which plan status is determined to qualify retirement plans for preferential tax treatmentarrow_forwardd) Describe Purell Magazine and Publishing House fraud prevention programme and identify any improvements that might be necessary to prevent this type of fraud or at least discover it sooner.arrow_forwardA business has a limited number of items upon which one can perform a financial analysis. true or false?arrow_forward

- Discuss the ethical considerations involved in financial statement analysis.arrow_forwardPrepare a 5-page benchmark analysis for your staff by responding to the following: Discuss the benchmarks used in financial analysis Explain the benefits of financial benchmarking. Evaluate the impact of balancing benefits to reduce harms and cost through screening and prevention services. Identify the benefits of patient screening Describe how screening and preventive care impact cost Discuss the GRADE system and its purpose Explain how the GRADE system is applied to reduce harm to patientsarrow_forwardAt a recent board meeting of Co., a non-executive director suggested that the company’s remuneration committee should consider scrapping the company’s share option scheme, since the executives could be rewarded by the scheme even when they do not perform well. A second non-executive director had a view that, even when the executives act in ways which decrease the agency problem, they might not be rewarded by the share option scheme if the stock markets were in decline. REQUIRED: Explain the nature of the agency problem and discuss the use of share option schemes and performance-related pay as methods of reducing the agency problem in a stock-market listed company.arrow_forward

- Mishap has a gross income of $43,360. She owns a condominium and donates to charity, but there's no way her tax deductible expenses come close to the standard deduction of $12,000. During a cold snap in the winter she donates an extra $500 to the local homeless shelter, a registered charity. How much will this donation save her on her taxes?arrow_forwardrecord the following transactions in the tho column cash book of Nnamdi super stores for the month of april,2023 # april 1 started business with cash in hand 5000 cash at bank 15000 april 3 sold good for cash 2500 april 5 bought goods by cheque 1500 april 8 bought office furniture by cash 3000 april 9 withdrew cash from bank 1000 april 12 paid eletricity bill by cash 3000 april 14 sold good for cheque 2000 april 28 paid rent by cheque 500arrow_forwardThe purpose of this assignment is to evaluate the impact of a financial analysis on administrative decisions in a health care organization. Review Northwestern Memorial HealthCare's "Consolidated Financial Report" (Years Ended August 31, 2019 and 2018), and answer the following prompts. Discuss the importance of and need for a financial analysis within a health care organization. Explain the relationship between a health care organization's financial plan and debt policy to its strategic plan. Assess the financial position of Northwestern Memorial HealthCare in 2019 as compared to 2018. Give specific examples of areas where improvement is needed or areas that should be of concern in terms of financial viability. Based upon these observations, make recommendations that management should consider from a strategic standpoint (i.e., strategic budgeting methods).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios