FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

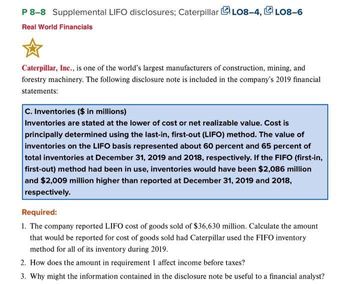

Transcribed Image Text:P 8-8 Supplemental LIFO disclosures; CaterpillarLO8-4,LO8-6

Real World Financials

Caterpillar, Inc., is one of the world's largest manufacturers of construction, mining, and

forestry machinery. The following disclosure note is included in the company's 2019 financial

statements:

C. Inventories ($ in millions)

Inventories are stated at the lower of cost or net realizable value. Cost is

principally determined using the last-in, first-out (LIFO) method. The value of

inventories on the LIFO basis represented about 60 percent and 65 percent of

total inventories at December 31, 2019 and 2018, respectively. If the FIFO (first-in,

first-out) method had been in use, inventories would have been $2,086 million

and $2,009 million higher than reported at December 31, 2019 and 2018,

respectively.

Required:

1. The company reported LIFO cost of goods sold of $36,630 million. Calculate the amount

that would be reported for cost of goods sold had Caterpillar used the FIFO inventory

method for all of its inventory during 2019.

2. How does the amount in requirement 1 affect income before taxes?

3. Why might the information contained in the disclosure note be useful to a financial analyst?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected transactions relate to liabilities of Chicago Glass Corporation for 2024. Chicago's fiscal year ends on December 31. On January 15, Chicago received $7,400 from Henry Construction toward the purchase of $70,000 of plate glass to be delivered on February 6. On February 3, Chicago received $7,100 of refundable deposits relating to containers used to transport glass components. On February 6, Chicago delivered the plate glass to Henry Construction and received the balance of the purchase price. First quarter credit sales totaled $740,000. The state sales tax rate is 4% and the local sales tax rate is 2%. Required: Prepare journal entries for the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardGranite, Incorporated is the largest uniform supplier in North America. Selected information from its annual report follows. For the 2019 fiscal year, the company reported sales revenue of $6.1 billion and Cost of Goods Sold of $4.3 billion. Fiscal Year Balance Sheet (amounts in millions) Cash and Cash Equivalents Accounts Receivable, Net Inventory Prepaid Rent and Other Current Assets Accounts Payable Salaries and Wages Payable Notes Payable (short-term) Other Current Liabilities 2019 Current Ratio Inventory Turnover Ratio Accounts Receivable Turnover Ratio $ 540 860 330 795 210 520 116 28 2018 $430 810 340 660 190 520 28 320 Required: Assuming that all sales are on credit, compute the following ratios for 2019. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.arrow_forward19. A listing of the estimated balances in the company's ledger accounts as of December 31, 2023 is given below (as well as in your Excel template): Cash Accounts receivable Inventory-raw materials Inventory-finished goods Capital assets (net) Assets $ 83,365 1,122,900 10,000 9,125 724,000 $1,949,390 Total assets Liabilities and Shareholders' Equity Accounts payable $ 231,563 Capital stock 1,000,000 Retained Earnings Total liabilities and shareholders' equity 717,828 $1,949,390 Required: 1. Prepare a monthly master budget for ToyWorks for the year ended December 31, 2024, including the following schedules (Use the Excel template provided!): Sales Budget & Schedule of Cash Receipts Production Budget & Manufacturing Overhead Budget Direct Materials Budget & Schedule of Cash Disbursements Direct Labour Budget Selling and Administrative Expense Budget Ending Finished Goods Inventory Budget Cash Budget 2. Prepare budgeted financial statements at December 31, 2024, using absorption costing.arrow_forward

- Hardevarrow_forwardA company prepares its financial statements according to International Financial Reporting Standards. During 2024 the company incurred $1,265,000 in research expenditures to develop a new product. An additional $776,000 in development expenditures were incurred after technological and commercial feasibility was established and after the future economic benefits were deemed probable. The project was successfully completed and the new product was patented before the end of the 2024 fiscal year. Sale of the product began in 2023. What amount of the above expenditures would be expensed in the 2024 income statement?arrow_forwardApplying the Fundamental Accounting Equation At the beginning of 2019, KJ Corporation had total assets of $554,000, total liabilities of $261,800, common stock of $139,300, and retained earnings of $152,900. During 2019, KJ had net income of $225,200, paid dividends of $74,400, and issued additional common stock for $93,900. KJ's total assets at the end of 2019 were $721,800. Required: Calculate the amount of liabilities that KJ must have at the end of 2019 in order for the balance sheet equation to balance.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education